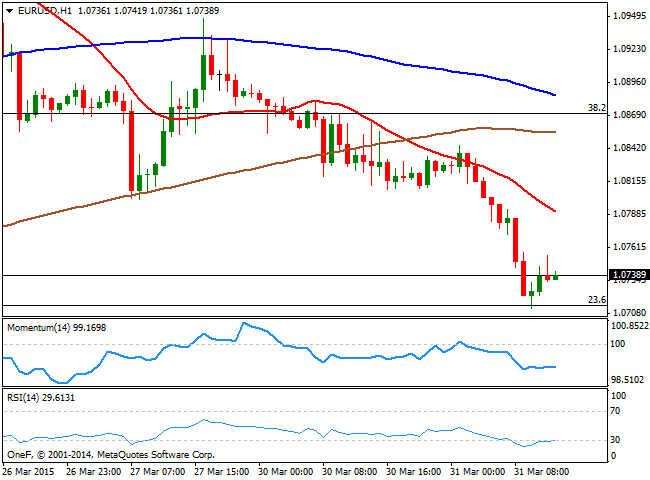

EUR/USD Current price: 1.0750

View Live Chart for the EUR/USD

The EUR/USD pair extended its decline this Tuesday, down to 1.0712 in the European morning on broad dollar strength. The pair found some short term demand around the 23.6% of the 1.1533/1.0461 monthly slide, albeit the recovery remains shallow, limited around 1.0760. Fundamentally, news came from Germany and resulted for the most positive, with unemployment down to 6.4% in March and Retail Sales up 3.6% in February, slightly below the 3.7% expected. But the good news were not enough to overshadow the fact that Greece and the EU have not yet found a solution to the debt problem of the troubled country that is in a brink of running out of cash and that the EZ inflation remains extremely low.

During the US session, several FOMC members will be offering different speeches, which can affect the dollar accordingly to their hawkishness when it comes to a rate hike. In the meantime, the 1 hour chart shows that the price extended far below its moving averages, whist the technical indicators correct oversold readings, aiming higher below their mid-lines. In the 4 hours chart however the technical outlook favors the downside, with a break below 1.0710 required to confirm a new leg south towards the 1.0660 price zone.

Support levels: 1.0710 1.0660 1.0620

Resistance levels: 1.0760 1.0800 1.0840

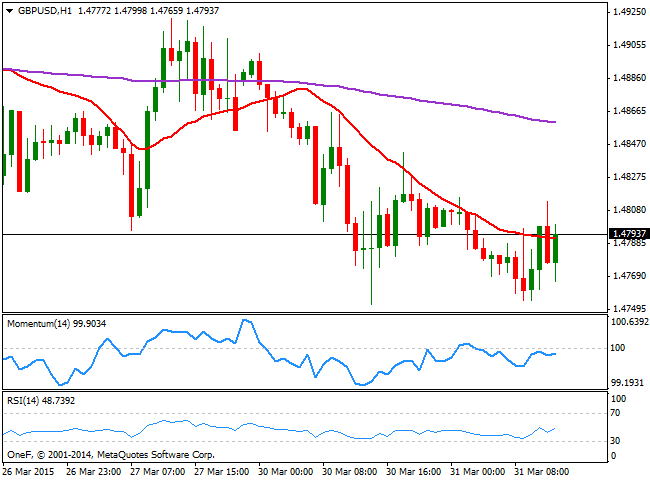

GBP/USD Current price: 1.4798

View Live Chart for the GBP/USD

The GBP/USD fell down to 1.4754 before recovering, limited to the downside by a positive surprise on the final revision of Q4 GDP figures, up to 0.6%. The pair however trades below its daily opening, and the 1 hour chart shows that the price struggles around a bearish 20 SMA, whilst the technical indicators remain in neutral territory. In the 4 hours chart the 20 SMA heads lower above the current price while the technical indicators retrace from their mid-lines and maintain their bearish slopes, supporting additional declines if the 1.4750 level gives up.

