EUR/USD Current price: 1.0636

View Live Chart for the EUR/USD

The common currency extended its decline versus its American rival to a fresh 7-month low of 1.0630 this Tuesday, as a return of risk appetite and better-than-expected US inflation data sent the USD higher particularly against safe havens and funding currencies such as the EUR. The German ZEW survey for November, released at the beginning of the day, showed that economic sentiment continued to decrease in the EU, down to 28.3 from a previous 30.1 and expectations of 32.5. German current situation is also seen worse than previously estimated albeit economic sentiment has improved from 1.9 to 10.4. Nevertheless, a tepid improve in US inflation data for October, weighed more in the market, as the CPI rose 0.2% compared to a year before, against previous 0.0%.The EUR/USD pair ends the day a few pips above the mentioned low, maintaining the dominant bearish tone, despite the limited intraday volatility seen in the pair during these past couple of weeks, with investors still considering a possible retest of the year low at 1.0461. Short term, the 1 hour chart shows that the 20 SMA presents a strong bearish slope, and that advances towards it attracted selling interest. In the same chart, the technical indicators hold below their mid-lines, lacking directional strength at the time being. In the 4 hours chart, the price extended further below a mild bearish 20 SMA, while the RSI indicator heads strongly lower near oversold territory, and the Momentum indicator aims higher below the 100 level, rather reflecting the latest bounce than suggesting further gains.

Support levels: 1.0630 1.0590 1.0550

Resistance levels: 1.0680 1.0715 1.0750

EUR/JPY Current price: 131.32

View Live Chart for the EUR/JPY

The EUR/JPY pair resumed its decline after its Monday's upward corrective move, and fell down to 131.19, ending the day a handful of pips above it. The Bank of Japan will have an economic policy meeting next Thursday, and investors are once again speculating on whether the Central Bank will extend its stimulus program, but chances seem quite limited after the latest officers' statements. Technically, the EUR/JPY pair 1 hour chart shows that the price retreated further below its 100 and 200 SMAs which are gaining bearish slope, while the technical indicators head slightly lower below their mid-lines, in line with further declines for this Tuesday. In the 4 hours chart, the price remains below a CLEARLY bearish 100 SMA, while the technical indicators remain below their mid-lines, with the RSI indicator accelerating lower around 41, in line with the shorter term view.

Support levels: 130.90 130.55 130.20

Resistance levels: 131.70 132.10 132.60

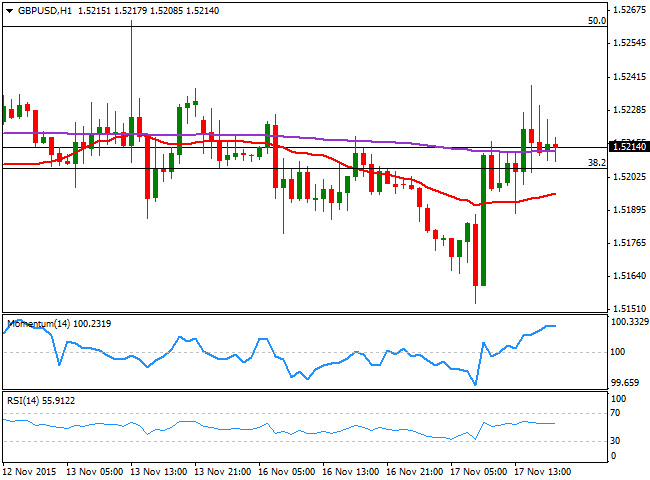

GBP/USD Current price: 1.5213

View Live Chart for the GPB/USD

The GBP/USD pair ended the day with some limited gains a few pips above the 1.5200 level, having set a lower low weekly basis at 1.5153 at the beginning of the European session, on the back of dollar's strength. Both economies released their October inflation data, with the UK reporting that the consumer price index fell by 0.1% year on year, and rose 0.1% from September, in line with market's expectations. Core inflation in the United Kingdom posted an annual rise of 1.1%, helping the Pound in bouncing from the mentioned low, albeit the numbers were not enough to restore investor's confidence after the latest BOE's economic policy announcement. Technically, the 1 hour chart shows that the neutral stance prevails, given that the price is moving back and forth around a horizontal 20 SMA and the 38.2% retracement of its latest weekly decline, whilst the technical indicators have turned back lower after a tepid advance in positive territory. In the 4 hours chart, the technical indicators remain stuck around their mid-lines, whilst the 20 SMA is also horizontal around the mentioned Fibonacci level, failing to offer a clear directional picture for the upcoming sessions.

Support levels: 1.5160 1.5120 1.5070

Resistance levels: 1.5220 1.5265 1.5310

USD/JPY Current price: 123.38

View Live Chart for the USD/JPY

The USD/JPY pair posted a soft advance this Tuesday, extending its weekly rally up to 123.48 in the American afternoon, following the positive mood among stocks traders. The pair, however, made little technical progress, still contained below the post-NFP high of 123.59, the level to break to confirm a more constructive outlook. Short term, the 1 hour chart shows that the 100 and 200 SMAs, head slightly higher and in a tight range around 122.80/123.00, reflecting a limited upward momentum at the time being. In the same chart, the technical indicators have turned lower, lacking directional strength, but holding above their mid-lines. In the 4 hours chart, the price holds near its daily high, whilst the technical indicators have lost their upward strength near overbought territory, still far from indicating a bearish movement for the upcoming sessions.

Support levels: 122.80 122.30 122.00

Resistance levels: 123.60 123.95 124.40

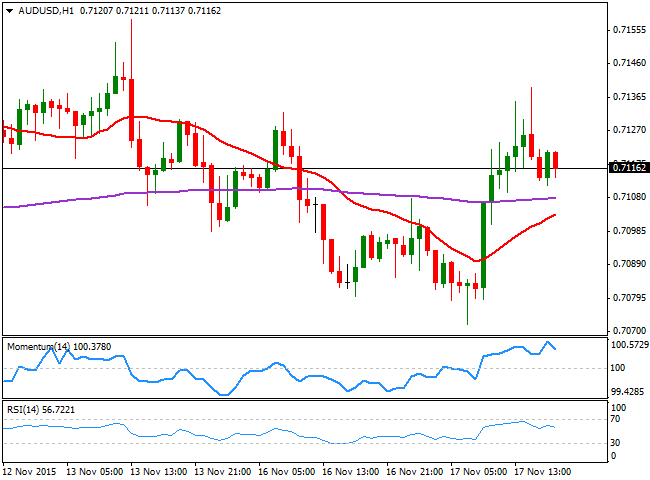

AUD/USD Current price: 0.7116

View Live Chart for the AUD/USD

The Australian dollar fell down to 0.7071 against its American counterpart, but trimmed losses during the European morning, following a strong recovery in copper prices that rebounded from a fresh multi-year low posted earlier this week. Despite gold prices plummeted to fresh lows later in the day, and most precious metal followed, the AUD/USD pair managed to end the day with some gains above the 0.7100 level, still far from confirming a more sustainable rally ahead. From a technical point of view, the 1 hour chart shows that the indicators are heading slightly higher above their mid-lines, whist the price stands above a bullish 20 SMA, all of which should keep the downside limited. In the 4 hours chart, however, the early advance was rejected by the 200 EMA still offering a strong dynamic resistance around 0.7150, whilst the price is hovering around a flat 20 SMA and the technical indicators lack clear directional strength around their mid-lines.

Support levels: 0.7070 0.7030 0.6990

Resistance levels: 0.7150 0.7190 0.7240

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.