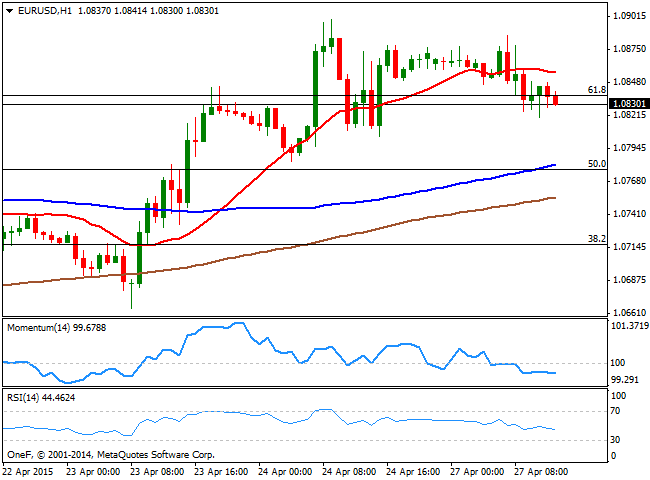

EUR/USD Current price: 1.0825

View Live Chart for the EUR/USD

In quite a dull Monday, the EUR/USD pair trades with a tepid bearish tone within range, aiming to break below the 1.0840 Fibonacci level, with the dollar slightly higher across the board as Greek risk weighs. The weekend ended with no deal reached between the troubled country and its creditors during the Eurogroup meeting in Riga. Ahead of US PMIs releases, the EUR/USD 1 hour chart shows that the price stands below its 20 SMA, whilst the technical indicators head lower below their mid-lines, anticipating some additional declines towards the 1.0800 level. In the 4 hours chart the 20 SMA is losing its upward slope, but below the current price, whilst the technical indicators turned lower above their mid-lines, keeping the risk towards the downside.

Support levels: 1.0800 1.0760 1.0725

Resistance levels: 1.0855 1.0900 1.0950

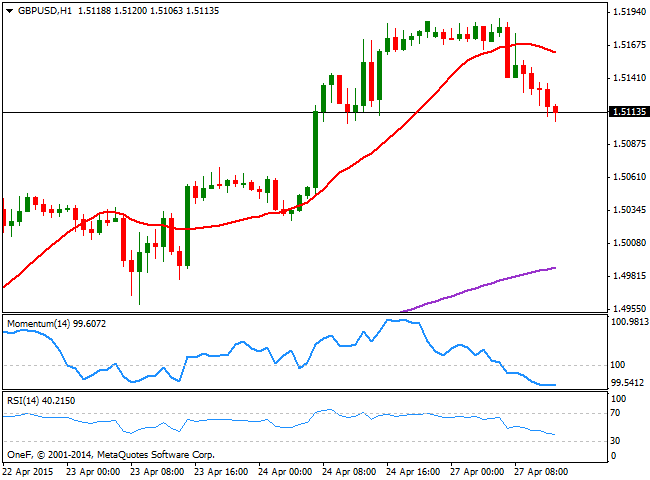

GBP/USD Current price: 1.5114

View Live Chart for the GBP/USD

The GBP/USD pair trades near a daily low established near 1.5106, having been slowly but steadily easing since the day opened. There market seems eager to take some profits out of the table ahead of several critical macroeconomic readings later on in this week, including the FOMC economic meeting this Wednesday. From a technical point of view, the short term picture favors the downside, as in the 1 hour chart, the price extended below its 20 SMA that turns lower in the 1.5160 region, whilst the technical indicators approach oversold territory. In the 4 hours chart the 20 SMA offers immediate support around 1.5090, whilst the technical indicators correct lower from overbought levels, supporting at least a test of the mentioned support. Should the pair break below it, the downside is favored towards the 1.5050 price zone.

