EUR/USD Current price: 1.1191

View Live Chart for the EUR/USD

The EUR/USD pair has fell down to 1.1133 this Tuesday, as Greece won't pay the IMF the maturities of June, whilst the first polls on the Greek referendum show that the NO is slightly up. But market talks of a last minute deal between the country and its creditors have triggered a bounce back towards the 1.1200 level, where it stands. High levels of uncertainty continue to weigh in the financial markets that are still looking for direction. In the meantime, the EUR/USD 1 hour chart shows that the price is being capped by a flat 20 SMA, whilst the technical indicators aim higher below their mid-lines, limiting slides in the short term. In the 4 hours chart, a neutral stance prevails, with the risk turning towards the downside on a break below 1.1120.

Support levels: 1.1160 1.1120 1.1080

Resistance levels: 1.1210 1.1245 1.1290

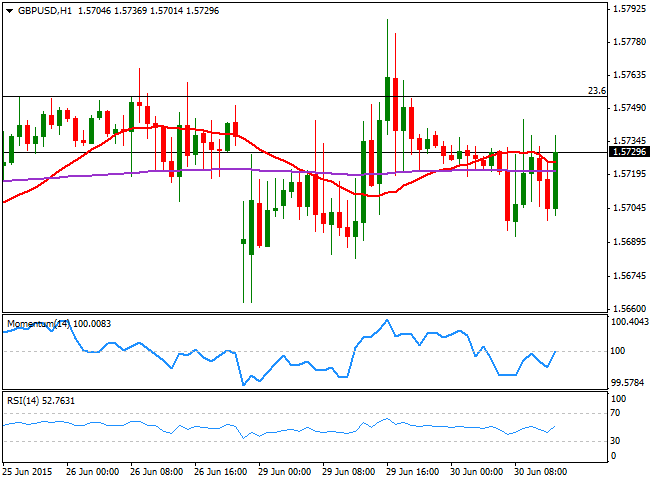

GBP/USD Current price: 1.5729

View Live Chart for the GBP/USD

The British Pound trades in a tight range against the greenback, some 20 pips either side of the 1.5700 level, and with no actual directional strength, despite a review of the first quarter GDP showed the economy grew more than initially estimated, up to 0.4% from previous 0.3%. The short term technical picture suggests the pair may attempt a retest of the 1.5750/60 region, as buyers have been surging on dips towards 1.5660. But in the 1 hour chart, there's not enough momentum at the time being, as the indicators aim higher around their mid-lines, whilst the price is stuck around a horizontal 20 SMA. In the 4 hours chart, the technical picture is also neutral, with declines down to 1.5645, the 38.2% retracement of the latest bullish run, seen as buying opportunities.

Support levels: 1.5695 1.5645 1.5610

Resistance levels: 1.5750 1.5795 1.5830

USD/JPY Current price: 122.42

View Live Chart for the USD/JPY

The Japanese Yen remains strong, having traded against the greenback at 121.93 earlier in the day. The pair is now unable to establish itself above the 122.45 level, whilst the 100 and 200 SMAs head lower above the current price and the technical indicators turn south below their mid-lines. In the 4 hours chart, the RSI has lost its downward strength but holds near oversold levels, whilst the Momentum indicator presents a tepid bearish slope in negative territory, supporting the ongoing bearish tone.

Support levels: 122.00 121.60 121.20

Resistance levels: 122.90 123.30 123.75

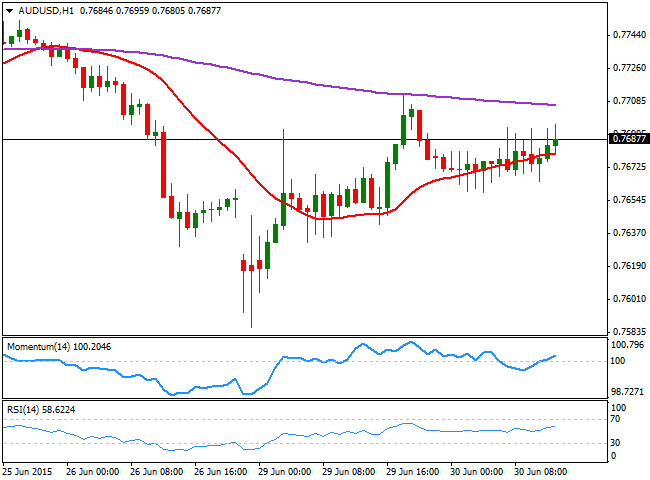

AUD/USD Current price: 0.7687

View Live Chart for the AUD/USD

The Australian dollar retreated below the 0.7700 against the greenback, but trades for the most range bound, with a slightly positive tone in the short term, as the 20 SMA maintains a limited upward slope, whilst the technical indicators head north above their mid-lines. In the 4 hours chart, however, the 20 SMA maintains a bearish slope, whilst the technical indicators remain below their mid-lines, limiting chances of a strong advance as long as the price holds below the 0.7720 resistance.

Support levels: 0.7640 0.7590 0.7555

Resistance levels: 0.7720 0.7755 0.7790

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.