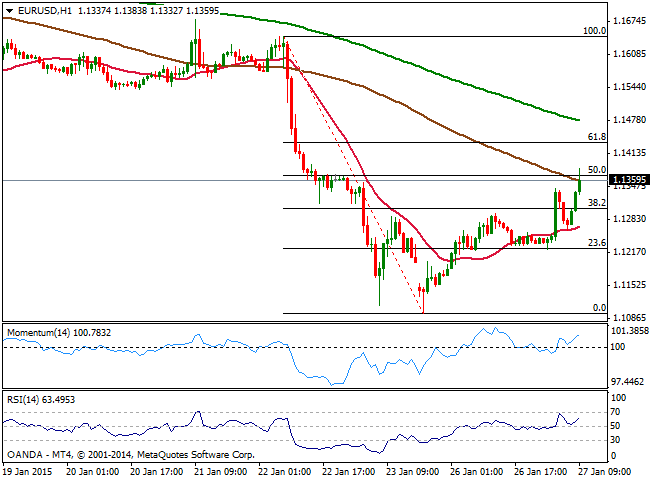

EUR/USD Current price: 1.1359

View Live Chart for the EUR/USD

The dollar is under pressure this Tuesday, hit initially by SNB’s vice chairman Dantine, stating the Central Bank is ready to intervene in the FX market if required, and that their watching the franc against both, EUR and USD. The news triggered a quick depreciation of CHF crosses, lifting EUR/USD to a fresh weekly high circa 1.1340. US data released shortly afterwards showed Durable goods orders plunge 3.4% in December, and the core reading also disappointed printing -0.8%. Ahead of the opening, US indexes are sharply lower, with the DJIA almost 300 points down, with yields also near 2014 lows, all of which maintains the greenback in selling mode against most rivals. The EUR/USD pair holds to its intraday gains, trading near fresh daily highs at 1.1383, and with the 1 hour chart showing a mild positive tone as per price finding intraday support around its 20 SMA, and indicators are heading higher above their midlines. Furthermore, the pair holds above the 38.2% retracement of its post ECB QE announcement slide, immediate support at 1.1310. The 50% retracement of the same rally stands at 1.1365, and if the price advances again above it, chances are of an upward continuation towards the 1.1400 figure.

Support levels: 1.1310 1.1250 1.1200

Resistance levels: 1.1365 1.1400 1.1440

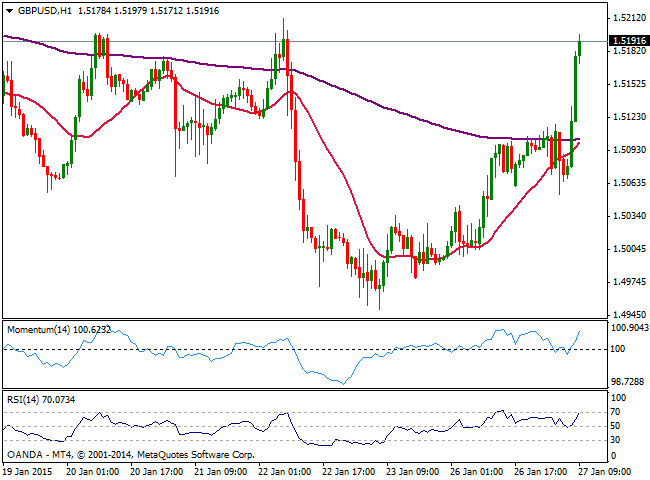

GBP/USD Current price: 1.5192

View Live Chart for the GBP/USD

The GBP/USD pair maintains a strong positive tone, having been flirting with the 1.5100 level earlier on the day. Worse than expected UK GDP readings triggered a temporal kneejerk in the pair sending it down to 1.5054, from where it sharply bounced on the back of weak US data. The pair trades near the 1.5200 figure, and the 1 hour chart shows indicators heading strongly higher well into positive territory as the price advances above its 20 SMA. In the 4 hours chart the technical picture is also clearly bullish, with price having erased all of last Thursday’s losses.

Support levels: 1.5170 1.5125 1.5080

Resistance levels: 1.5200 1.5240 1.5285

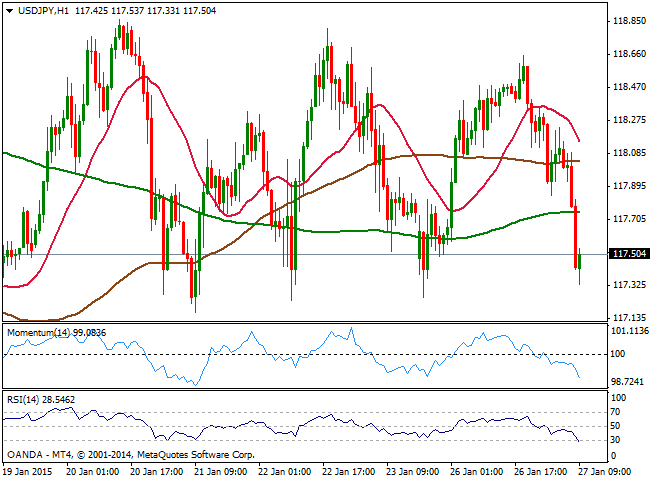

USD/JPY Current price: 117.50

View Live Chart for the USD/JPY

The USD/JPY trades back in the base of its latest range, having eased down to 117.33 early US session, and maintaining a strong bearish tone in the short term, as per the price holding below its moving averages and indicators heading south well into negative territory. The 4 hours chart shows indicators also biased lower, albeit near their midlines, presenting a more neutral stance as the pair has traded between 117.00 and 118.80 for a week already. A break below any of both extremes is required to set some directional strength, with the downside favored towards 116.60 on a break below 117.00

Support levels: 117.30 117.00 116.60

Resistance levels: 117.60 118.00 118.40

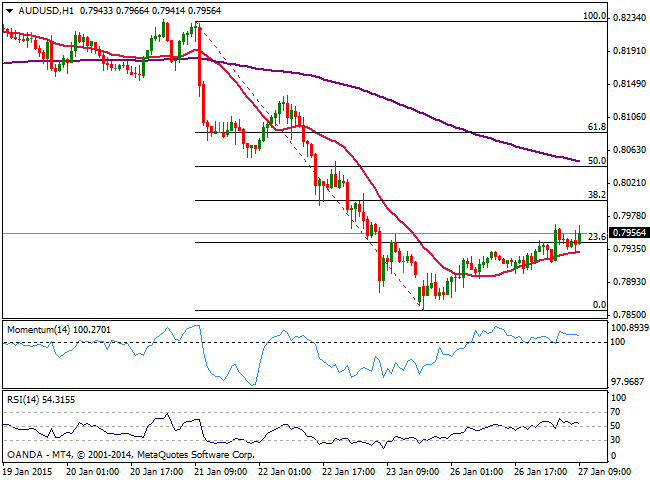

AUD/USD Current price: 0.7956

View Live Chart of the AUD/USD

The AUD/USD pair trades in positive territory albeit with limited intraday gains, supported by dollar weakness rather than Aussie self strength. The 1 hour chart shows that the price holds above a mild bullish 20 SMA although indicators are flat in neutral territory, showing no directional strength. In the 4 hours chart indicators are losing their upward strength right below their midlines, further limiting advances, as price struggles around a strongly bearish 20 SMA. Some follow through above critical long term resistance at 0.7965 should favor a test of the 0.8000 level, albeit failure at the level will maintain the pair in the bearish track.

Support levels: 0.7930 0.7900 0.7860

Resistance levels: 0.7965 0.8000 0.8040

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.