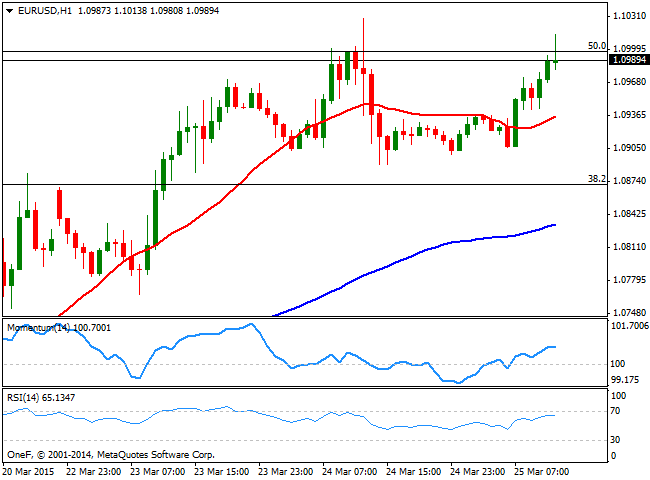

EUR/USD Current price: 1.0919

View Live Chart for the EUR/USD

The EUR/USD pair trades near a fresh daily high set at 1.1013, following the release of worse-than-expected Durable Goods Orders in the US that unexpectedly dropped in February, signaling a slowdown in economic growth. Orders declines 1.4% against a 0.4% rise expected, weighing on the American currency that trades lower across the board. The EUR/USD has been finding buyers ever since the European opening, but so far is unable to sustain gains beyond the 1.1000 area, a tough bone to break. The intraday technical picture maintains a bullish stance, with the price advancing above a mild bullish 20 SMA and the technical indicators holding above their mid-lines, albeit showing no directional strength at the time being. In the 4 hours chart, the 20 SMA maintains a strong bullish slope well below the current price, acting as dynamic support around 1.0890, while the technical indicators present mild bullish slopes above their midlines, supporting additional gains should the 1.1000 level is finally broken.

Support levels: 1.0955 1.0920 1.0890

Resistance levels: 1.1000 1.1040 1.1085

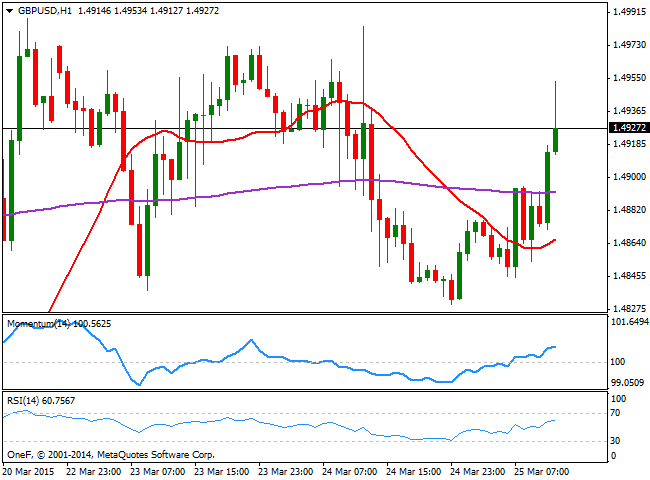

GBP/USD Current price: 1.4926

View Live Chart for the GBP/USD

The GBP/USD pair surged on dollar weakness, reaching a daily high of 1.4953 before beginning to retrace some. The pair has a slightly positive tone, as the 1 hour chart shows that the price advances above its 20 SMA while the technical indicators aim higher in positive territory. In the 4 hours chart, the price is holding a few pips above a bullish 20 SMA, whilst the Momentum indicator crossed its mid-line to the upside and the RSI holds around 54, supporting some additional gains as long as the price holds above the 1.4900 level. A price acceleration through 1.4950 is now required to see the pair testing the 1.5000 figure, where selling interest is expected to offer battle.

Support levels: 1.4880 1.4845 1.4810

Resistance levels: 1.4950 1.5000 1.5040

USD/JPY Current price: 119.25

View Live Chart for the USD/JPY

The USD/JPY pair accelerates south and pressures its recent lows in the 119.20 price zone, resuming its decline following disappointing US data. The 1 hour chart shows a strong bearish momentum coming from technical readings, as the indicators head sharply south and approach oversold territory. In the same time frame, the price develops below strong moving averages, with the 100 SMA now offering dynamic resistance around 120.00, and well below the 200 SMA, which means the downward potential keeps increasing. In the 4 hours chart the price was rejected from its 200 SMA, whilst the indicators head strongly south below their mid-lines, supporting additional declines on a downward acceleration below the 119.20 immediate support.

Support levels: 119.20 118.80 118.50

Resistance levels: 119.65 120.00 120.30

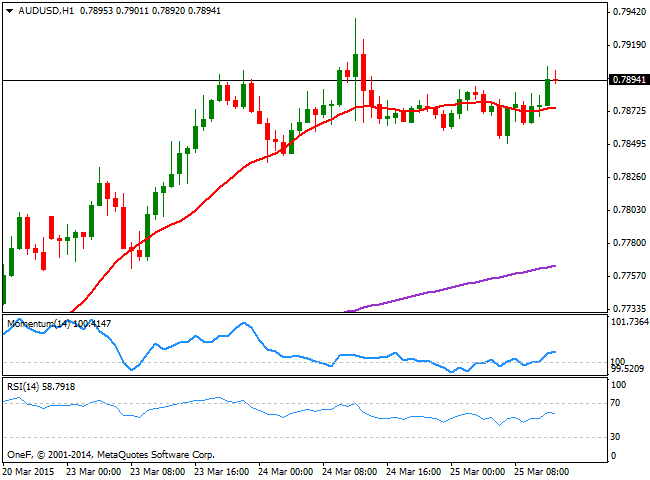

AUD/USD Current price: 0.7895

View Live Chart for the AUD/USD

The AUD/USD pair is posting limited intraday gains , pressuring the 0.7900 figure, early in the American session. The technical picture however, shows no actual strength, as the price stands a few pips above a flat 20 SMA, whilst the technical indicators are for the most neutral, flat above their midlines. In the 4 hours chart the 20 SMA presents a strong upward slope well below the current price, whilst the Momentum indicator heads higher above 100 and the RSI also advances around 63. In this same chart, the pair presents some intraday highs at 0.7910, meaning a break above the level is required to confirm additional gains for the day, towards the 0.8000 price zone.

Support levels: 0.7845 0.7800 0.7770

Resistance levels: 0.7910 0.7950 0.7990

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.