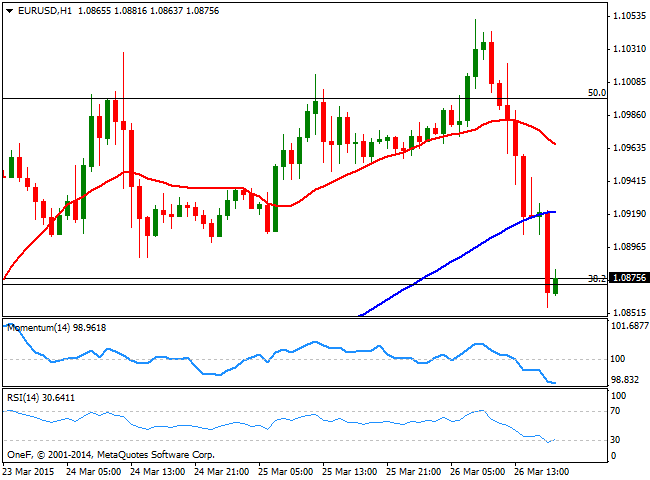

EUR/USD Current price: 1.0875

View Live Chart for the EUR/USD

The greenback retreated sharply this Thursday, only to jump higher in the American afternoon. The day started with a risk-off sentiment and commodities soaring, on news Saudi Arabia launched an air strike on Yemen arising tension in the Middle East that led to a sell-off in equities markets, and drove the EUR/USD to a fresh 3-week high of 1.1051. The fall in EUR for these last months, alongside with ECB's bond buying, was the reason European share markets rose to record highs, as a cheaper currency helped boost export relates equities, and the inverted correlation prevailed until the American session began. In the US, better-than-expected weekly unemployment claims, down to 282K last week helped the greenback claw back higher, whilst quietus came after the release of US Markit Services PMI figures, posting the sharpest rise in the sector for six months in March.

The EUR/USD pair nose-dived down to 1.0855, finding finally buying interest around the 38.2% retracement of these last two months slide. The 1 hour chart shows that the price extended below its 20 and 100 SMAs, whilst the technical indicators remain near oversold territory, albeit losing their bearish strength. In the 4 hours chart the price accelerated below its 20 SMA, currently around 1.0950, whilst the technical indicators maintain their strong bearish slopes below their mid-lines, anticipating additional declines particularly if the price falls beyond the mentioned low.

Support levels: 1.0855 1.0820 1.0780

Resistance levels: 1.0900 1.0950 1.1000

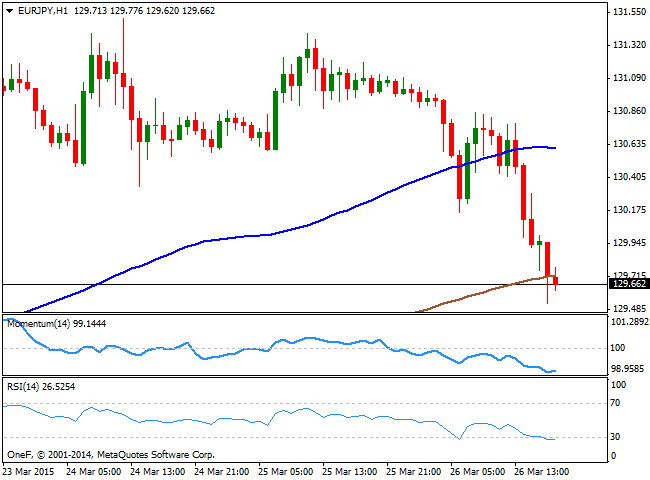

EUR/JPY Current price: 129.65

View Live Chart for the EUR/JPY

The Japanese yen strengthened against most of its rivals, supported by safe-haven demand and falling stocks. The EUR/JPY pair fell down to 129.52, and the 1 hour chart shows that the price broke below its 100 and 200 SMA, with the latest offering an immediate short term resistance at 129.70, whilst the technical indicators remain well into negative territory and with the RSI still heading lower, despite being at 26. In the 4 hours chart the price is back below a bearish 100 SMA whilst the technical indicators head south below their mid-lines, supporting some further declines for this Friday.

