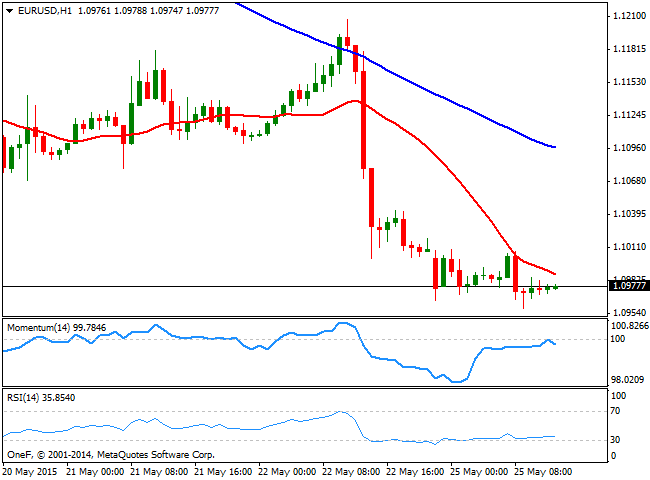

EUR/USD Current price: 1.0977

View Live Chart for the EUR/USD

The holidays in Europe and the US are keeping the FX board subdued, with majors consolidating in quite limited ranges this Monday. The EUR/USD pair has fell down to 1.0958, breaking below the 1.1000 level for the first time this May, amid doom Greek headlines, anticipating the country won't be able to meet its due payments to the IMF in June. The dollar surged on Friday, as higher inflation in the US boosted hopes of a soon rate hike in the country. Technically, the EUR/USD 1 hour chart maintains a negative tone, with the price a few pips above the mentioned level, and the technical indicators in negative territory, albeit lacking directional momentum amid the lack of volume. In the 4 hours chart the bias is also lower as the Momentum indicator heads south below 100 whilst the 20 SMA maintains is bearish slope above the current price.

Support levels: 1.0960 1.0910 1.0870

Resistance levels: 1.1000 1.1050 1.1100

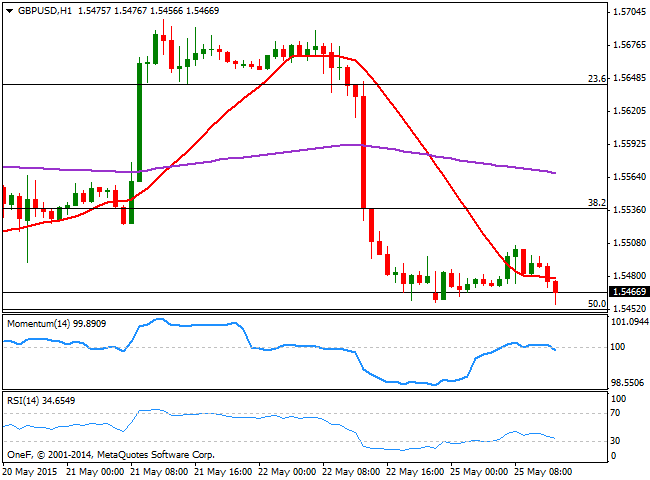

GBP/USD Current price: 1.5467

View Live Chart for the GBP/USD

The GBP/USD pair failed to regain the 1.5500 level, as an early spike to 1.5506 resulted in a retracement down to fresh daily lows of 1.5456. Trading with a limited bearish tone, the 1 hour chart shows that the price is now below its 20 SMA, whilst the Momentum indicator turned lower around 100 and the RSI indicator maintains a bearish slope near oversold levels. In the 4 hours chart the price is approaching a critical support area at 1.5440, 50% retracement of its latest bullish run, and last week low, whilst the technical readings present a bearish tone that supports additional declines on a break below the mentioned Fibonacci level.

Support levels: 1.5440 1.5400 1.5340

Resistance levels: 1.5495 1.5535 1.5580

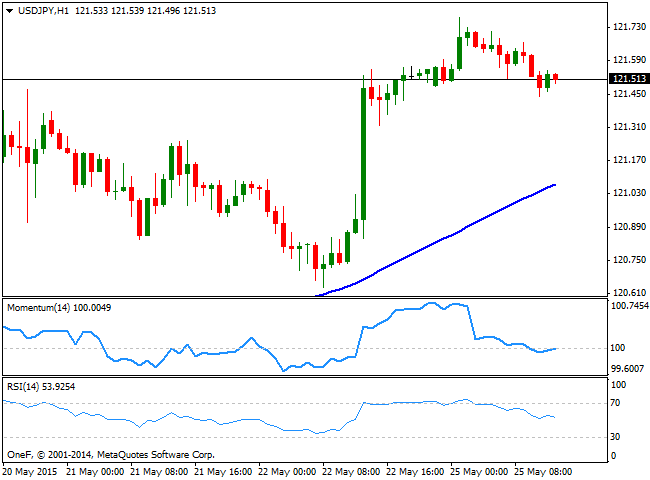

USD/JPY Current price: 121.51

View Live Chart for the USD/JPY

The USD/JPY extended its advance up to 121.77 during the Asian session, but gave up its intraday gains and hovers around its daily opening in the 121.50 price zone. Nevertheless, the 1 hour chart shows that the price stands well above a strongly bullish 100 SMA around 121.10, whilst the Momentum indicator aims to regain the upside around the 100 level and the RSI indicator hovers around 53. In the 4 hour chart, the technical indicators remain well into positive territory and aiming higher, supporting the ongoing bullish trend despite the lack of upward momentum.

Support levels: 121.10 120.85 120.45

Resistance levels: 121.60 122.10 122.50

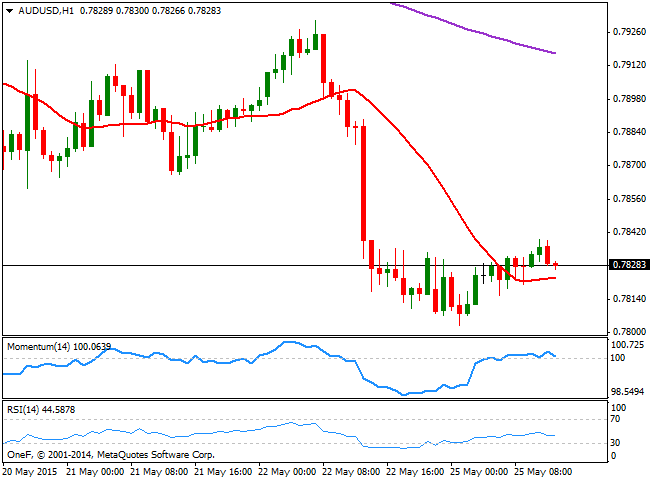

AUD/USD Current price: 0.7827

View Live Chart for the AUD/USD

The AUD/USD trades around its daily opening, having set a daily low of 0.7802 earlier in the day. The downside is favored on a break below the critical figure, as the 1 hour chart shows that the indicators are turning south around their midlines, albeit limited due to the lack of volume. In the 4 hours chart, the price continues to extend below its 200 EMA, wilst the 20 SMA has crossed below it and maintains a strong bearish slope, supporting the general negative tone.

Support levels: 0.7800 0.7775 0.7750

Resistance levels: 0.7845 0.7890 0.7930

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700, eyes on US first-quarter GDP data

EUR/USD hovers around the 1.0700 psychological level on Thursday during the early Thursday. The modest uptick of the major pair is supported by the softer US Dollar. Later in the day, Germany’s GfK Consumer Confidence Survey for April will be released.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.