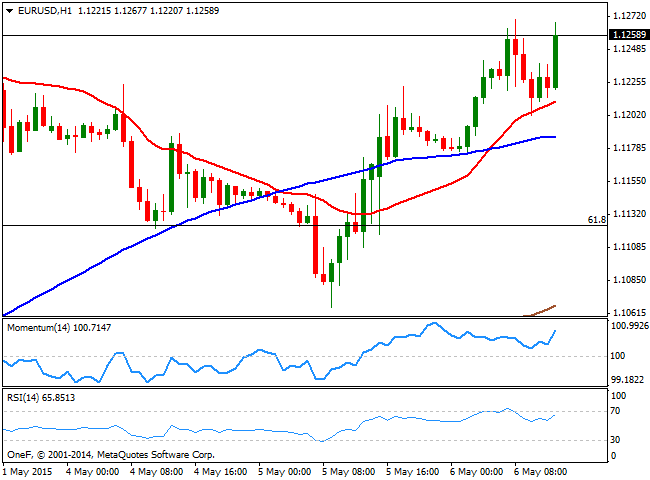

EUR/USD Current price: 1.1259

View Live Chart for the EUR/USD

The EUR/USD pair not only advanced above the 1.1200 level, but also reached a fresh weekly high of 1.1270, finding support in better-than-expected PMI readings in Europe. The EU Services PMI for April surge to 54.1, whilst the Composite beat expectations by printing 53.9. The readings were generally higher in all of the European major economies, with Germany being the only laggard. In the meantime, Greece has made a €200 million payment to the IMF, taking off the pressure over the common currency. The country is due to repay another €750 million to the IMF next May 12, which means by then, the market's sentiment may flip again towards risk off. In the US, the ADP survey missed expectations in April, printing just 169K, below previous 189K and below expectations of 200K, adding to the bearish dollar case. The EUR/USD pair advances towards its daily high after the news, with the 1 hour chart showing that the price held above a mild bullish 20 SMA and that the technical indicators head higher above their mid-lines, anticipating additional advances. In the 4 hours chart the pair advances above a flat 20 SMA in the 1.1180 area, whilst the technical indicators head higher above their mid-lines, anticipating additional advances.

Support levels: 1.1225 1.1180 1.1450

Resistance levels: 1.1280 1.1330 1.1365

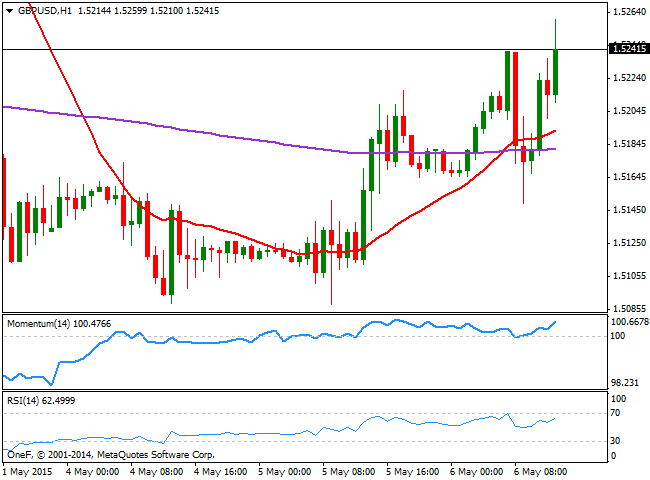

GBP/USD Current price: 1.5242

View Live Chart for the GBP/USD

The British Pound advances this Wednesday, extending up to 1.5260 against the greenback on the back of stronger local data and poor US employment readings. In the UK, the Services PMI for April surged to a eight month high of 59.5. The technical picture favors further short term advances, as the 1 hour chart shows that the price extends above a bullish 20 SMA, whilst the technical indicators head north well above their mid-lines. In the 4 hours chart the 20 SMA stands below the current level, flat around 1.5160 now, acting as intraday support whilst the technical indicators head higher in positive territory, supporting the shorter term view. Nevertheless, beware of quick profit taking on spikes ahead of Thursday UK elections.

