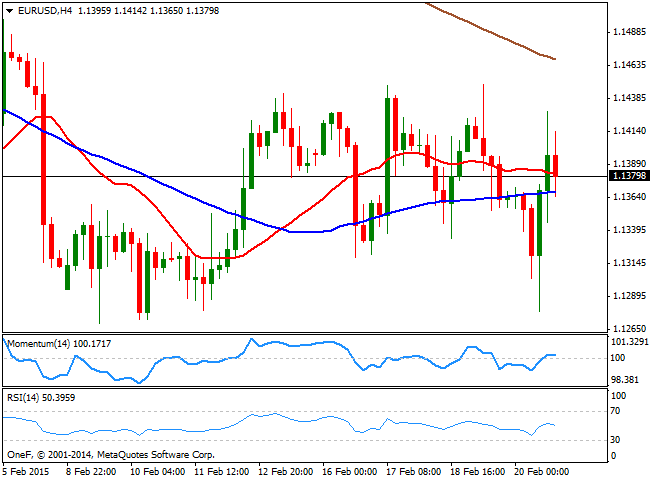

EUR/USD Current price: 1.1389

View Live Chart for the EUR/USD

The previous week ended with relief for investors, as the Greek government finally got a deal with its creditors that is, to extend by four months the ongoing bailout program. The country's government however, will have to come up with a list of reforms, and submit it to the Troika if they plan to keep their anti-austerity promises made ahead of the elections. As usual in Europe, problems get delayed, but not solved. In the meantime, the attention will shift towards the US this week, as FED's Yellen is due to testify before the houses. The market will be looking there for some clues on what's next for the country, when it comes to a rate hike. During the last few weeks, the US macroeconomic data has been for the most, disappointing, whilst European number have been slightly encouraging, something that may trigger some short covering upon the upcoming days.

From a technical perspective however, the upside remains limited for the common currency, as the immediate relief-rally stalled below the strong static resistance level around 1.1440, confining the pair to its recent range. The 4 hours chart shows that the price hovers around a horizontal 20 SMA that stands a few pips above the 100 SMA, both signaling the lack of directional strength. The indicators in the mentioned time frame also fail to support a dominant trend, with the Momentum flat above 100 and the RSI heading lower around 10.

Support levels: 1.1340 1.1305 1.1280

Resistance levels: 1.1400 1.1440 1.1485

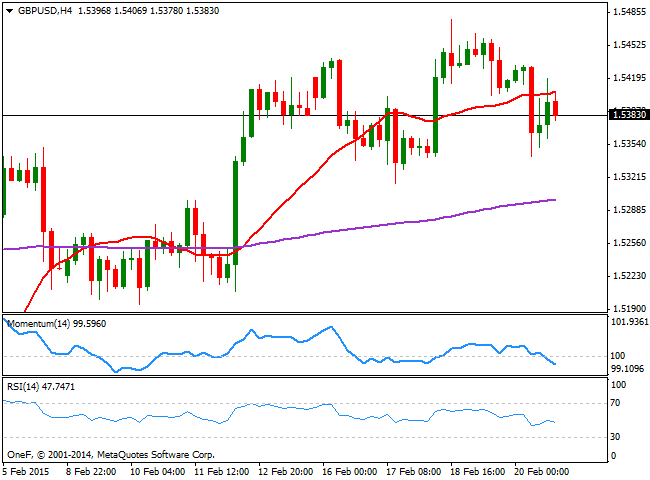

GBP/USD Current price: 1.5391

View Live Chart for the GBP/USD

The GBP/USD pair holds to its recent gains, despite having failed to extend its gains last week beyond the 1.5500 level. The sterling has been doing well on its own, supported by strong economic developments. And, during the upcoming days, the economy will release its inflation and GDP figures, which can see the pair finally breaking out higher if the figures overcome expectations. The main risk will come from the CPI as the BOE has warned that inflation may fall below 0.00% sometime this year, blaming the slowdown on weak crude oil prices. Also, if the dollar gets a boost from Yellen, the risk in the pair will turn towards the downside, albeit limited compared to other high yielders. From a technical point of view, the 4 hours chart presents a negative bias, as the price develops below its 20 SMA, currently offering the immediate short term resistance around 1.5410, while the Momentum indicator heads south below 100 and the RSI also presents a bearish slope around 47.

