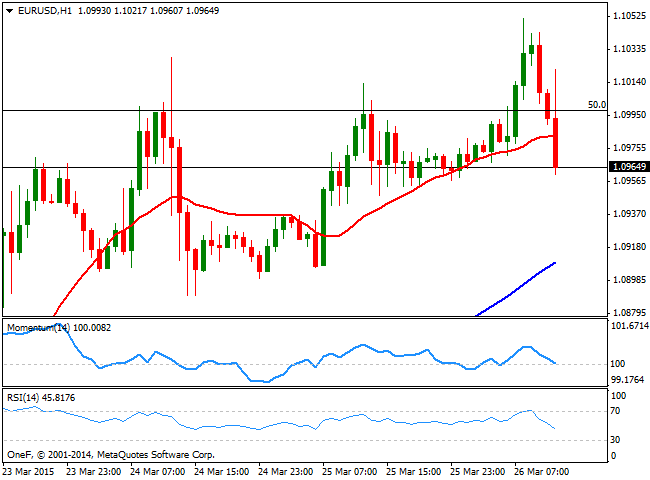

EUR/USD Current price: 1.0978

View Live Chart for the EUR/USD

The market is all about risk-off this Thursday, with commodities soaring amid news reporting Saudi Arabia’s air strikes in Yemen. WTI oil prices soared to $52.46 a barrel, whilst gold futures neared $ 1,220 a troy ounce. The dollar was broadly lower across the board, weighed by weak Durable Goods Orders released on Wednesday. The EUR/USD pair soared up to 1.1051, but the pair changed course after the release of better than expected US weekly unemployment claims, down to 282K. The sharp reversal is also following a retracement in oil prices back towards the $50.00 level, and ahead of key US Marking PMI readings. For the upcoming American session, the short term technical picture has turned towards the downside, as the price broke below its 20 SMA in the 1 hour chart, whilst the technical indicators turned lower and are about to cross their mid-lines. In the 4 hours chart the 20 SMA maintains a strong bullish slope and offers immediate intraday support around 1.0950, whilst the technical indicators maintain their bearish slope, also approaching their midlines from above. The market is quite volatile this Thursday, although a break below the mentioned level should see a downward extension, particularly if US upcoming data results up beating.

Support levels: 1.0950 1.0920 1.0890

Resistance levels: 1.1000 1.1050 1.1095

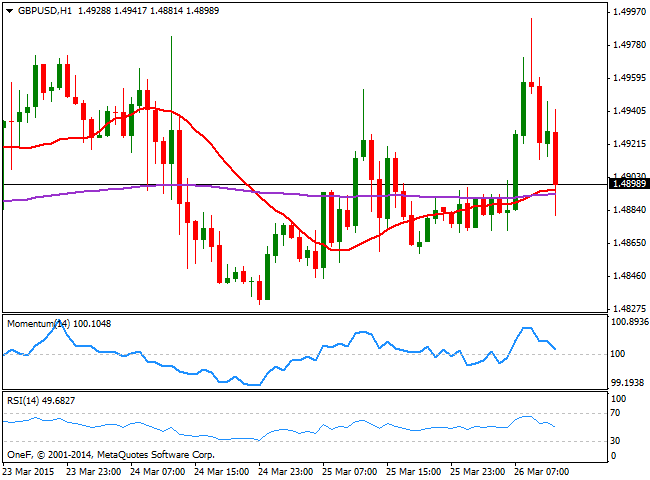

GBP/USD Current price: 1.4896

View Live Chart for the GBP/USD

The GBP/USD pair struggles around the 1.4900 level early in the US session, having failed once again to extend beyond the 1.5000 critical level, on much better than expected UK Retail Sales, released earlier today. The 1 hour chart shows that the price battles around a flat 20 SMA, while the technical indicators have turned lower, but remain above their midlines, whilst the 4 hours chart shows that the price pressures also its 20 SMA, while the technical indicators present a more bearish stance heading lower below their midlines. Renewed selling pressure below the 1.4880 level should lead to a test of the 1.4830 lows set earlier this month, while only a steady recovery above 1.4950 may lead to a retest of the daily high.

