EUR/USD Current price: 1.1394

View Live Chart for the EUR/USD

The European session started with a weakening dollar, and the EUR extending its recent rally up to 1.1410 against the greenback. Stocks around the world are in the red, as worse-than-expected Chinese trade figures revived fears over the global economic slowdown. The macroeconomic calendar has been pretty busy early in the session, with disappointing readings, both in Europe and the UK. Earlier in the day, German inflation resulted as expected in September, down 0.2% monthly basis and at 0.0% compared to an year before. The ZEW survey showed that in Germany, economic sentiment fell down 1.9 from previous 12.1, whilst the assessment of the current situation resulted at 55.2 from previous 67.5. The EU economic sentiment, according to the same survey, shrank to 30.1 matching expectations, sending the EUR/USD down to 1.1364.

In the US, FED's Bullard, and usual hawk, offered a speech saying that a lift-off is still appropriate, as the recent challenges are not significantly robust to guide the economic policy. The pair has been holding ground well above the mentioned session low ,and the technical picture shows that in the 1 hour chart the price stands above a horizontal 20 SMA, whilst the technical indicators turned north above their mid-lines, supporting further gains. In the 4 hours chart, the price is well above a still bullish 20 SMA, whilst the technical indicators have turned lower from overbought readings, and the Momentum indicator is about to cross its mid-line towards the downside. Only below 1.1340, the mentioned 20 SMA, the pair can extend its decline down to 1.1290, should the dollar maintain the positive tone.

Support levels: 1.1340 1.1290 1.1245

Resistance levels: 1.1400 1.1430 1.1460

GBP/USD Current price: 1.5209

View Live Chart for the GPB/USD

The GBP/USD pair advanced to a fresh 3-week high, a few pips above the previous one, reaching 1.5387 before beginning to retrace, accelerating its decline on the back of worse-than-expected inflation data in the UK. The pair shed around 180 pips following news that the inflation fell 0.1% in September, compared to a year before, the second time inflation goes negative since 1960. In the same month, and also yearly basis, the producer prices index fell by 1.8%. The GBP/USD pair flirts with the 1.5200 level ahead of the US opening, having extended its decline below several intraday supports without looking back. Short term, the 1 hour chart shows that the 20 SMA maintains a strong bearish slope well above the current level, whilst the technical indicators maintain their strong bearish slopes, despite being in oversold levels. In the 4 hours chart, the 20 SMA has turned lower far above the current level, whilst the technical indicators have partially lost their bearish strength, but hold well into negative territory, limiting chances of an upward move. The immediate resistance comes at 1.5230, the 23.6% retracement of its latest daily decline, whilst below 1.5190, the pair has scope to extend its decline down to 1.5150 today.

Support levels: 1.5190 1.5150 1.5110

Resistance levels: 1.5230 1.5260 1.5300

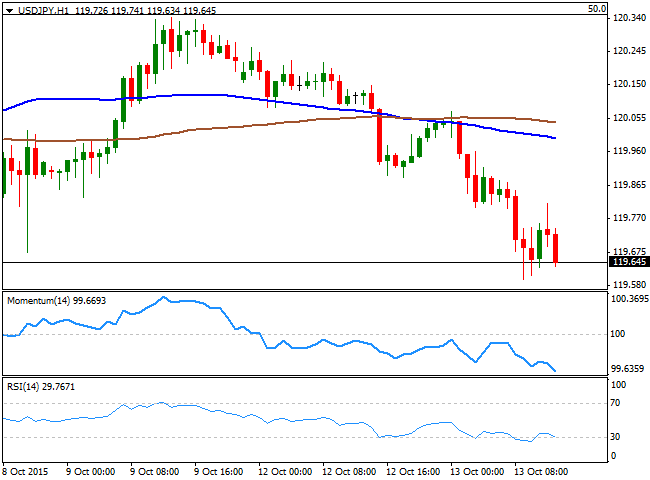

USD/JPY Current price: 119.65

View Live Chart for the USD/JPY

More slides below 119.35. The USD/JPY pair trades slightly lower daily basis, holing near its daily low of 119.59 ahead of the US opening. The pair come under pressure on the back of stocks' slide in Asia, albeit the movement lacks momentum, with the price still confined within its latest range. Technically, the 1 hour chart shows that the 100 SMA is slowly detaching from the 200 SMA well above the current level, whilst the technical indicators head sharply lower in negative territory, maintaining the risk towards the downside. In the 4 hours chart, the technical indicators also head south below their mid-lines, supporting a downward continuation, with the next support at 119.35, the 38.2% retracement of its latest bearish run. Below this level, the pair can extend down to 118.90, followed later by 118.55, the base of its latest range.

Support levels: 119.35 118.90 118.55

Resistance levels: 120.05 120.35 120.70

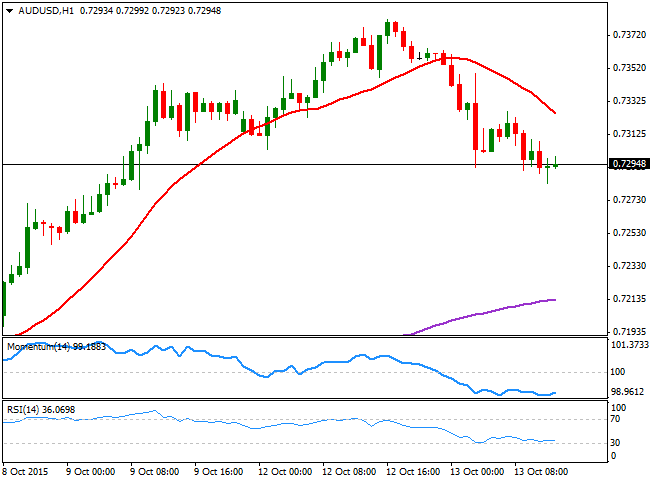

AUD/USD Current price: 0.7359

View Live Chart for the AUD/USD

Bad news from China and easing gold prices have weighed on the Aussie, down against the greenback to a fresh weekly low of 0.7283. The AUD/USD pair hourly chart, shows that the price is well below a bearish 20 SMA, whilst the technical indicators are aiming to bounce from near oversold levels, suggesting the pair may recover some, should the price extends above 0.7310. In the 4 hours chart however, the Momentum indicator heads sharply lower, whilst the price is below a bearish 20 SMA and the RSI indicator has turned flat around 54, pointing for limited intraday gains during the upcoming session.

Support levels: 0.7260 0.7220 0.7175

Resistance levels: 0.7310 0.7350 0.7390

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.