Support levels: 1.5340 1.5300 1.5260

Resistance levels: 1.5420 1.5460 1.5500

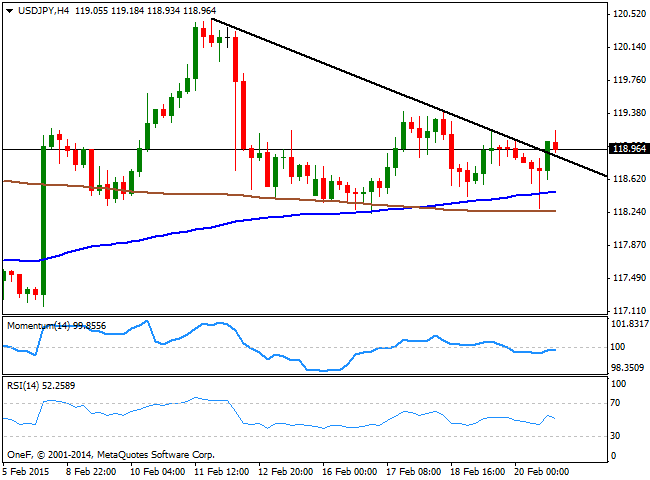

USD/JPY Current price: 119.03

View Live Chart for the USD/JPY

The USD/JPY pair staged a shy recovery during the last week, but run of steam around the 119.00 level, as the pair has been unable to sustain gains above it, despite the strong recovery in worldwide indexes. This week calendar will be pretty light in Japan until Thursday, when the country will release its inflation figures, with the core reading seen slowing amid tumbling oil prices. The number is key, as it has been slowing for several months in a row, far from the BOJ´s target. From a technical point of view, the 4 hours chart shows that the pair closed last week above a short term descendant trend line coming from 120..47, February 11 daily high, but mostly, the price traded within range. In the same time frame the technical indicators present a neutral stance, while the price stands above its 20 SMA, giving some limited support to the pair. At this point, some follow through beyond 119.40 is required to confirm a firmer rally, eyeing a retest of the mentioned monthly high.

Support levels: 118.70 118.25 117.80

Resistance levels: 119.40 119.85 120.40

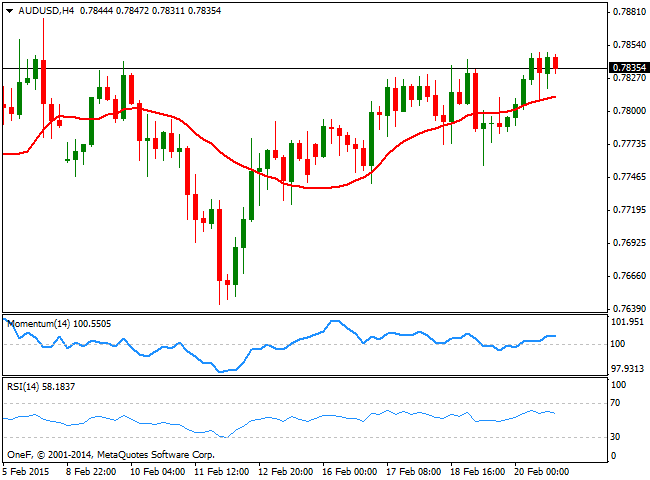

AUD/USD Current price: 0.7844

View Live Chart for the AUD/USD

The Australian dollar trades at the higher end of its recent range against the greenback, and surprisingly, last week COT report shows that net-short positions have been reduced partially in most majors, exception made in the Aussie. The 4 hours chart shows that the price has managed to extend above its 20 SMA, and that the moving average has offered short term support on retracements, now around 0.7810. The momentum indicator in the mentioned time frame heads slightly higher above 100, but the RSI turned lower around 58, showing little upward potential ahead of the opening. The pair needs to advance beyond the 0.7850 price zone to be able to extend its gains towards the 0.7890, while a decline below 0.7770 should favor a downward continuation towards the 0.7730 price zone.

Support levels: 0.7810 0.7770 0.7735

Resistance levels: 0.7855 0.7890 0.7925

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.