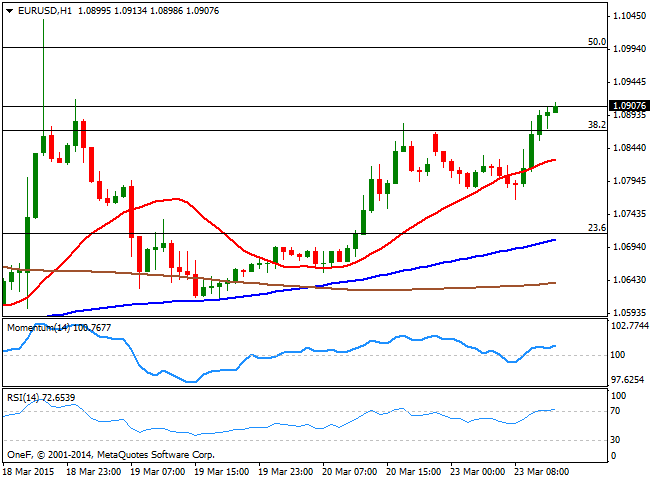

EUR/USD Current price: 1.0820

View Live Chart for the EUR/USD

The American dollar is under strong pressure across the board, having saw a short lived upward correction earlier in the day, with the European opening. Nevertheless, the currency trades at fresh daily lows against most of its major rivals ahead of the US opening. So far there were no fundamental news, but in a few, the US will release its Existing Home Sales figures, whilst ECB's Draghi will testify before the European Parliament's Economic and Monetary Affairs Committee, in Brussels, which should keep markets lively. In the meantime, the EUR/USD pair trades above a critical Fibonacci level, the 38.2% retracement of its latest bearish run between February and March, at 1.0865, the immediate short term support. Having been as high as 1.0910, the 1 hour chart shows that the 20 SMA maintains a strong bullish slope around 1.0820, while the Momentum indicator heads higher above its mid-line and the RSI indicator retraces from overbought levels. In the 4 hours chart the technical indicators have lost their upward strength but remain well above their midlines, while the 20 SMA heads higher below the current price, all of which supports further advances, particularly if the pair accelerates above the mentioned daily high.

Support levels: 1.0865 1.0820 1.0780

Resistance levels: 1.0910 1.0955 1.1000

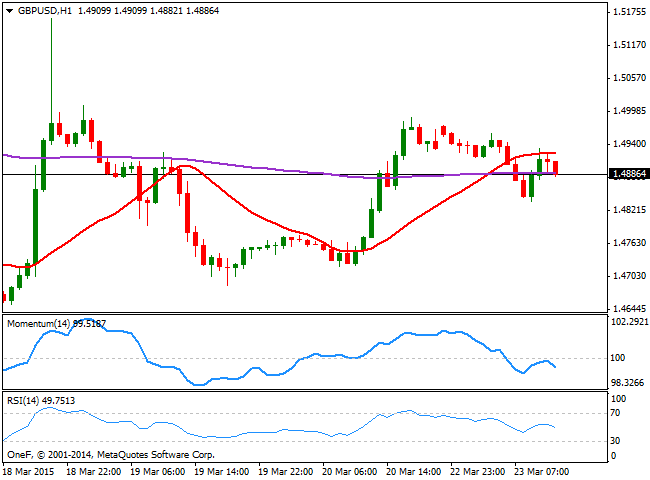

GBP/USD Current price: 1.4887

View Live Chart for the GBP/USD

The GBP/USD trades down on the day, having failed to extend gains beyond the 1.4900 level during the European session. The 1 hour chart shows that the 20 SMA capped the latest advance and is now flat acting as dynamic resistance around 1.4925, whilst the technical indicators are turning sharply lower from their midlines, supporting some short term additional declines. In the 4 hours chart the price holds above a bullish 20 SMA, currently providing short term support around 1.4840, whilst the technical indicators have turned lower in positive territory, and particularly the Momentum is trying to break below the 100 level. The daily low stands at 1.4837, which means it will take a downward acceleration below it to confirm a downward continuation for the upcoming hours.

Support levels: 1.4840 1.4800 1.4770

Resistance levels: 1.4925 1.4950 1.5000

USD/JPY Current price: 119.82

View Live Chart for the USD/JPY

The USD/JPY pair trades below the 120.00 level, consolidating in the short term near the daily low established at 119.73. The 1 hour chart shows that the price extended further below its moving averages that are gaining bearish slope, while the technical indicators hold in bearish territory, showing no directional strength at the time being. In the 4 hours chart the technical indicators have now turned flat near oversold levels, which should at least keep the upside limited.

Support levels: 119.60 119.25 118.80

Resistance levels: 120.00 120.40 120.85

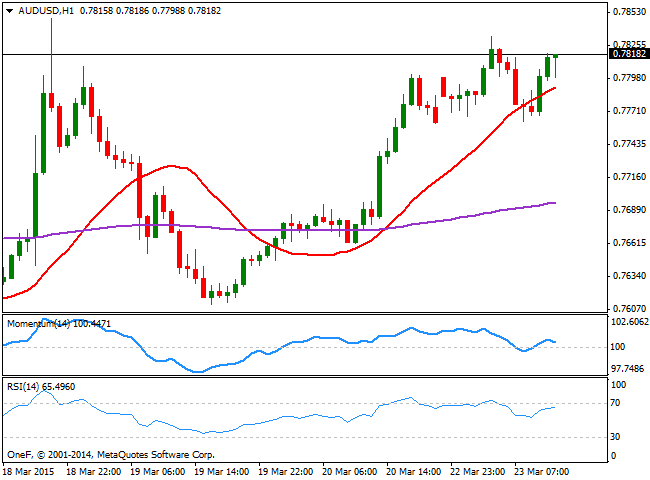

AUD/USD Current price: 0.7818

View Live Chart for the AUD/USD

The AUD/USD trades above the 0.7800 level, advancing towards its daily high of 0.7833, advancing on dollar weakness. The 1 hour chart shows that the price stands above a bullish 20 SMA, whilst the indicators present mild bullish slopes above their midlines. In the 4 hours chart the technical upward momentum is even stronger, as the indicators maintain their bullish slopes near overbought levels, whilst the 200 EMA contains the downside around the 0.7770 level.

Support levels: 0.7800 0.7770 0.7740

Resistance levels: 0.7840 0.7880 0.7915

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.