Support levels: 1.5210 1.5160 1.5120

Resistance levels: 1.5260 1.5300 1.5340

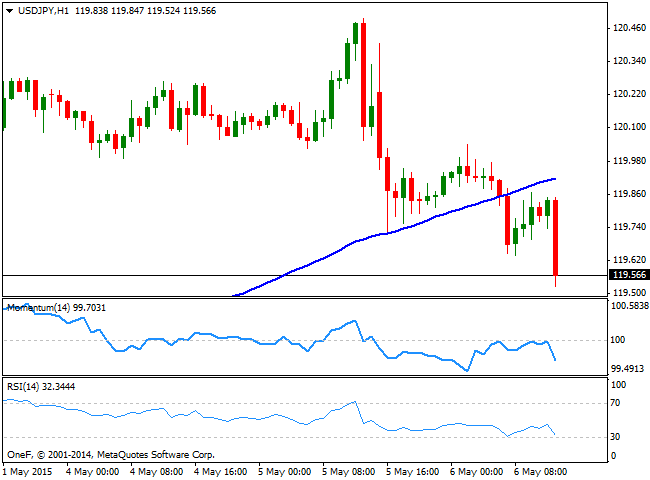

USD/JPY Current price: 119.56

View Live Chart for the USD/JPY

The USD/JPY pair accelerated its decline, now trading at fresh daily lows in the 119.50 region. The 1 hour chat shows that the price broke below its 100 SMA during the Asian session, whilst the latest decline has turned the technical indicators sharply lower from their mid-lines. In the same chart, the 200 SMA stands at 119.45 providing an immediate short term support. In the 4 hours chart the pair presents a strong downward potential, as the technical indicators head sharply lower below their mid-lines, whilst the price is breaking through the 200 SMA that presents a mild bearish slope and stands above the 100 SMA, suggesting the longer term interests are biased lower.

Support levels: 119.45 118.90 118.50

Resistance levels: 119.80 120.10 120.45

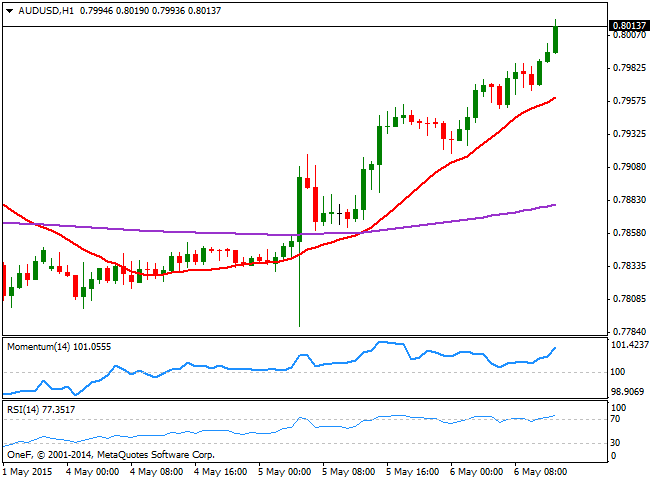

AUD/USD Current price: 0.8015

View Live Chart for the AUD/USD

The AUD/USD pair continues advancing, trading above the 0.8000 figure ahead of the US opening. The pair has been in a steady advance ever since the latest RBA meeting, as despite the Central Bank cut its rates by 0.25%, the statement was far more hawkish than expected. Technically, the 1 hour chart shows that the price advanced sharply above a bullish 20 SMA whilst the technical indicators head higher in positive territory, and with the RSI indicator heading north around 76. In the 4 hours chart the overall stance is also bullish, supporting further advances towards recent highs in the 0.8100 price zone.

Support levels: 0.7980 0.7940 0.7900

Resistance levels: 0.8020 0.8060 0.8100

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.