Support levels: 1.4880 1.4830 1.4800

Resistance levels: 1.4920 1.4950 1.5000

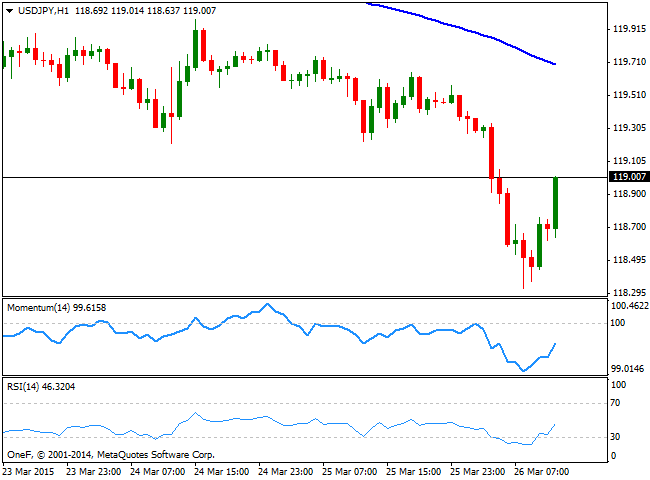

USD/JPY Current price: 118.97

View Live Chart for the USD/JPY

The USD/JPY pair sunk to a multi-week low of 118.32, before bouncing sharply, now struggling to recover above the 119.00 level. The 1 hour chart shows that the technical indicators are heading strongly north below their midlines and coming from extreme oversold readings, whilst the 100 SMA remains well above the current price, now around 119.70. In the 4 hours chart technical indicators are also in the process of correcting oversold readings, but remain deep in negative territory. The price needs to accelerate above 119.20 to be able to continue advancing, whilst back below 118.70, the bearish momentum will likely resume.

Support levels: 118.70 118.30 117.90

Resistance levels: 119.20 119.65 120.00

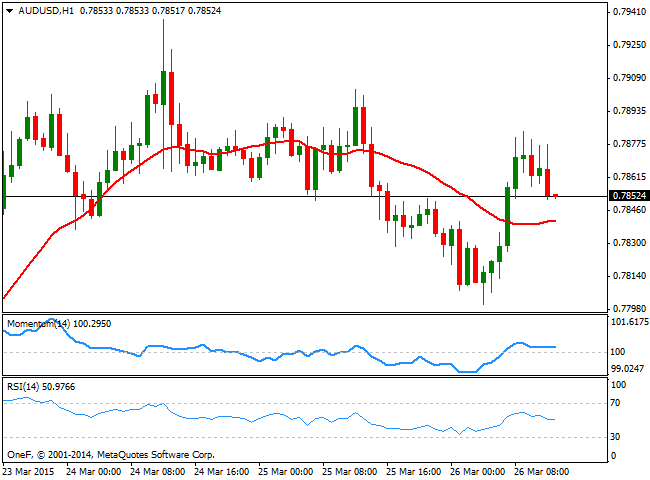

AUD/USD Current price: 0.7852

View Live Chart for the AUD/USD

The Australian dollar's advance against its American counterpart was limited by selling interest around the 0.7880 level, with the pair now approaching its daily opening. The short term technical picture is mild bullish as the price holds above its 20 SMA, whilst the Momentum indicator stands flat above 100 and the RSI turned lower around its midline. In the 4 hours chart the bearish potential is stronger, as per the price extending below its 20 SMA and the technical indicators turning lower after failing to regain the upside. Nevertheless, the 0.7840 level is quite a strong static support level, so only a break below it could lead to additional intraday declines.

Support levels: 0.7840 0.7805 0.7770

Resistance levels: 0.7880 0.7910 0.7940

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.