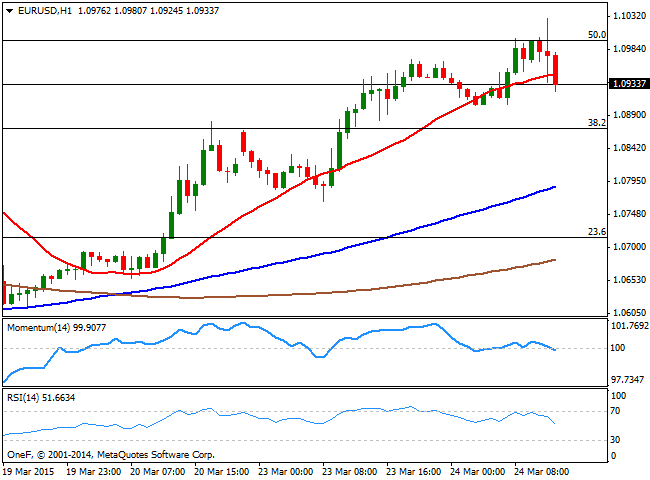

EUR/USD Current price: 1.0932

View Live Chart for the EUR/USD

The EUR/USD surged to 1.1002 following the release of strong Manufacturing and Service figures across Europe confirming the sense the area is growing lately. Nevertheless, the pair was unable to break above the critical psychological figure, also the 50% retracement of these last two months decline. US inflation data ticked slightly higher in February, up 0.2% as expected, whilst excluding food and energy, the year-to-year figure rose above forecasted up t 1.7%. Still subdued, the initial market reaction saw the EUR/USD diving down to 1.0936 before quickly bouncing up to a fresh daily high of 1.1029, before regaining the downside. Early in the US session, the pair is under selling pressure, and the 1 hour chart shows that the price is breaking below its 20 SMA, whilst the technical indicators head lower around their midlines. In the 4 hours chart the technical indicators are retracing from extreme overbought levels, supporting some further declines, particularly on a break below 1.0920 the immediate short term support.

Support levels: 1.0920 1.0890 1.0865

Resistance levels: 1.0955 1.1000 1.1040

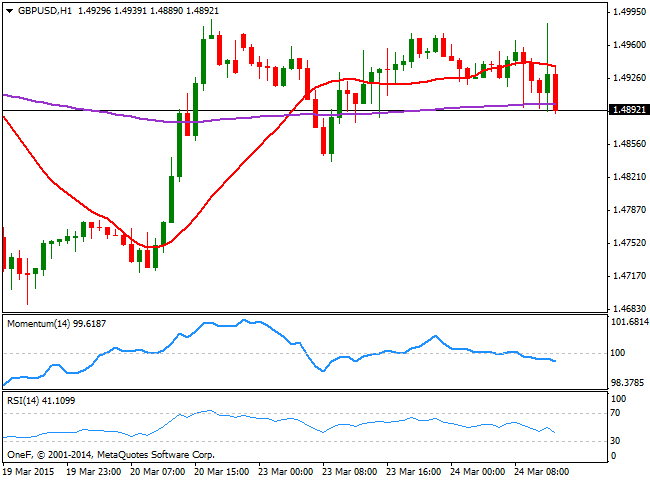

GBP/USD Current price: 1.4892

View Live Chart for the GBP/USD

The GBP/USD pair pressures its daily low set so far at 1.4889, weighed by weak UK inflation readings released earlier in the day. The pair has been trading quite rage bound ever since the day started, although the greenback seems ready to extend its advance in the short term, as the 1 hour chart shows that the price is unable to overcome its 20 SMA, whilst the technical indicators aim lower below their midlines. In the 4 hours chart hover, the price is still holding above a flat 20 SMA, whilst the technical indicators turning lower, but still above their midlines. A break through 1.4850 the immediate support, should lead to a stronger decline, which can extend down to the 1.4770 support.

Support levels: 1.4850 1.4810 1.4770

Resistance levels: 1.4925 1.4950 1.5000

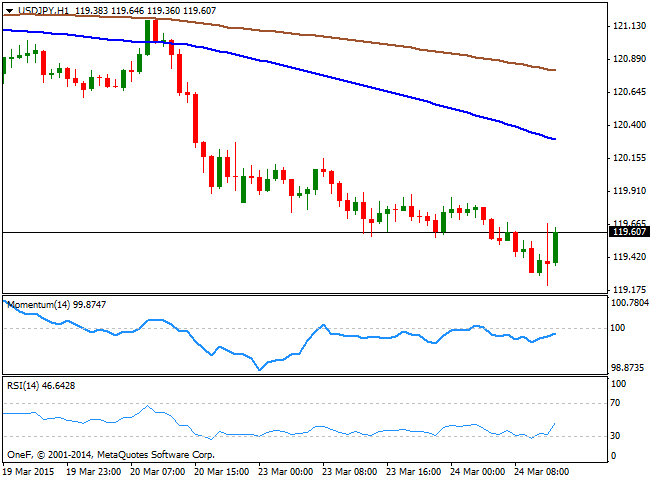

USD/JPY Current price: 119.58

View Live Chart for the USD/JPY

The USD/JPY fell down to a fresh 4-week low at 119-21 before bouncing back above the 119.50 level, far however from signaling a stronger advance in the short term, as the 1 hour chart shows that the price holds below strongly bearish moving averages, and that the technical indicators remain well below their midlines. In the 4 hours chart the Momentum indicator maintains a strong bearish slope while the RSI consolidates around 30 and the price stands below its moving averages, all of which should keep the upside limited, probably below the 120.00 level.

Support levels: 119.20 118.80 118.50

Resistance levels: 119.65 120.00 120.40

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.