EUR/USD Current price: 1.1407

View Live Chart for the EUR/USD

The American dollar trades lower against most of its major rivals, exception may by the EUR that fell to a daily low of 1.1424 on speculation the ECB may extend its QE program in its economic policy meeting next week, after ECB's Nowotny said additional measures need to be taken to reach the 2.0% inflation target. The pair bounced some after posting the low, but selling interest capped the upside around 1.1460, with the pair holding near its low ahead of the US batch of data. In the American country, September inflation resulted at -0.2% monthly basis as expected, and remained flat at 0.0% compared to a year before, beating expectations. The annual reading ex food and energy surged to 1.9% from previous 1.8%. Also, weekly unemployment claims fell down to 255K much better than the 270K expected, while the NY Empire manufacturing index posted a sharp drop, down by 11.36 against a decline of 8.00 expected.

The EUR/USD pair accelerated its decline towards 1.1400 after the releases, with the greenback advancing against all of its rivals. Technically, the 1hour chart for the pair shows that the price is well below its 20 SMA but above the 100 SMA around the mentioned low, whilst the technical indicators maintain sharp bearish slopes below their mid-lines. In the 4 hours chart, the price fell briefly below its 20 SMA, whilst the technical indicators continue correcting lower from extreme overbought readings. Nevertheless, buyers are aligned in the 1.1380/1.1400 region, meaning it will take a clear break below this level, to confirm a continued decline for this Thursday.

Support levels: 1.1380 1.1340 1.1310

Resistance levels: 1.1460 1.1500 1.1545

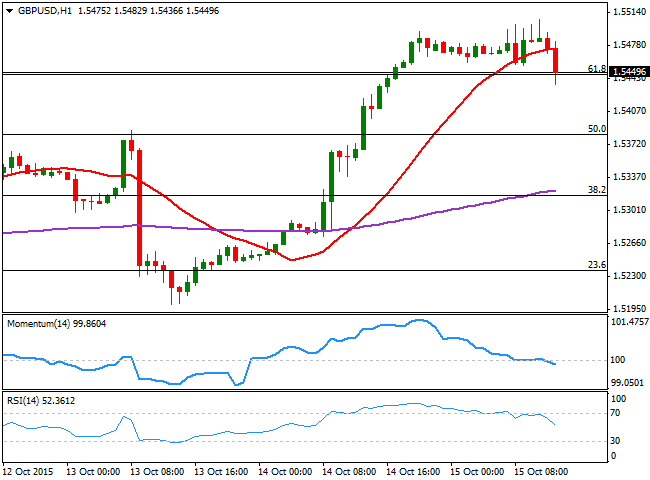

GBP/USD Current price: 1.5444

View Live Chart for the GPB/USD

The Pound spent the first half of the day consolidating its latest gains against the greenback, having extended its rally by a few pips this Thursday, up to 1.5506. With no macroeconomic events in the UK, the pair has been showing little directional strength, until the release of US data, which sent the pair down to 1.5436. Hovering now around the 61.8% retracement of its latest daily decline at 1.5445, the 1 hour chart suggest the pair may decline further, as the price is accelerating below its 20 SMA whilst the technical indicators head lower below their mid-lines. In the 4 hours chart, the technical indicators are retreating from overbought levels, but remain well above their mid-lines, whilst the price is way above its moving averages, limiting the strength on any possible bearish movement.

Support levels: 1.5410 1.5375 1.5330

Resistance levels: 1.5500 1.5560 1.5600

USD/JPY Current price: 118.52

View Live Chart for the USD/JPY

Bouncing from 118.05, upside seen limited. The USD/JPY fell sharply for a second day in a row, after finally breaking its almost 2-month range. The pair traded as low as 118.05 in the European morning, stalling around the 23.6% retracement of its latest decline. The release of US better-than-expected inflation and employment data, helped the pair to bounce up to 118.55, which is the base of the mentioned 2-month range. The 1 hour chart shows that the price is well below its moving averages, but that the technical indicators are bouncing strongly from extreme oversold levels, still well below their mid-lines. In the 4 hours chart, the technical indicators also turned higher, but are still in oversold territory, supporting an upward corrective movement should the price accelerate above the current level. The rally can extend up to 119.35, yet it sellers surged around this last, the risk will turn back lower, with the market then looking for a break of the mentioned daily low.

Support levels: 118.10 117.70 117.20

Resistance levels: 118.60 119.00 119.35

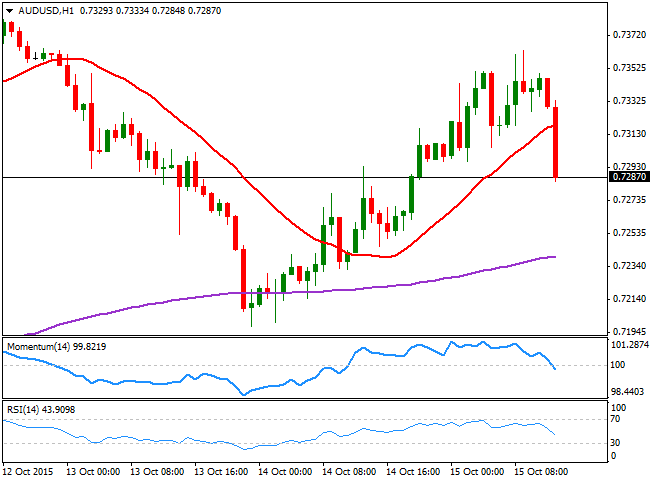

AUD/USD Current price: 0.7284

View Live Chart for the AUD/USD

The Australian dollar continued recovering ground early Thursday, rallying against the greenback up to 0.7363, after mixed employment data. According to the latest release, Australian unemployment rate dropped to 6.2%, as the participation rate decreased to 64.9%. Employment fell 5,100 from August compared with a median forecast of a 9,600 increase. Also, inflation expectations rose in October, to 3.5% from previous 3.2%. Better-than-expected US data however, has sent the pair to a fresh daily low below the 0.7300 level, turning the short term picture strongly bearish, as the price is accelerating below its 20 SMA, whilst the technical indicators are in line with further declines after breaking below their mid-lines. In the 4 hours chart, the technical readings also favor the downside, with further declines seen on a break below 0.7250.

Support levels: 0.7250 0.7220 0.7175

Resistance levels: 0.7300 0.7350 0.7390

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.