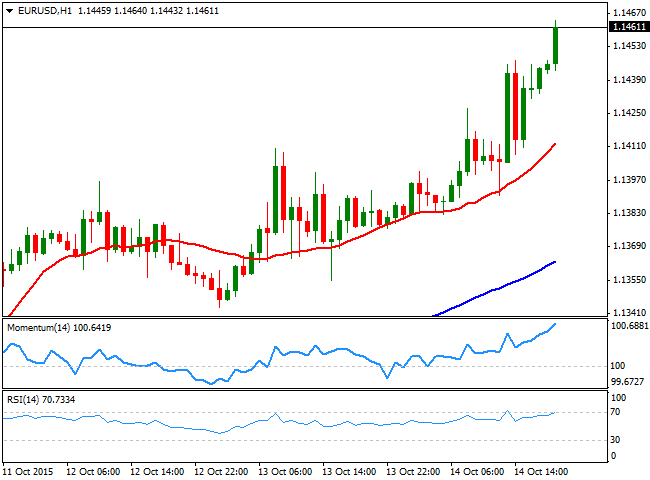

EUR/USD Current price: 1.1472

View Live Chart for the EUR/USD

The dollar edged sharply lower this Wednesday, with the EUR/USD pair reaching fresh daily highs ahead of the US close, and holding in the 1.1460 region. The common currency was on demand ever since the European opening, as poor Chinese inflation readings spurred demand for the common currency earlier in the day, sending the pair above the 1.1400 level. There were some minor releases in the EU, including the region's industrial production data for August, which fell by 0.5%. But it was worse-than-expected US data, which triggered a dollar's sell-off all across the board, as in September, the producer price index fell by 1.1% compared to a year before, whilst the core reading, excluding food and energy, reached 0.8% against expectations of a 1.2% advance and 0.9% previous.

Technically speaking, selling interest has capped rallies around the current level since May this year - dismissing the Black Monday high of 1.1713 - which means that if the level is broken, the rally can extend over the upcoming sessions. The short term picture is bullish, despite the technical indicators are in overbought territory in the 1 hour chart, but there are no signs the pair may change course any time soon. In the same chart, the price is well above its moving averages, all with strong bullish slopes, supporting further advances. In the 4 hours chart, the RSI indicator heads higher around 80, while the rest of the technical readings are in line with a continued advance. Nevertheless, some downward corrective movement should not be disregarded, with buyers most likely surging on approaches to the 1.1400 figure.

Support levels: 1.1430 1.1380 1.1340

Resistance levels: 1.1500 1.1545 1.1590

EUR/JPY Current price: 136.29

View Live Chart for the EUR/JPY

The EUR/JPY pair has shown little progress this Wednesday, trading range bound within a tight range, as both, the EUR and the JPY rallied against the greenback. The pair is closing the day with a doji for a second day in-a-row, lacking directional strength. Short term, the 1 hour chart shows that the price is holding a few pips above a bullish 20 SMA, whilst the technical indicators are turning slightly lower around their mid-lines, presenting a neutral stance at the time being. In the 4 hours chart, the price remains well above its 100 and 200 SMAs, whilst the Momentum indicator is flat below its 100 level, and the RSI indicator heads lower around 54, maintaining the risk towards the downside, particularly on a break below 135.90, the immediate support.