Support levels: 129.30 128.80 128.40

Resistance levels: 129.90 130.35 130.80

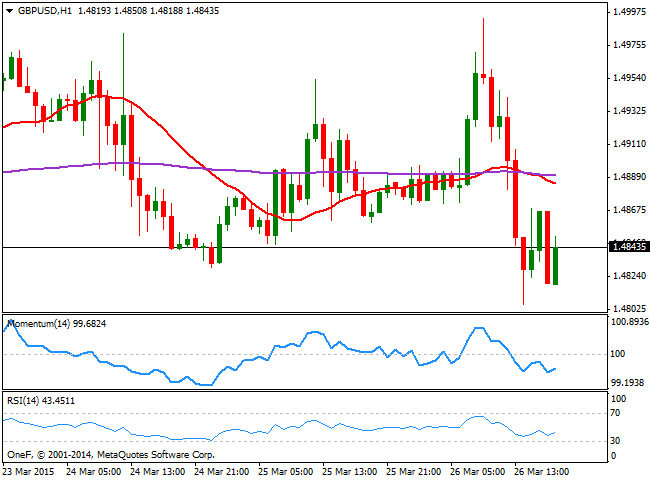

GBP/USD Current price: 1.4843

View Live Chart for the GBP/USD

The British Pound enjoyed some temporal demand during the European session, following the release of the UK Retail Sales that grew sharply in March, up 5.7% compared to a year before. The GBP/USD pair rose to a daily high of 1.4993, but selling interest halted the advance once again and the pair edged down to 1.4806 on dollar's later recovery. The technical picture in the short term favors the downside, as the price consolidates around former weekly low, whilst the 20 SMA gains a mild bearish slope above the current level, and the technical indicators stand below their mid-lines, albeit lacking directional strength. In the 4 hours chart the price stands below its 20 SMA whilst the Momentum indicator consolidates below the 100 level and the RSI indicator heads lower around 44, all of which supports the shorter term bias. A break below 1.4805 should lead to a quick decline towards the 1.4770 level a strong static support, while if this last gives up, the fall can extend down to 1.4730.

Support levels: 1.4805 1.4770 1.4730

Resistance levels: 14880 1.4920 1.4950

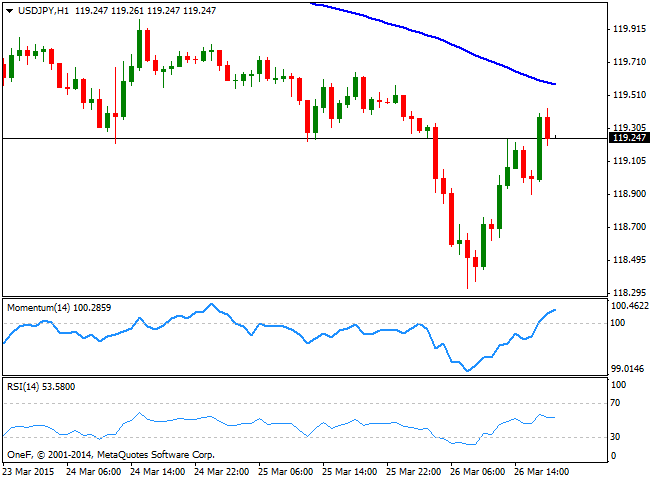

USD/JPY Current price: 119.25

View Live Chart for the USD/JPY

The USD/JPY pair fell down to a fresh 5-week low of 118.32, before finally stalling having recovered around 100 pips on the back of USD strength and rising US yields, with the 10Y one back at 2.00%. During the upcoming Asian session, Japan will release data related to inflation, employment and household spending, which may imprint some life to yen crosses particularly if the figures are soft. In the meantime, the 1 hour chart shows that the intraday recovery extended up to 119.42, well below a strongly bearish 100 SMA, currently around 119.65. In the same chart, the Momentum indicator remains above 100 although partially losses its bullish strength while the RSI stands around 53. In the 4 hours chart the technical indicators bounced strongly from oversold territory and maintain their bullish slopes, albeit are still below their mid-lines. The price needs to recover above the 119.65 resistance level to be able to continue advancing, with the next resistance at the psychological 120.00 figure.

Support levels: 119.15 118.70 118.30

Resistance levels: 119.65 120.00 120.40

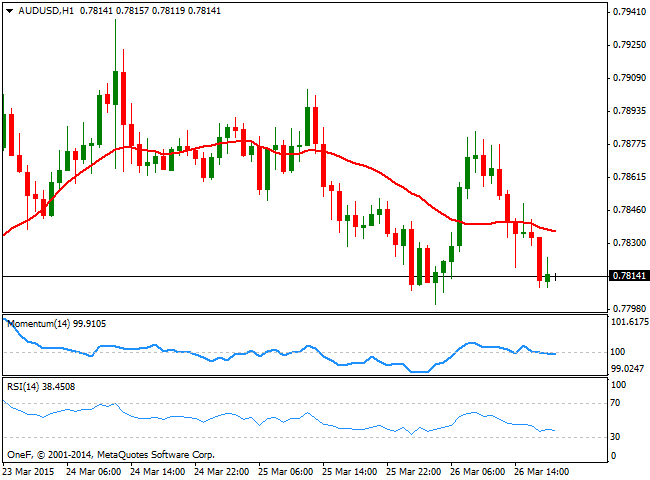

AUD/USD Current price: 0.7814

View Live Chart for the AUD/USD

The AUD/USD pair posted a lower high daily basis before resuming its decline, posting its third negative day in a row. The sentiment towards the Aussie is negative, considering investors are still pricing in a rate cut as soon as next month in Australia. Trading near the daily low established during the past Asian session at 0.7800, the 1 hour chart presents a mild bearish tone, as the price develops below its 20 SMA whilst the Momentum indicator presents a tepid bearish slope below 100 and the RSI anticipates additional declines, heading lower around 37. In the 4 hours chart the technical picture is strongly bearish, as the price extends below its 20 SMA while the technical indicators maintain a strong bearish bias below their mid-lines. In this last time frame, the 200 EMA stands around 0.7770, providing a strong dynamic support, which means a break below it should favor further dollar gains, eyeing an approach to the 0.7720/30 price zone.

Support levels: 0.7800 0.7770 0.7725

Resistance levels: 0.7840 0.7880 0.7910

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.