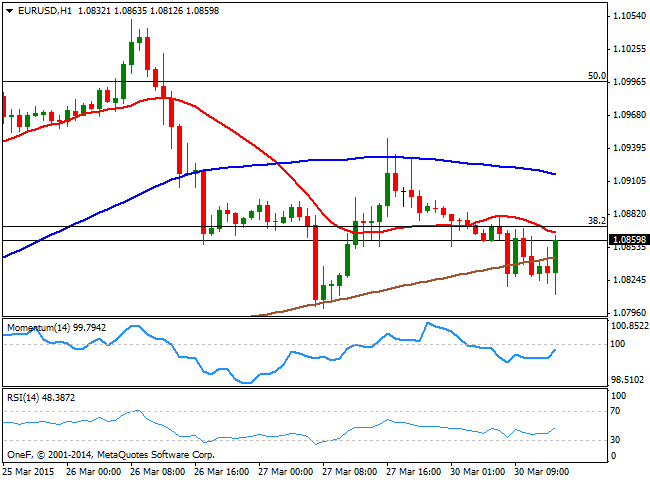

EUR/USD Current price: 1.0860

View Live Chart for the EUR/USD

The EUR/USD pair bounces from a fresh daily lows in the 1.0810 area ahead of the US opening, as the dollar was broadly higher across the board, ever since the day started. Early in the day, Germany released its monthly inflation figures for March that met expectations, down to 0.5% monthly basis, whilst in the US, Personal consumption figures grew less than expected in February, up 0.1%, despite Personal income surged 0.4%. The EUR/USD pair maintains a bearish short term tone, as the 1 hour chart shows that the price develops below its 20 and 100 SMAs, whilst the technical indicators present tepid bearish slopes below their mid-lines. In the 4 hours chart the price holds below its 20 SMA, while the technical indicators stand in negative territory, albeit flat at the time being. Renewed selling interest that drives the pair below 1.0790, should lead to a steadier decline, eyeing 1.0710, the 23.6% retracement of the latest daily fall.

Support levels: 1.0790 1.0755 1.0710

Resistance levels: 1.0865 1.0910 1.0950

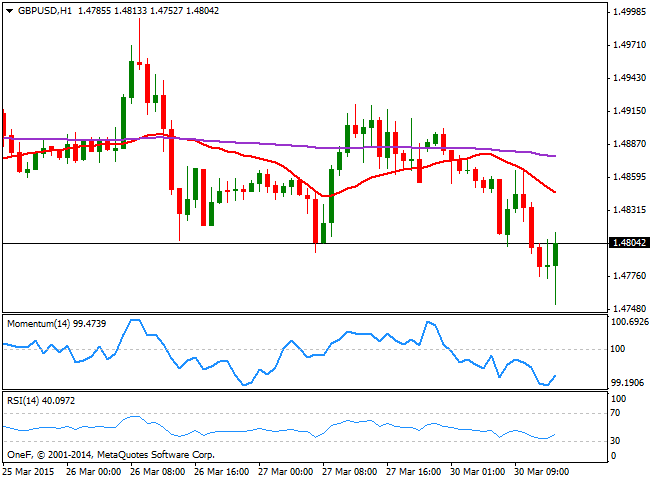

GBP/USD Current price: 1.4802

View Live Chart for the GBP/USD

The GBP/USD pair fell down to 1.4752 this Monday, keeping a short term bearish bias, despite recovering now up to 1.4800, as the 1 hour chart shows that the 20 SMA gained bearish slope well above the current price, now offering dynamic resistance around 1.4850, whilst the technical indicators remain in negative territory. In the 4 hours chart the bearish momentum is even stronger, as the price was rejected earlier in the day from a bearish 20 SMA, whilst the technical indicators head sharply lower below their midlines. The immediate support is now the 1.4730 area, with a break below signaling a probable downward continuation towards the 1.4690 price zone.