Support levels: 1.5090 1.5050 1.5010

Resistance levels: 1.5150 1.5200 1.5240

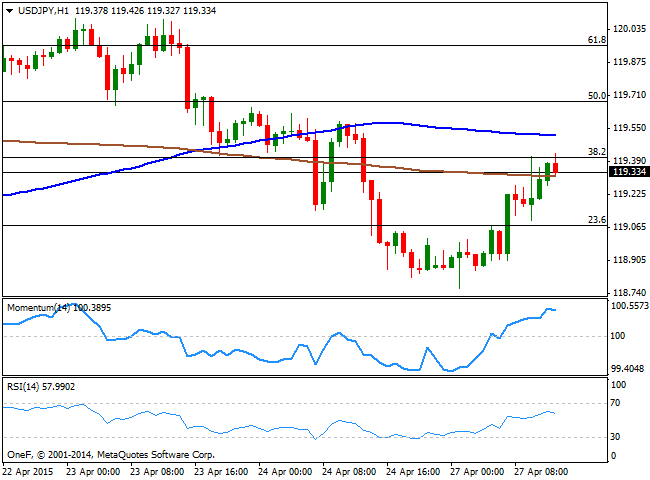

USD/JPY Current price: 118.97

View Live Chart for the USD/JPY

The USD/JPY pair recovered from a daily low set at 118.76, with the yen pressured by Flitch rating agency decision to downgraded Japan's Long-Term Foreign and Local Currency Issuer Default Ratings (IDRs) to 'A' from 'A+', maintaining the outlook at stable. The pair however, found short term selling interest in the 119.40 region, 38.2$ retracement of the latest daily decline. The 1 hour hart shows that the price is battling around its 200 SMA whilst the 100 SMA stands as key resistance around 119.55, and the technical indicators lose their upward strength near overbought levels. In the 4 hours chart indicators are turning lower well into negative territory, all of which should keep the upside limited, and favor additional declines on a break below the 119.00 level.

Support levels: 119.00 118.60 118.20

Resistance levels: 119.50 120.00 120.40

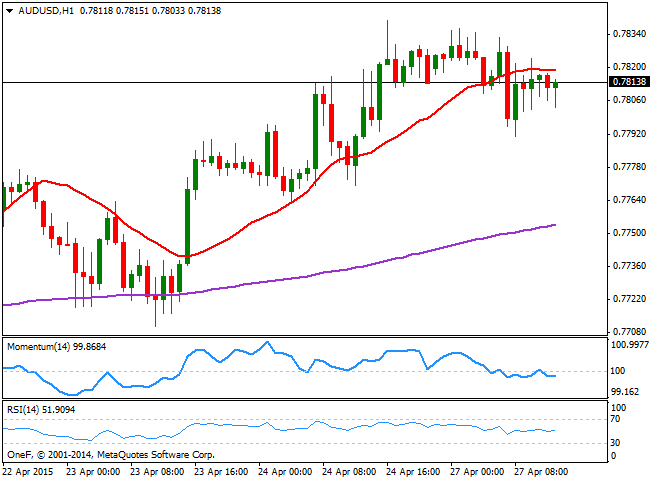

AUD/USD Current price: 0.7813

View Live Chart for the AUD/USD

The Australian dollar trades around its daily opening against its American rival, having flirted with the critical resistance level around 0.7840 during Asian hours. The pair however, maintains a neutral technical stance, with the 1 hour chart showing that the price stands below a flat 20 SMA and that the technical indicators hover around their mid-lines, lacking directional strength. In the 4 hours chart the pair presents a mild positive tone, as the 20 SMA heads slightly higher around 0.7780, whilst the technical indicators hold above their mid-lines, albeit lacking directional strength. There should be large stops above the 0.7840 level, as the price has stalled several times around it during these last few weeks, meaning it will take a clear break above it to see the pair advancing towards the 0.7900 level.

Support levels: 0.7780 0.7750 0.7705

Resistance levels: 0.7840 0.7890 0.7940

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.