Support levels: 1.4750 1.4710 1.4670

Resistance levels: 1.4805 1.4840 1.4890

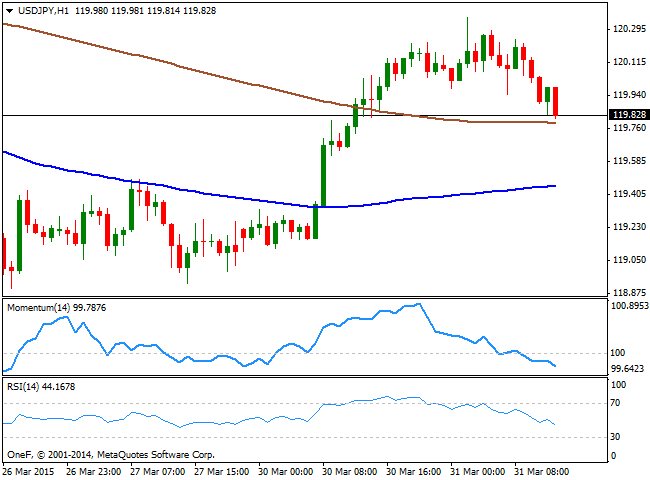

USD/JPY Current price: 119.82

View Live Chart for the USD/JPY

The USD/JPY surged up to 120.35, before retreating back below the 120.00 figure, turning lower early in the American session as local share markets aim to open in the red. The risk appetite seen during Asian hours hardly affected the Nikkei or the Yen, in the last day of the fiscal year, usually a time for taking profits out of the table and repatriate currency. Anyway, the short term technical picture favors the downside, as in the 1 hour chart, the price is pressuring its 200 SMA whilst the technical indicators head lower below their mid-lines. In the 4 hours chart however, indicators hold in positive territory, with the Momentum now turning slightly higher. A downward acceleration below 119.65 is required to confirm renewed selling interest, eyeing then a quick test of the 119.20 price zone.

Support levels: 119.65 119.20 118.80

Resistance levels: 120.00 120.45 120.80

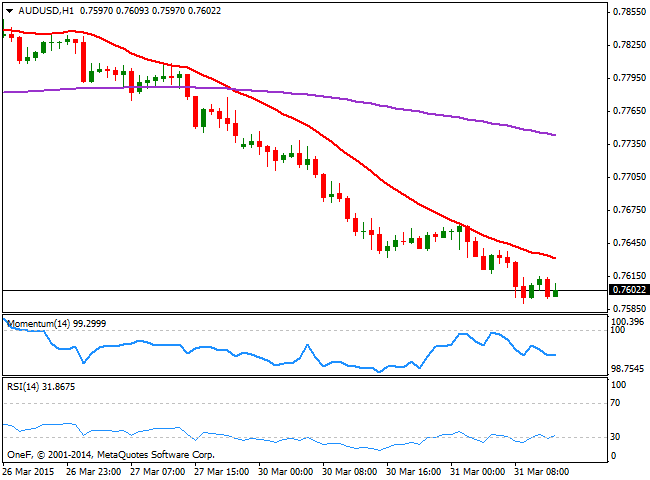

AUD/USD Current price: 0.7601

View Live Chart for the AUD/USD

The Australian dollar remains in a descending spiral, having reached 0.7596 against the greenback, before a limited bounce. The antipodean currency is in sell mode as the market expects another rate cut coming from the RBA this month, particularly after the iron ore, the nation’s biggest export, plunged to a decade low. Technically and in the short term, the 1 hour chart shows that the price holds below a bearish 20 SMA, whilst the technical indicators are presenting limited upward bounces in negative territory. In the 4 hours chart the technical indicators continue to head lower despite in extreme oversold territory, limiting chances of an upward recovery.

Support levels: 0.7590 0.7555 0.510

Resistance levels: 0.7625 0.7660 0.7700

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.