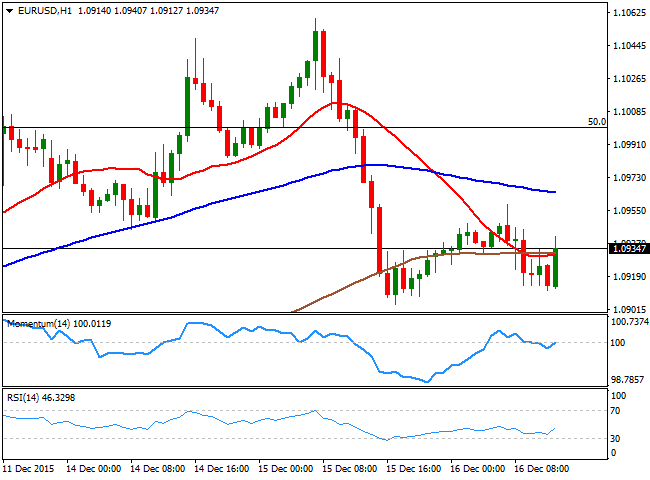

EUR/USD Current price: 1.0934

View Live Chart for the EUR/USD

The American dollar trades higher ahead of the FED's latest meeting outcome, advancing mostly on sentiment rather than anything else. The pair traded as low as 1.0911 and recovered a handful of pips above the level, with the greenback holding into gains after the release of solid housing data. According to official data, new-home construction climbed 10.5% in November, to a 1.17 million annualized rate. The EUR/USD 1 hour chart shows that the price is currently struggling around the 20 SMA, which stands flat and converges with the 200 SMA, while the technical indicators aim slightly higher around their mid-lines. In the 4 hours chart, the price is below its 20 SMA, while the technical indicators hold horizontal below their mid-lines, maintaining the risk towards the downside. Nevertheless, whatever Yellen decides is what's going to determinate the pair's upcoming moves; a rate hike may have been already priced in, but that does not implies the dollar can't run. Overall, it's the market belief that what will decide the future of the greenback is any announcement regarding future movements.

Support levels: 1.0910 1.0880 1.0830

Resistance levels: 1.0950 1.0990 1.1045

GBP/USD Current price: 1.5032

View Live Chart for the GPB/USD

The GBP/USD pair is recovering ahead of the US opening, recovering from the daily low of 1.4981, reached after the release of the UK employment figures, showing a strong setback in wages. Wage growth excluding bonuses fell to 2.0% from 2.4%YoY while including bonuses fell to 2.4% from a previous 3.0% also YoY. The number of people filing for unemployment rose more than expected, although the unemployment rate fell to 5.2%. The 1 hour chart shows that dips below the 1.5000 figure are resulting in quick bounces, as short term buying interest surges, but that the general tone is still bearish for the pair, given that it holds below a bearish 20 SMA, while the technical indicators remain in negative territory. In the 4 hours chart, the bearish tone is even clearer, given that the pair is below a bearish 20 SMA, while the technical indicators maintain their strong bearish slopes below their mid-lines.

Support levels: 1.4980 1.4940 1.4890

Resistance levels: 1.5050 1.5090 1.5135

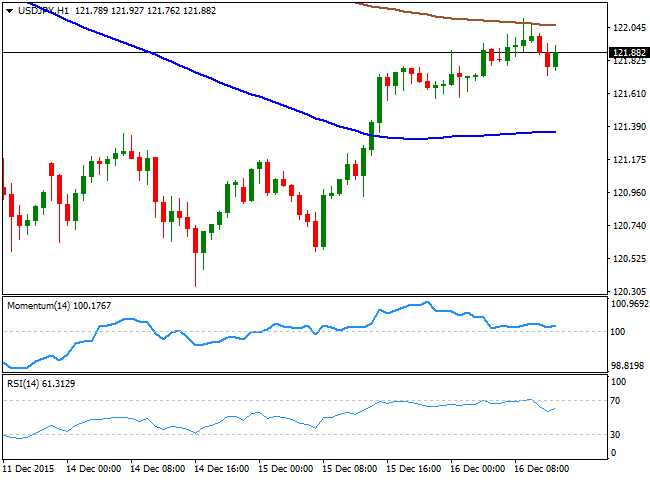

USD/JPY Current price: 121.90

View Live Chart for the USD/JPY

Nearing critical resistance at 122.20. The USD/JPY pair flirts with the 122.00 level this Wednesday, having extended its rally during the Asian session on hopes the US will raise rates and therefore favor some dollar demand. Despite the upcoming directional move will depend solely on how the market reacts to the FED, the technical picture is mildly positive in the short term, as in the 1 hour chart, the price extended further above its 100 SMA, and pressures the 200 SMA around the mentioned 122.00 figure. In the same chart however, the technical indicators have lost their upward strength and turned lower above their mid-lines. In the 4 hours chart, the price remains below its moving average, while the technical indicators lack directional strength, well above their mid-lines. The level to watch to confirm further gains is 122.20, as the level has been a major support for most of the past two months, and a break above it should revert the ongoing bearish tone.

Support levels: 121.70 121.30 121.00

Resistance levels: 122.20 122.60 123.00

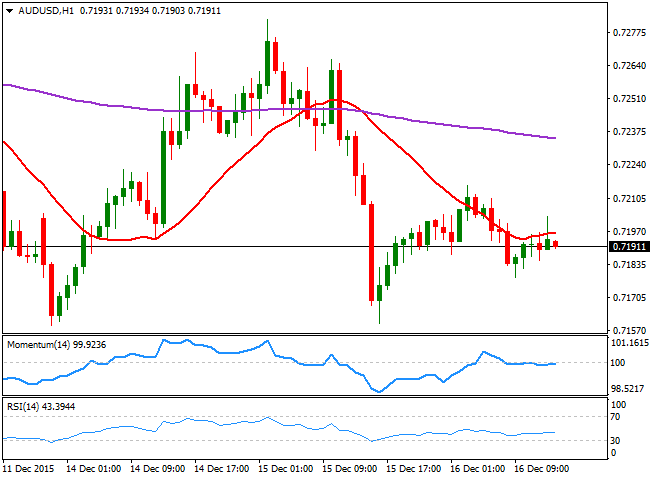

AUD/USD Current price: 0.7191

View Live Chart for the AUD/USD

The AUD/USD pair trades flat daily basis, right below the 0.7200 figure and mostly range bound, as investors wait for the US Central Bank. Gold prices are recovering strongly ahead of the news, limiting the downside for the Aussie, as investors square positions ahead of the event. Technically speaking, the short term outlook is neutral, given that the price is now below a flat 20 SMA while the technical indicators head nowhere around their mid-lines. In the 4 hours chart, the technical indicators are biased lower around their mid-lines, while the price remains below its 20 SMA, with only a recovery above 0.7240 opening doors for further recoveries.

Support levels: 0.7160 0.7125 0.7090

Resistance levels: 0.7240 0.7285 0.7335

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.