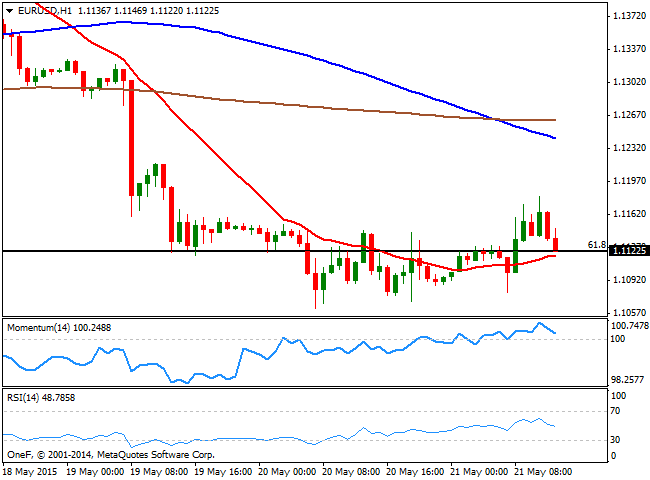

EUR/USD Current price: 1.1120

View Live Chart for the EUR/USD

The EUR/USD pair surged to a 2-day high of 1.1180 as investors digests FOMC Minutes released late Wednesday. The FED's statement has diminished chances for a rate hike in June, something the market had already priced in, and at the same time, upgraded the economic outlook in the midterm, which may suggest rates may remain low for longer. Data in Europe was mixed, with German Markit PMIs missing expectations, albeit manufacturing in the EU rose more than expected. In the US, weekly unemployment claims for the week ending May 15th, came out at 274K slightly worse than expected, keeping the greenback in selling mode. Technically, the short term picture supports the downside, with the pair pressuring the 1.1120 region and a mild bullish 20 SMA, whilst the technical indicators have accelerated south below their mid-lines. In the 4 hours chart , the technical indicators turned back south below their mid-lines after correcting oversold readings, keeping the risk towards the downside should the price finally break below the current support.

Support levels: 1.1120 1.1050 1.1000

Resistance levels: 1.1170 1.1220 1.1250

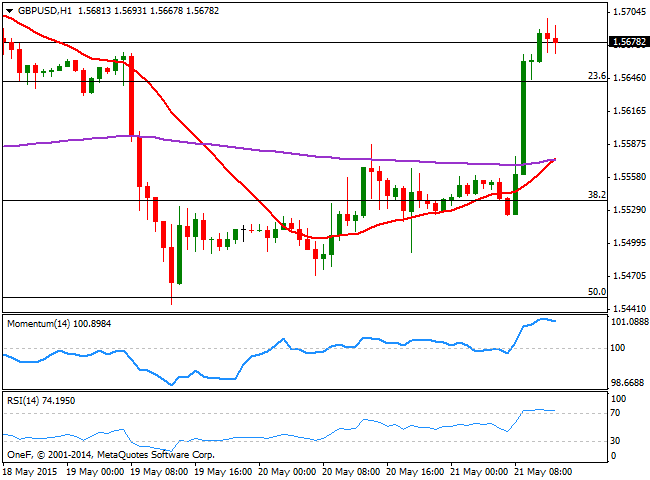

GBP/USD Current price: 1.5679

View Live Chart for the GBP/USD

The British Pound resume its bullish trend following the release of better-than-expected UK Retail Sales for May that send the pair sharply higher, up to 1.5699. Having advanced over 150 pips in the day, the pair is now consolidating near the high, and the 1 hour chart shows that the technical indicators are turning lower in extreme overbought territory, not yet signaling a downward correction. In the 4 hours chart, the latest candle opened above the 20 SMA and the 23.6% retracement of the latest daily bullish run, whilst the technical indicators are losing their upward strength around their mid-lines. Nevertheless, as long as above 1.5640 the upside is favored towards the year high set earlier this month at 1.5814.

Support levels: 1.5640 1.5600 1.5550

Resistance levels: 1.5700 1.5735 1.5780

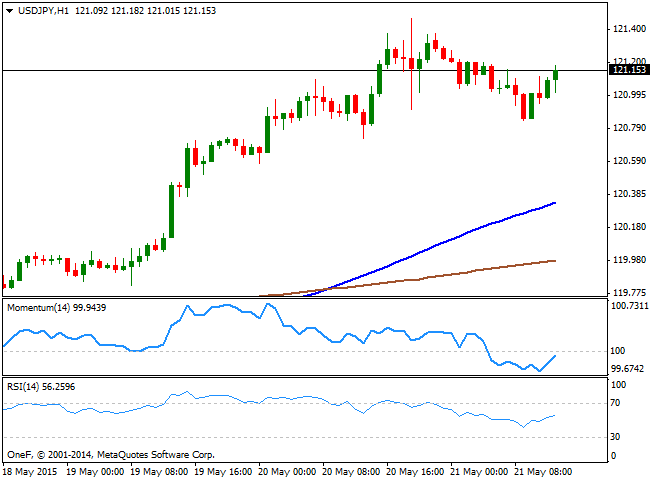

USD/JPY Current price: 121.15

View Live Chart for the USD/JPY

The USD/JPY pair holds ground above the 121.00 level, after an early dip down to 120.84. The dollar advances ahead of the US opening despite tepid employment figures, suggesting there's room for further gains beyond the weekly high set at 121.46. Technically, the 1 hour chart shows that the price stands well above its moving averages, with the 100 SMA breaking above the 200 SMA as the technical indicators head higher around their mid-lines. In the 4 hours chart the technical indicators are regaining the upside after correcting partially extreme overbought readings, supporting the shorter term view.

Support levels: 120.85 120.45 120.10

Resistance levels: 121.45 121.70 122.10

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.