Support levels: 135.90 135.60 135.20

Resistance levels: 136.50 136.95 137.30

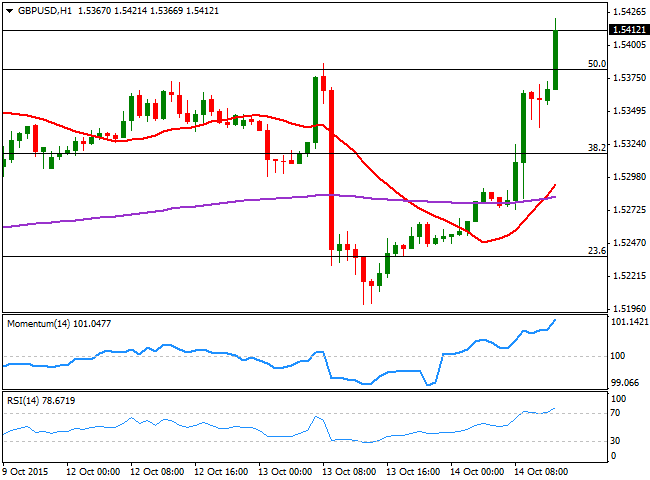

GBP/USD Current price: 1.5468

View Live Chart for the GPB/USD

The GBP/USD pair advanced nearly 200 pips this Wednesday, and reaching a fresh 3-week high of 1.5472. In the UK, mixed employment data showed that employment rose 140,000 in the three months to August while unemployment fell 79,000 resulting in an unemployment rate of 5.4%, its lowest in seven years. Wages missed expectations, but growth above previous month readings, with the average weekly earnings up 3% yearly basis. The pair initially fell with the headline, but markets' player quickly realized that solid wages along with lower inflation should give local consumption a nice boost over the upcoming months, putting back on the table a possible rate hike. The 1 hour chart shows that the pair is now advancing beyond the 61.8% retracement of its latest daily decline at 1.5445, now the immediate support, whilst the technical indicators continue heading higher, despite being in extreme overbought territory. In the 4 hours chart, the technical indicators maintain their bullish slopes well into positive territory, in line with the shorter term picture and with additional gains for this Thursday.

Support levels: 1.5445 1.5410 1.5375

Resistance levels: 1.5500 1.5560 1.5600

USD/JPY Current price: 118.86

View Live Chart for the USD/JPY

The Japanese yen accelerated its rally in the American afternoon, leading to a USD/JPY decline down to the 118.80 region before the US closing bell. The pair posted a mild decline during the Asian session, following the release of Chinese inflation data for September, much worse than expected as the CPI rose by 0.1% compared to the previous month, when it rose 0.5%, whilst yearly basis, inflation was up 1.6% from the previous 2.0%. Trading at its lowest since October 2nd, the 1 hour chart shows that price holds well below its moving averages, and below the 38.2% retracement of its latest weekly decline at 119.35, while the technical indicators maintain their strong bearish slopes and are currently entering oversold levels. In the 4 hours chart, the technical indicators also present strong bearish slopes, despite being in oversold territory, supporting a bearish continuation, particularly as there are no buyers around, with the price holding steady near its low. The immediate support comes at the 118.50/60 region, from where the pair has bounced several times since late August. Should the pair extend below this area, the downside is open for a retest of the 116.13, the low posted last August.

Support levels: 118.55 118.10 117.70

Resistance levels: 119.00 119.35 119.70

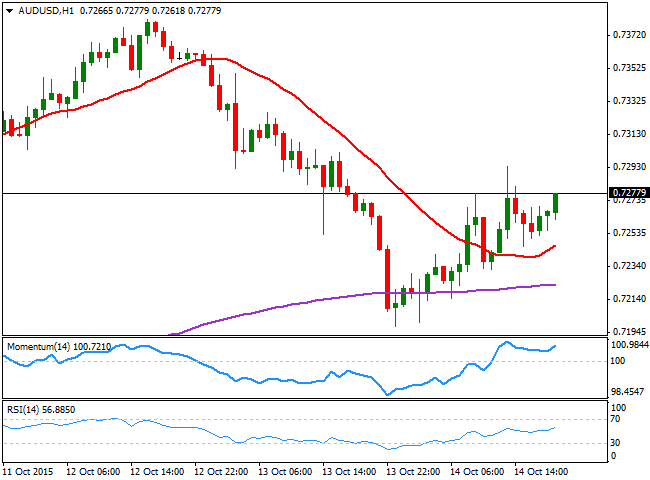

AUD/USD Current price: 0.7278

View Live Chart for the AUD/USD

The AUD/USD pair recovered half of its Tuesday's losses, despite an early test of the 0.7200 figure following disappointing Chinese inflation figures. The Aussie got a boost from gold, as spot price advanced up to $1,188.36 a troy ounce, its highest since mid June. Nevertheless the Australian dollar is the worst performer against the dollar daily basis, capped by the 0.7300 level. Technically the 1 hour chart however, supports additional gains, as the price is now above a bullish 20 SMA, whilst the technical indicators recovered their bullish slopes, and head north above their mid-lines. In the 4 hours chart, the technical indicators present tepid positive slopes, but well below their mid-lines, while the 20 SMA heads slightly lower around the mentioned 0.7300 level, being the level to overcome to confirm a continued advance during the upcoming sessions.

Support levels: 0.7250 0.7220 0.7175

Resistance levels: 0.7300 0.7350 0.7390

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.