EUR/USD Current price: 1.0625

View Live Chart for the EUR/USD

The EUR/USD pair trades in quite a thin range around the 1.0550 area, as the market waits for the ECB economic policy meeting this Wednesday. Earlier in the day, local data resulted mild weak, with German wholesale prices down by 1.1% in March, yearly basis, and Spain inflation still negative. In the US, Retail Sales missed expectations, up 0.9% in March against 1.1% expected, while Producer price indexes came out as expected, triggering a dollar bearish run across the board. Technically, the EUR/USD 1 hour chart shows that the price advances above a flat 20 SMA and extends above the 1.0600 figure, whilst the technical indicators head strongly up above their mid-lines. In the 4 hours chart, the price advances above a bearish 20 SMA, while the technical indicators gain upward momentum above their mid-lines, supporting additional advances, up to 1.0690, the 61.8% retracement of its latest bullish daily run.

Support levels: 1.0600 1.0550 1.0520

Resistance levels: 1.0690 1.0720 1.0755

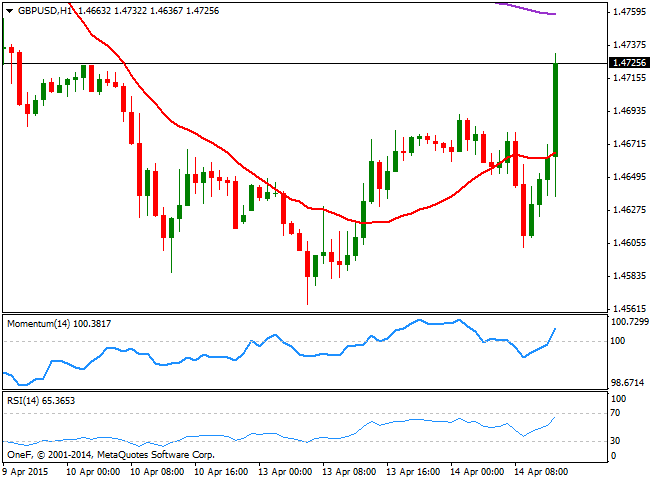

GBP/USD Current price: 1.4725

View Live Chart for the GBP/USD

The GBP/USD pair recovered earlier in the day, but stalled a few pips below the 1.4700 figure, from where it fell down to 1.4602. In the UK, inflation was unchanged at 0.0% y/y in March, while house prices rose less than expected in March, up 7.2%. The short term picture favors the upside after tepid US data, as the pair surged to a fresh 3-day high and the 1 hour chart shows that the price accelerated above its 20 SMA, whilst the technical indicators head higher above their mid-lines. In the 4 hours chart the technical indicators are accelerating above their mid-lines, supporting also a continued advance as long as the 1.4690 price zone now attracts buying interest.

Support levels: 1.4690 1.4635 1.4585

Resistance levels: 1.4750 1.4790 1.4830

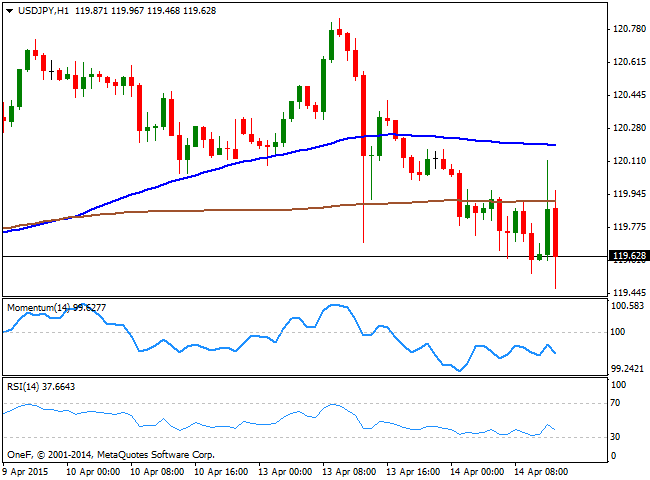

USD/JPY Current price: 119.60

View Live Chart for the USD/JPY

Abe's advisor Hamada is back on the wires, trying to correct the mess triggered yesterday after talking about an USD/JPY at 105.00. Today, he stated that 120.00 is an acceptable level, but if the price surges further up to 125/130, then that will widen the gap between purchasing power parity and spot rate, something undesirable. The USD/JPY pair recovered from a daily low at 119.54 and approached to the 120.00 level before resuming the downside, extending its daily decline down to 119.46. The 1 hour chart shows that the 200 SMA continues to cap the upside in the 119.90 level, whilst the technical indicators have turned lower in negative territory after correcting oversold readings. In the 4 hours chart the indicators stand well below their mid-lines, albeit lacking directional strength at the time being, whilst the price stands below its moving averages, favoring a downward continuation particularly if the pair breaks below the 119.35 level, the immediate support.

Support levels: 119.35 118.90 118.50

Resistance levels: 119.90 120.20 120.45

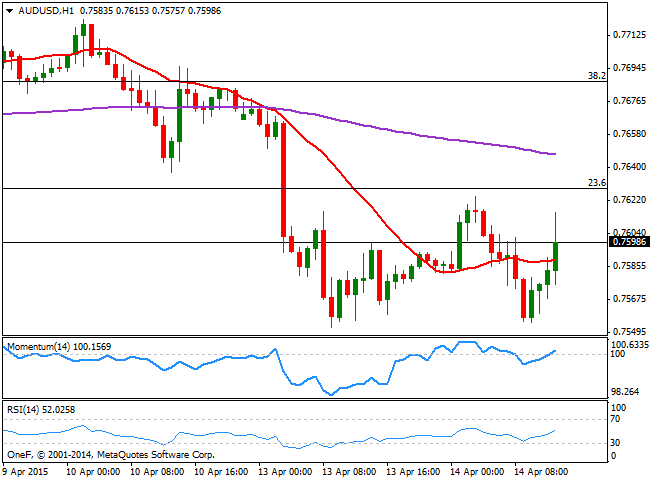

AUD/USD Current price: 0.7598

View Live Chart for the AUD/USD

The Australian dollar maintains a heavy tone against the greenback, as the pair surged up to 0.7624 during the last Asian session before regaining the downside. Falling gold prices that approached the $1,180 level, indeed weighed on the antipodean currency. Technically, the 1 hour chart shows that the price is still unable to advance above the 0.7600 level, albeit a mild positive tone prevails, with the price above its 20 SMA and indicators crossing their mid-lines to the upside. In the 4 hours chart, the 20 SMA maintains a strong bearish slope well above the current level, whist the technical indicators are barely bouncing from oversold readings, keeping the upside limited as long as the price remains below 0.7625.

Support levels: 0.7550 0.7520 0.7490

Resistance levels: 0.7625 0.7660 0.7700

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.