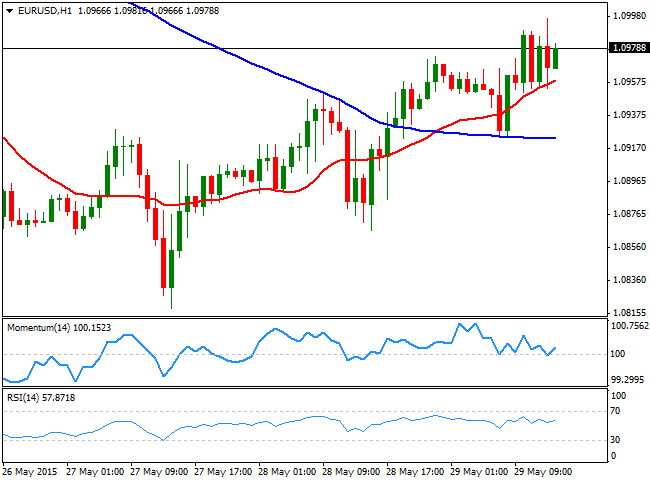

EUR/USD Current price: 1.0979

View Live Chart for the EUR/USD

The EUR/USD approached to the 1.1000 level early in the European session, holding to its recent gains, despite looming risk coming from Greece. Nevertheless, the market remained range bound ahead of the second revision of the first quarter US GDP, which showed that the economy shrank at a annualized rate of 0.7%, against expectations of a 0.8% decline. The reading was better-than-expected, but worse than previously estimated, leaving majors trading choppy, but within range. An initial spike up to 1.0997 was quickly rejected, albeit the pair held above 1.0950 the immediate support. The pair remains contained in a 50 pips range, with the 1 hour chart showing that the price remains above a bullish 20 SMA, whilst the technical indicators present a limited upward tone in neutral territory. In the 4 hours chart, the technical indicators are also above their mid-lines, but turning lower, whilst the price develops above a flat 20 SMA.

Support levels: 1.0950 1.0900 1.0860

Resistance levels: 1.1000 1.1050 1.1090

GBP/USD Current price: 1.5265

View Live Chart for the GBP/USD

The GBP/USD pair extended its decline down to 1.5235 ahead of US news, bouncing sharply and approaching the 1.5300 level afterwards, but pulled back quickly, maintaining the dominant bearish tone. The 1 hour chart shows that the price was unable to advance beyond a bearish 20 SMA, whilst the technical indicators maintain their bearish tone in negative territory, supporting additional intraday declines. In the 4 hours chart the 20 SMA maintains a strong bearish slope whilst crossing below the 200 EMA around 1.5350/60 a strong resistance level as it's also the 61.8% retracement of the latest bullish run. The technical indicators remain in bearish territory albeit lacking directional strength, with a break below 1.5220 now required to confirm an extension towards 1.5000 next week.

Support levels: 1.5260 1.5220 1.5180

Resistance levels: 1.5290 1.5320 1.5365

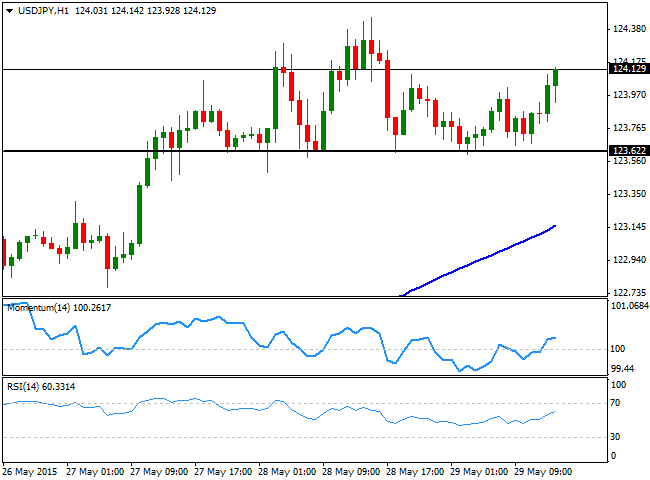

USD/JPY Current price: 124.12

View Live Chart for the USD/JPY

The USD/JPY pair recovered the 124.00 level, but so far is unable to run, maintaining however the bullish tone seen over these past 2 weeks. The 1 hour chart, shows that the 100 and 200 SMAs, have extended their advances below the current price, whilst the technical indicators remain in positive territory, lacking however momentum at the time being. In the 4 hours chart, the technical indicators are regaining the upside after correcting overbought readings, and stand well above their mid-lines, supporting the dominant bullish trend. Nevertheless, the pair needs to advance above 124.40 to be able to extend its gains up to the 125.00 price zone.

Support levels: 124.00 123.65 123.30

Resistance levels: 124.40 124.85 125.10

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.