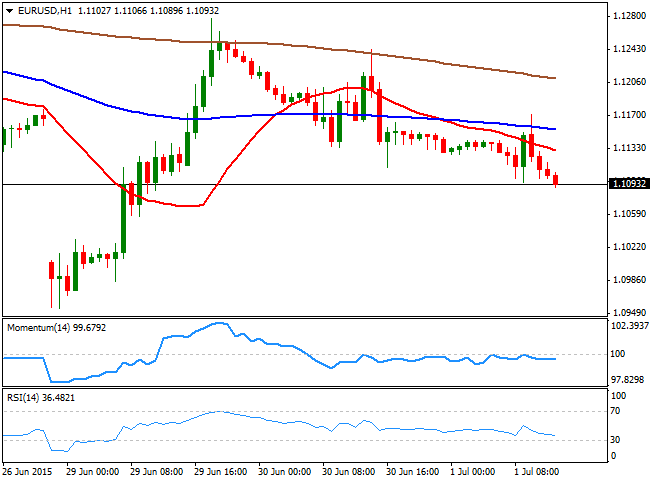

EUR/USD Current price: 1.1089

View Live Chart for the EUR/USD

And when finally the Greek default become real, and markets began to quiet down a bit, PM Tsipras sent a letter accepting the latest proposal with some conditions. Not enough, neither on time, the EU leaders are now delaying negotiations for after the weekend referendum, and then, will take time to be analyzed, and ever more time to be approved by different Parliaments across Europe, so if a deal is to be reached, will be by the ends of July. That suggest that Greek banks may not be able to reopen next Monday, and that the cap of €60 extraction a day will remain. The news however, was enough to boost local equities markets, up for the first time ever since the week started.

In the meantime, data from Europe shown local manufacturing PMIs for June came out mixed, with German and the EU readings matching expectations, but with growth limited in peripheral countries such as Italy and Spain. The EUR/USD pair traded as low as 1.1094, jumped up to 1.1170 on Greek news, and resumed its decline, down to 1.1100 ahead of the US ADP survey release, which resulted at 237K, beating expectations. The dollar jumped higher across the board, and the EUR/USD extended its intraday decline, presenting a short term bearish tone as the 1 hour chart shows that the price extends below its moving averages, whilst the technical indicators head south below their mid-lines. in the 4 hours chart, the Momentum indicator turned sharply lower around the 100 level, supporting the shorter term view, with chances of a test of the critical 1.1050 level in the upcoming hours.

Support levels: 1.1080 1.1050 1.1010

Resistance levels: 1.1120 1.1160 1.1210

GBP/USD Current price: 1.5732

View Live Chart for the GBP/USD

The Pound took a hit from the UK manufacturing PMI showing that the country grew at it slowest pace in two years in June, printing 51.4 against expectations of 52.5. The GBP/USD fell down to 1.5639, a fresh 2- week low, and held nearby ahead of US data release. The pair is accelerating to new daily lows after the positive US ADP survey, and the 1 hour chart shows a strongly bearish 20 SMA well above the current level, whilst the RSI indicator anticipated further declines, heading lower around 30. In the 4 hours chart, an early recovery was limited by a mild bearish 20 SMA, whilst the technical indicators are slowly turning south in negative territory, suggesting the pair may extend its decline over the upcoming hours. A break below 1.5600, should lead to a test of 1.5550, 50% retracement of the latest daily bullish run.

Support levels: 1.5600 1.5550 1.5520

Resistance levels: 1.5645 1.5695 1.5750

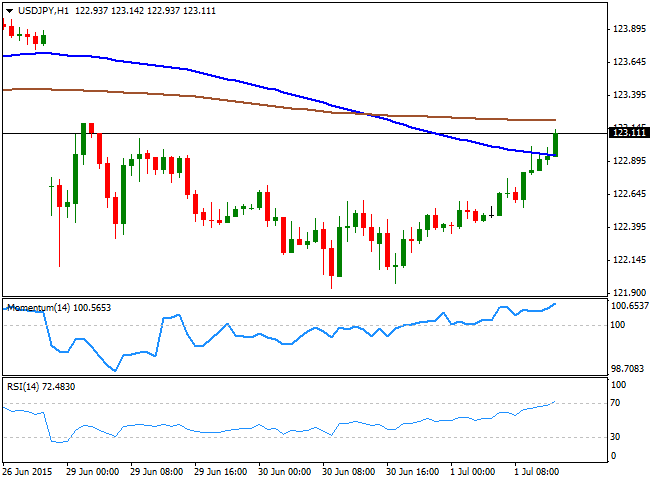

USD/JPY Current price: 123.18

View Live Chart for the USD/JPY

Market's positive mood has helped the USD/JPY regain the 123.00 level, now advancing further on positive US employment data. The 1 hour chart for the pair shows that the price has advanced above its 100 SMA, for the first time this week, with the 200 SMA now offering an immediate resistance in the 123.30 region, a strong static resistance level also. The technical indicators in the mentioned time frame head sharply higher, entering overbought territory, whilst in the 4 hours chart the technical readings are also biased strongly higher in positive territory, albeit the 100 and 200 SMAs converge a few pips above the current level, limiting chances of a stronger advance.

Support levels: 122.90 122.45 122.00

Resistance levels: 123.30 123.75 124.10

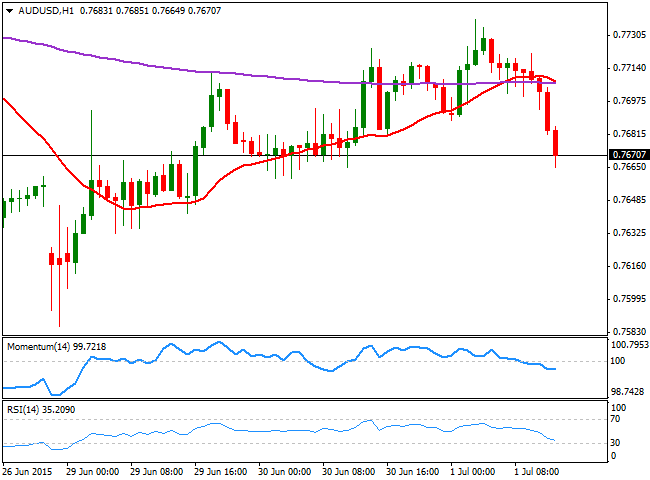

AUD/USD Current price: 0.7671

View Live Chart for the AUD/USD

The Aussie came under selling pressure as the greenback advanced across the board, accelerating down to 0.7664 ahead of the US opening. The pair has traded as high as 0.7738 early Asia, but selling interest around the level pushed it back south, with the 1 hour chart now supporting additional declines on a break below 0.7640, the immediate support, as the technical indicators head lower in negative territory whilst the price broke below its 20 SMA. In the 4 hours chart, the price is now trying to extend below its 20 SMA, whilst the technical indicators have turned lower around their mid-lines, supporting the shorter term view.

Support levels: 0.7640 0.7590 0.7550

Resistance levels: 0.7700 0.7740 0.7780

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.