EUR/USD Current price: 1.0920

View Live Chart for the EUR/USD

The dollar remains on demand after solid US data reinforced the idea that a rate hike is around the corner. The Advanced GDP figures for the second quarter of 2015 resulted slightly below expected, but much better than the previous, printing 2.3%. The first quarter number was revised to the upside from -0.2% to 0.6%, whilst unemployment claims came out at 267K, against expectations of 270K. The EUR/USD pair break to fresh daily lows after the US opening, an approaches the 1.0900 level, with the 1 hour chart showing that the price is now below all of its moving averages, and that the technical indicators have turned south deep in the red, entering oversold territory. In the 4 hours chart, the technical indicators have resumed their decline near oversold levels, supporting a continued decline towards the lows in the 1.0800/20 region for the upcoming sessions.

Support levels: 1.0880 1.0850 1.0810

Resistance levels: 1.0960 1.1010 1.1050

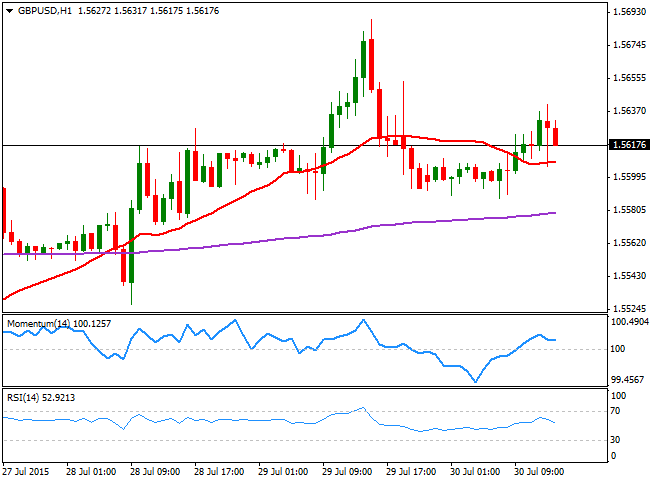

GBP/USD Current price: 1.5620

View Live Chart for the GPB/USD

The GBP/USD pair holds above the 1.5600 level, with the Pound refusing to give up to broad dollar's strength. Despite there were no fundamental releases in the UK, the pair has been maintaining its latest positive tone, albeit the bearish potential increases in the US session, as the 1 hour chart shows that the price is approaching a horizontal 20 SMA, whilst the technical indicators have turned south above their mid-lines. In the 4 hours chart, however, the price holds above a bullish 20 SMA, whilst the technical indicators lack directional strength above their mid-lines, limiting chances of a stronger decline, as long as buyers continue surging around 1.5580/90.

Support levels: 1.5580 1.5545 1.5500

Resistance levels: 1.5635 1.5670 1.5730

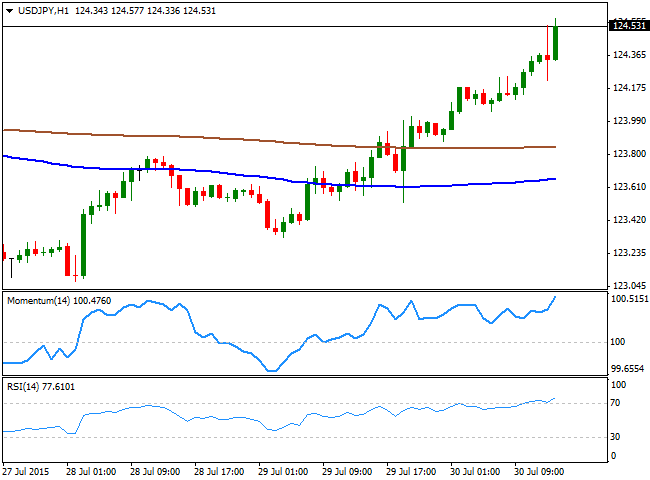

USD/JPY Current price: 124.63

View Live Chart for the USD/JPY

Fresh highs, scope to test 125.00. The USD/JPY pair trades at levels not seen since mid June, struggling however to extend its gains. The pair printed a high of 124.57 so far in the day, and maintains a strong positive short term tone, as the 1 hour chart shows that the technical indicators continue to head strongly higher despite being in overbought territory, whilst the price has extended far above its moving averages. In the 4 hours chart, the 100 SMA posts a mild advance above the 200 SMA, whilst the technical indicators are losing their upward strength well in positive territory, signaling some temporal exhaustion. Nevertheless, as long as the pair holds above 124.00, the upside remains favored, with scope to extend up to 125.00 on a break above the mentioned daily high.

Support levels: 124.10 123.70 123.30

Resistance levels: 124.60 125.00 125.30

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.