EUR/USD Current price: 1.1117

View Live Chart for the EUR/USD

The EUR/USD pair traded as low as 1.1103 this Wednesday, weighed by worse than expected Services PMI in the Euro area, and looming ECB meeting this Thursday. The US ADP private survey said the country added 212K new jobs last February, slightly below the 220K expected, and with January reading reviewed to the upside, up to 250K. Early in the US session, the pair trades near the mentioned low, with 1.1150 capping the upside, and the 1 hour chart showing that the price holds below a bearish 20 SMA, whilst indicators turned flat after correcting oversold readings. In the 4 hours chart the bearish tone has lost downward momentum, but is far from signaling a change in the dominant bearish trend. The market may remain on hold ahead of tomorrow's ECB decision, furthermore considering the Central Bank is expected to shed light on the QE program expected to be launched as soon as next week.

Support levels: 1.1095 1.1050 1.1010

Resistance levels: 1.115 1.1180 1.1230

GBP/USD Current price: 1.5378

View Live Chart for the GBP/USD

The GBP/USD pair trades near a three-week low of 1.5315 posted mid February, with a heavy bearish tone as per dollar broad strength against its European rivals. The 1 hour chart shows a strong bearish momentum coming from technical readings as the price extends further below a bearish 20 SMA whilst indicators accelerate lower below their midlines. In the 4 hours chart the price is sliding further below its 200 EMA, while the technical indicators gained bearish strength well below their midlines, supporting additional declines in the short term.

Support levels: 1.5315 1.5280 1.5250

Resistance levels: 1.5340 1.5385 1.5420

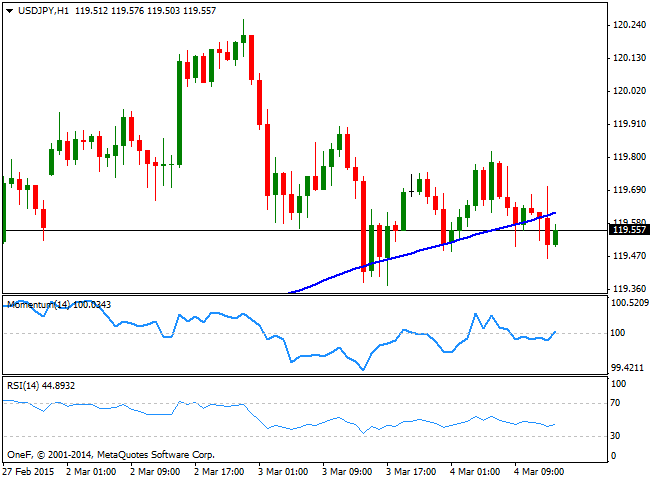

USD/JPY Current price: 119.55

View Live Chart for the USD/JPY

The USD/JPY pair continues to trade range bound, finding short term buyers around the 119.40 price zone. The 1 hour chart shows that the pair trades below its 100 SMA, while the technical indicators aim higher around their midlines, lacking directional strength at the time being. In the 4 hours chart the price holds well above its moving averages but the technical indicators head lower below their midlines, keeping the risk towards the downside. Nevertheless, the pair will likely continue to hold in range ahead of US monthly employment figures.

Support levels: 119.40 119.10 118.80

Resistance levels: 119.95 120.45 120.90

AUD/USD Current price: 0.7841

View Live Chart for the AUD/USD

The Australian dollar advanced up to 0.7859 against its American rival, with the pair maintaining its intraday gains. The 1 hour chart shows that the price holds above a flat 20 SMA while the technical indicators are turning south above their midlines. In the 4 hours chart the technical picture favors the upside as the indicators head higher above their midlines whilst the 20 SMA offers intraday support around 0.7800.

Support levels: 0.7800 0.7755 0.7720

Resistance levels: 0.7840 0.7890 0.7925

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.