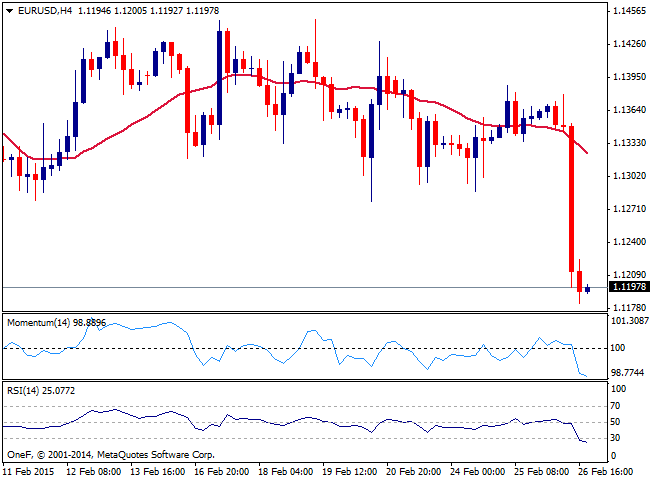

EUR/USD Current price: 1.1198

View Live Chart for the EUR/USD

The EUR/USD pair fell sharply on Thursday as the dollar staged a rally across the board following a batch of mixed US data. Even though January US consumer prices declined more than expected, core figures beat expectations rising by 0.2% MoM and 1.6% YoY. Meanwhile, durable goods orders bounced strongly in January after 2 months of falls, rising 2.8% versus 1.7% expected. On the other hand, initial jobless claims rose to 313,000 last week versus 290,000 of consensus.

From a technical perspective, daily indicators have turned neutral as spot trades below a flat 20 SMA. In the 4-hour charts, the pictures has turned bearish although, with the RSI signaling oversold conditions, EUR/USD might take a breather before another push lower. The pair needs to at least regain the 1.1270 area (former support zone) to ease the short-term pressure.

Support levels: 1.1183 1.1130 1.1097

Resistance levels: 1.1270 1.1355 1.1379

GBP/USD Current price: 1.5409

View Live Chart for the GBP/USD

The GBP/USD pair also suffered on the back of a stronger dollar, surrendering most of its weekly gains. GBP/USD pulled back sharply from an 8-week high of 1.5551 high scored during the European session and briefly dropped below the 1.5400 level. Daily charts hold the bullish tone despite today’s setback, although indicators have lost strength. In the 4-hour chart, both the Momentum indicator and the RSI have crossed their midlines to the downside turning short-term focus to the downside. A decisive break below 1.5400 could send the pair to 1.5330/10, which is next support area. On the flip side, Cable needs climb back above 1.5475 to regain short-term bullish strength.

Support levels: 1.5330 1.5310 1.5240

Resistance levels: 1.5475 1.5500 1.5551

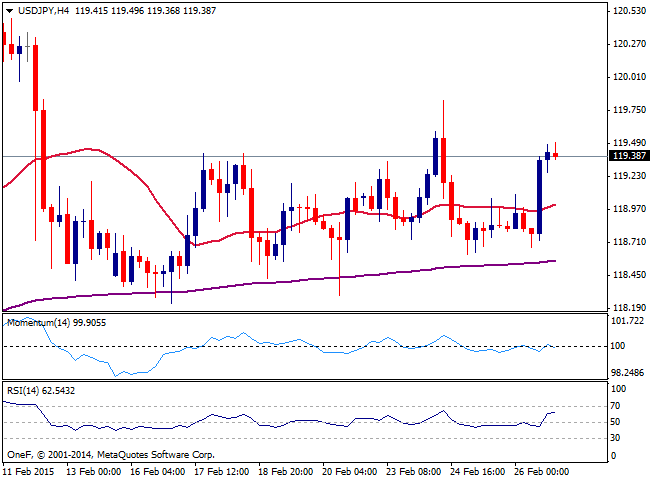

USD/JPY Current price: 119.36

View Live Chart for the USD/JPY

USD/JPY rose sharply and reached a 2-day high of 119.50 during the New York session, supported by US economic data. Technical speaking, indicators have turned flat in the daily chart, following big swings this week, triggered by Fed’s Chairwoman Janet Yellen testimony. In the 4-hour chart, the bias is positive, suggesting a rise toward 119.85, this week’s high, en-route to 120.00 shouldn’t be ruled out. On the downside, the 118.25 area is key support with a break below this latter, targeting February’s low at 116.85.

Support levels: 118.25 118.00 116.85

Resistance levels: 119.50 119.85 120.00

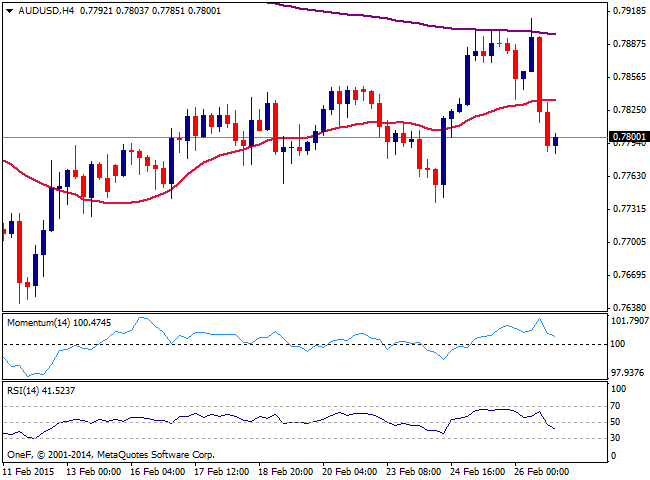

AUD/USD Current price: 0.7795

View Live Chart for the AUD/USD

The AUD/USD gave up its daily gains to print a sizeable bearish outside day after an abrupt reversal off 0.7910, suggesting a potential change of the recent corrective bullish dynamics seen over the last 2 weeks. While weaker-than-expected Australian capex numbers initially led the pair to dip towards sub 0.7850 in the last Asian session, leveraged names emerged in early London seeking higher liquidity, fading the bear-induced capex move, however, a major surprise in US real wage growth saw USD strengthen across the board as odds of a Fed rate 'liftoff' mid this year firmed up. On the hourly chart, the 1.2 cents drop has distorted bullish technicals, with price breaking back down the 100 and 200-EMA, with focus now shifted towards lower quotes, expecting rallies to be seen as sell value propositions as long as 0.7850/60 resistance holds. On the 4-hour chart, price was strongly rejected by the 200-EMA, with bears also reclaiming the 100 and 20 EMAs, implying that at the bare minimum, a period of consolidation with potential lower levels are expected, although losses will only accelerate should price break below an ascending trendline coming off this year's low.

Support levels: 0.7775 0.7750 0.7700

Resistance levels: 0.7840 0.7860 0.7900

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.