Support levels: 1.4740 1.4690 1.4660

Resistance levels: 1.4815 1.4850 1.4890

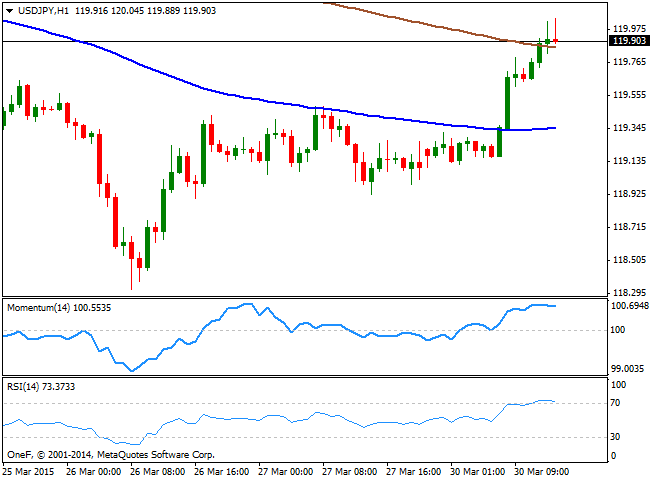

USD/JPY Current price: 119.90

View Live Chart for the USD/JPY

The USD/JPY pair advanced up to 120.04, finally halting the rally around the key psychological figure. The pair is founding intraday support in rising stocks around the world, and the 1 hour chart shows that the price extended above the 100 and 200 SMAs, although indicators are beginning to look exhausted in overbought territory, suggesting an upcoming short term downward correction. In the 4 hours chart the price stands around the 200 SMA, whilst the technical indicators are well into positive territory albeit also losing upward strength. The immediate support comes at 119.65, and sellers should surge on approaches to the level, whilst only an upward acceleration above 120.10 should signal further intraday gains towards the 120.80 price zone.

Support levels: 119.65 119.20 118.80

Resistance levels: 120.10 120.45 120.80

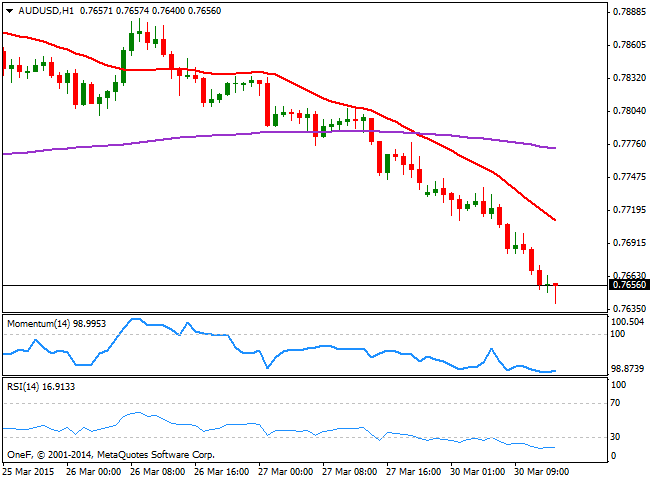

AUD/USD Current price: 0.7655

View Live Chart for the AUD/USD

Australian dollar is under strong selling pressure since the day started, trading against the greenback near a fresh 2-week low set at 0.7640. There has been no catalyst behind the slide, although investors are largely anticipating an RBA rate cut this week. In the meantime, the 1 hour chart shows that the technical indicators maintain a strong bearish tone despite in oversold territory, whilst the 20 SMA stands well above the current price, currently at 0.7710 offering an intraday dynamic resistance. In the 4 hours chart the technical indicators are also heading south despite in oversold territory, supporting the overall negative tone in the pair. Upward short term corrections would be seen as selling opportunities rather than a sign of reversal, up to the 0.7745 level.

Support levels: 0.7640 0.7625 0.7580

Resistance levels:0.7710 0.7745 0.7790

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.