EUR/USD Current price: 1.1007

View Live Chart for the EUR/USD

The EUR/USD pair raised following Draghi's initial speech, as the ECB president announced the Central Bank will begin purchasing bonds as soon as next Monday, albeit the pair quickly retraced towards fresh 11 year lows a few pips above 1.1000. Despite the economic outlook has been reviewed to the upside, and the ECB president gave a positive review on how the economy is doing this year, selling interest around 1.1100 was way too much for the mild hawkish review. Technically, the 1 hour chart shows that the price holds below a bearish 20 SMA, whilst the indicators gain strong bearish momentum below their mid-lines, supporting the ongoing slide. In the 4 hours chart the technical indicators also present a strong bearish tone, with the RSI heading lower despite being in extreme overbought readings, pointing for a break down to 1.0960 should the 1.1000 level gives up.

Support levels: 1.1000 1.0960 1.0920

Resistance levels: 1.1050 1.1100 1.1145

GBP/USD Current price: 1.5236

View Live Chart for the GBP/USD

The GBP/USD pair fell as low as 1.5217 following a limited upward spike to 1.5269, consolidating around pre news levels. The pair is being weighed by dollar demand, and the 1 hour chart presents a mild bearish tone, as the price develops below its 20 SMA and the technical indicators remain below their mid-lines, albeit with tepid bullish slopes. In the 4 hours chart the technical indicators are biased strongly south well into negative territory, anticipating some further declines particularly if 1.5210 the immediate support, gives up.

Support levels: 1.5210 1.5180 1.5135

Resistance levels: 1.5250 1.590 1.5330

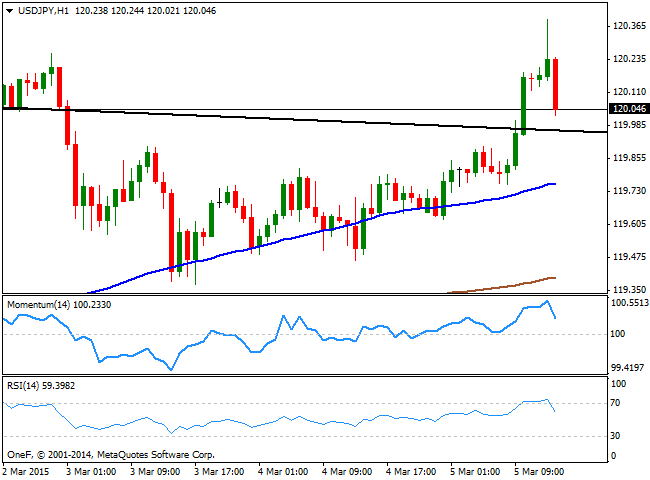

USD/JPY Current price: 120.04

View Live Chart for the USD/JPY

The USD/JPY pair reached a daily high of 120.39 before the news, reversing its intraday gains and now pressuring the 120.00 figure. The 1 hour chart shows that indicators turned lower from overbought levels, but that the price remains well above its 100 and 200 SMAs. The price also stands above a daily descendant trend line coming from the multi-year high reached last year at 121.84, now offering support around 119.90. In the 4 hours chart, the technical indicators lost upward potential above their mid-lines, not giving too much clues on what's next on the pair. The most likely scenario is some consolidation around the current levels, ahead of Friday's US employment figures.

Support levels: 119.90 119.40 119.10

Resistance levels: 120.45 120.90 121.35

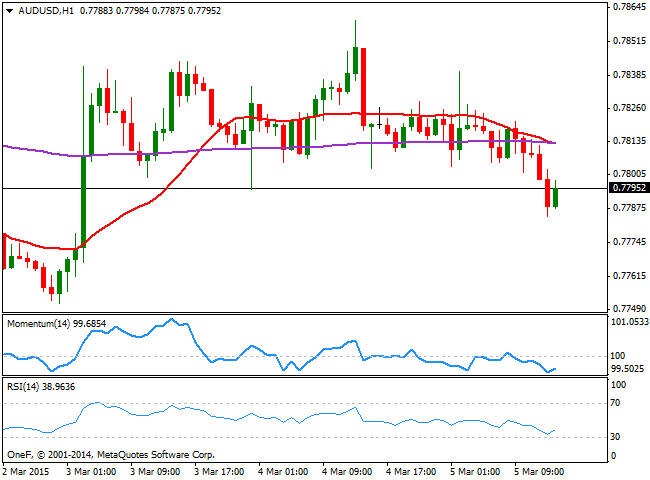

AUD/USD Current price: 0.7790

View Live Chart for the AUD/USD

The Australian dollar has shown a limited reaction to ECB announcement, as the AUD/USD pair turned south before the news, reaching 0.7784 before bouncing some. Trading below the 0.7800 level, the 1 hour chart presents a limited bearish tone, as the price develops below its moving averages and indicators hover below their midlines, albeit lacking bearish strength. In the 4 hours chart however the bearish tone is firmer, as the price extends below its 20 SMA and the technical indicators are crossing their mid-lines, extending into negative territory.

Support levels: 0.7755 0.7720 0.7690

Resistance levels: 0 .7800 0.7840 0.7890

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.