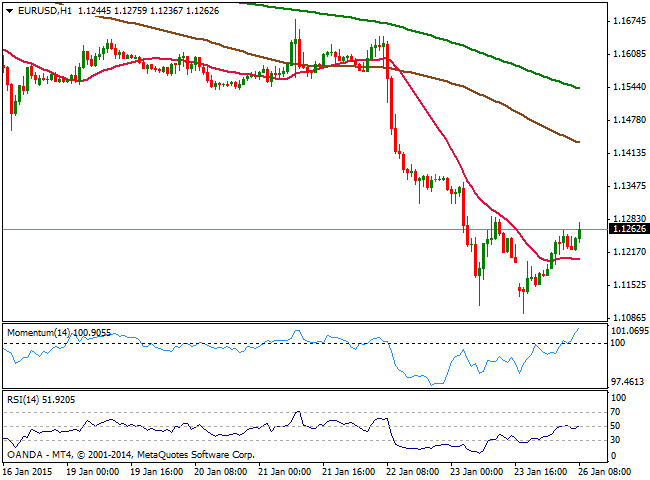

EUR/USD Current price: 1.1262

View Live Chart for the EUR/USD

Following a recovery from a fresh 11-year low at 1.1097 posted early Asian session, the EUR/USD pair advances to fresh daily highs in the 1.1270 price zone. The lack of relevant data, stocks momentum, and market speculation the SNB continues to intervene the currency markets to keep franc down despite lifting the cap, is giving the common currency a breather this Monday. The pair continues to trade in wide intraday ranges, having so far moved around 180 pips. Technically, the short term picture favors the upside, with the 1 hour chart showing indicators aiming higher above their midlines, and price approaching 1.1285 area, the immediate static resistance. In the 4 hours chart indicators lost upward strength after recovering from extreme oversold levels, whilst 20 SMA maintains a strong bearish slope limiting the upside around 1.1325 in case of further advances.

Support levels: 1.1245 1.1200 1.1150

Resistance levels: 1.1290 1.1325 1.1360

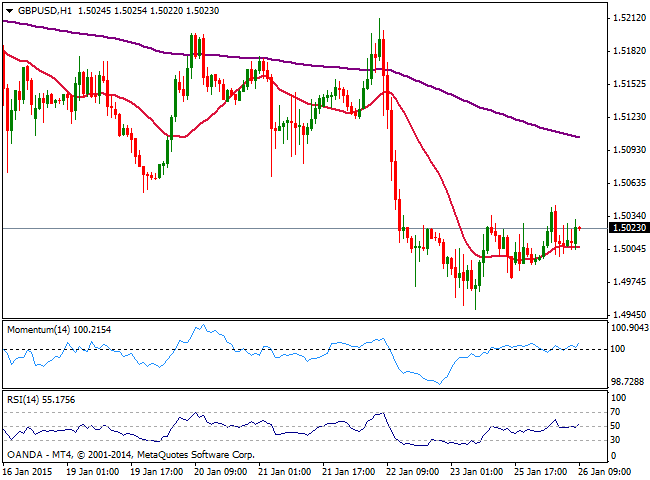

GBP/USD Current price: 1.5023

View Live Chart for the GBP/USD

The GBP/USD pair consolidates above the 1.5000 figure, having set a daily high of 1.5043 earlier on the day. With no local data to drive the currencies, the pair trades in a quite tight range, lacking intraday strength according to the 1 hour chart, as per indicator aiming barely higher around their midlines. In the same time frame, the price stands above a flat 20 SMA, offering dynamic support around the 1.5000 figure. In the 4 hours chart however, the technical picture is clearly bearish, with the price holding below a bearish 20 SMA and indicators heading lower below their midlines.

Support levels: 1.5000 1.4950 1.4910

Resistance levels: 1.5035 1.5080 1.5125

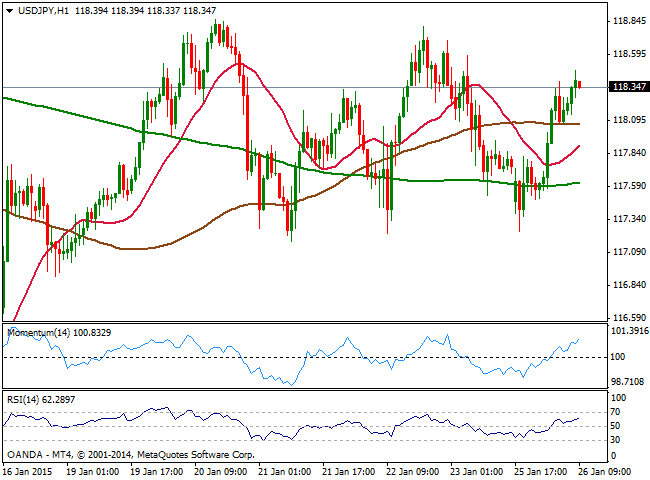

USD/JPY Current price: 118.34

View Live Chart for the USD/JPY

The USD/JPY found again buyers around the 117.30 level, and trades near its daily high of 118.47, confined to its last week range. Short term, the technical picture favors the upside, as per indicators heading strongly up above their midlines, and the price developing above moving averages, with the 100 SMA offering intraday support at 118.10. In the 4 hours chart however, the technical picture remains neutral, with indicators hovering around their midlines. The pair needs to extend either above 118.80 or break below 117.00 to gain some directional strength.

Support levels: 118.00 117.60 117.30

Resistance levels: 118.80 119.20 119.55

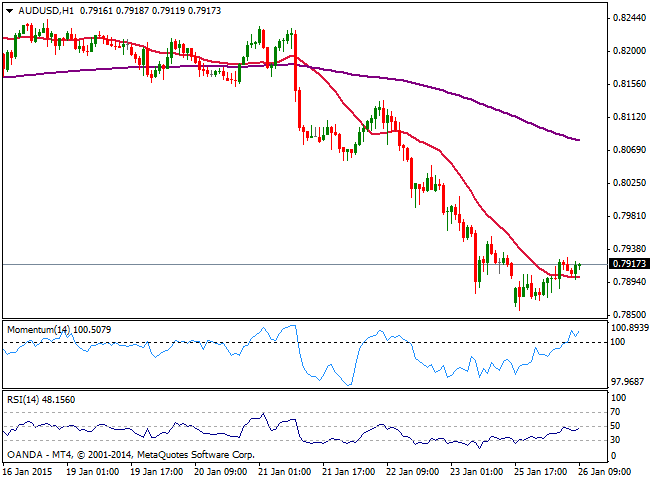

AUD/USD Current price: 0.7918

View Live Chart of the AUD/USD

Australian dollar recovered ground against the greenback, but the pair remains subdued, trading right above the 0.7900 mark. The 1 hour chart shows that indicators aim higher above their midlines, while 20 SMA stands flat around the figure, offering short term support. In the 4 hours chart the corrective movement has lost momentum according to indicators that turn now lower, while 20 SMA maintains a strong bearish slope well above current levels, still favoring the downside, regardless of intraday upward corrections.

Support levels: 0.7900 0.7860 0.7830

Resistance levels: 0.7925 0.7960 0.8000

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.