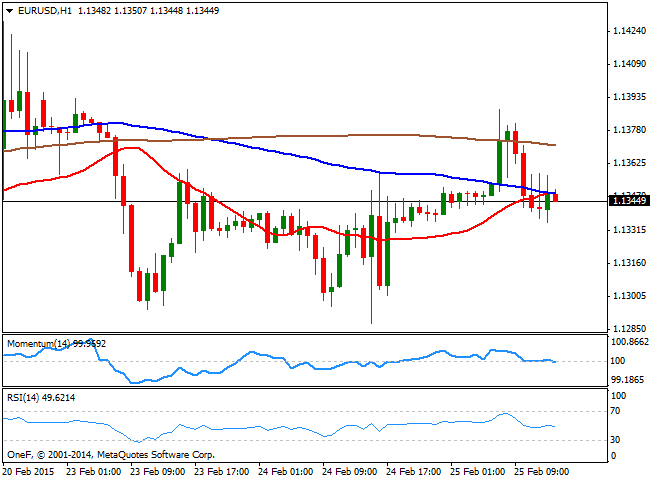

EUR/USD Current price: 1.1335

View Live Chart for the EUR/USD

The EUR/USD pair advanced up to 1.1388, a fresh 3-day high, as the dollar came under broad pressure after Yellen announced yesterday that there won't be a rate hike at least for the next couple of meetings. There have been no fundamental releases that could affect the price of the pair, but both, Yellen from the FED and Draghi from the ECB, are due to testify before their respective Parliaments in separated events during the upcoming hours. In the meantime, the pair trades within its latest range, and the 1 hour chart shows that the price is now contained below its 20 SMA that converges with 100 one around 1.1350, while the indicators present a tepid bearish slope around their midlines. In the 4 hours chart the technical picture remains neutral, as the price needs either to break below 1.1250, or to advance above 1.1440, to be able to gain some directional potential.

Support levels: 1.1320 1.1280 1.1250

Resistance levels: 1.1380 1.1440 1.1485

GBP/USD Current price: 1.5485

View Live Chart for the GBP/USD

The GBP/USD pair advanced up to 1.5538 this Tuesday, retracing from the level more on profit taking ahead of the upcoming Central Bank's heads speeches than because of dollar strength. From a technical point of view, the 1 hour chart shows that the price holds above a bullish 20 SMA although indicators turned lower, now approaching their midlines. In the 4 hours chart the price holds also above a bullish 20 SMA while the technical indicators are retracing from near overbought levels, still well above their midlines. If the price manages to recover above 1.5500, the pair will likely continue advancing towards the 1.5582 level this year high.

Support levels: 1.5450 1.5420 1.5390

Resistance levels: 1.5500 1.5535 1.5580

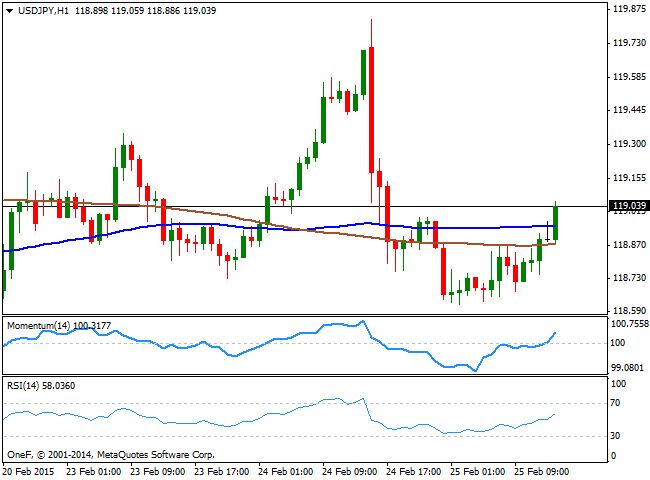

USD/JPY Current price: 119.04

View Live Chart for the USD/JPY

The USD/JPY recovers above the 119.00 level early in the US session, having found support around the 118.60 level. The 1 hour chart shows that the price extends above its 100 and 200 SMAs while indicators head higher above their midlines, supporting additional advances in the short term, albeit some follow through beyond the 119.40 level is required to confirm a stronger advance. In the 4 hours chart, the technical picture is neutral to bullish, as the price found intraday support in a bullish 10 SMA, but indicators lack directional strength.

Support levels: 118.60 118.25 117.80

Resistance levels: 119.40 119.85 120.20

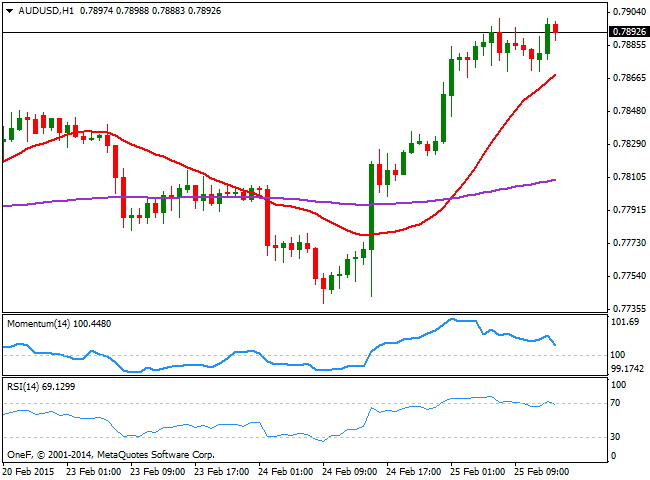

AUD/USD Current price: 0.7892

View Live Chart for the AUD/USD

The Australian dollar continues advancing, having flirted with the 0.7900 level against the greenback. The antipodean currency found support in Chinese data, as the HSBC Flash Manufacturing PMI surprised with a rise above the critical 50 mark, up to 50.1 points for February. Technically, the 1 hour chart shows that the technical indicators are retracing from overbought levels, although the price holds near the highs, suggesting the pair has still scope to advance. In the 4 hours chart the price stalled at the 200 EMA, currently around 0.7900, having been unable to sustain gains above it since July 2014. Therefore, a continued advance above it during the upcoming sessions, should signal an interim bottom in the pair with chances of a break above the 0.8000 mark.

Support levels: 0.7865 0.7830 0.7780

Resistance levels: 0.7900 0.7940 0.7990

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.