EUR/USD Current price: 1.1630

View Live Chart for the EUR/USD

The dollar is down across the board early US session, with the EUR/USD pair surging above the 1.1600 figure as stocks came under pressure and risk aversion rules. Some short covering ahead of ECB announcement on their economic policy tomorrow also weights in the pair. So far today, the most relevant data came from the housing sector in the US, with new residential construction raising more than expected in December, to 4.4%. Building permits however where softer than expected and below November reading.

Nevertheless, the EUR/USD trades in a quite tight range, contained to the upside by a strong static resistance in the 1.1640 price zone. Short term the pair presents a positive tone as per the price advancing above its 20 SMA and indicators picking up above their midlines. In the 4 hours the technical picture is also slightly bullish yet more as a consequence of latest lack of activity than of surging demand. The pair may found sellers should current recovery extend around the mentioned 1.1640 price zone.

Support levels: 1.1590 1.1550 1.1510

Resistance levels: 1.1640 1.1680 1.1720

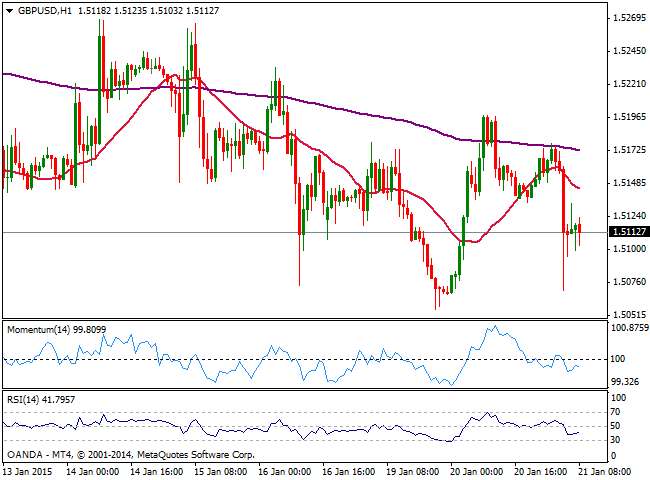

GBP/USD Current price: 1.5112

View Live Chart for the GBP/USD

The British Pound took a hit from its Central Bank this Wednesday, after BOE’s Minutes showed all of the 9 voting members choose to kept rates steady in their January meeting. Despite local employment figures actually beat expectations, the Cable sunk to a daily low of 1.5070 as the decision anticipates no rate hikes in the UK this year. The short term technical picture is bearish, as the price develops below its 20 SMA and indicators are biased lower in negative territory. In the 4 hours chart the outlook is bearish to neutral, with indicators turning south in neutral territory and the price holding below its 20 SMA ever since the news were released.

Support levels: 1.5110 1.5070 1.5030

Resistance levels: 1.5190 1.5225 1.5250

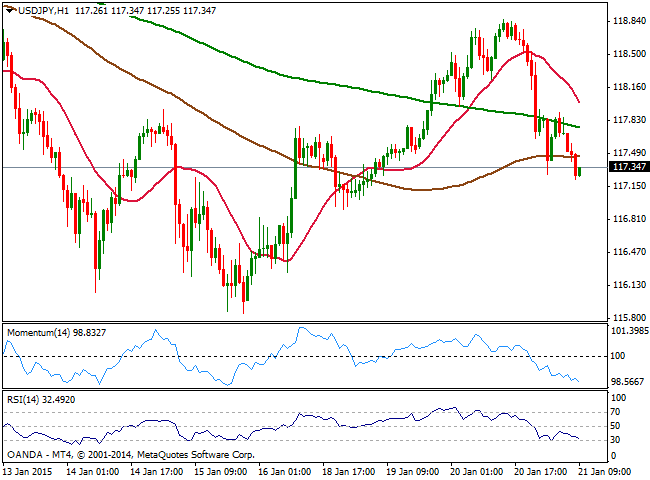

USD/JPY Current price: 117.34

View Live Chart for the USD/JPY

Japanese yen strengthened against its rivals following BOJ’s decision to remain on hold in its economic policy stance, with the USD/JPY pair approaching the 117.00 figure as US equities slide. The 1 hour chart shows that the pair trades again below its moving averages, with the 100 SMA offering immediate resistance at 117.45 and indicators heading strongly south below their midlines. In the 4 hours chart indicators had also turned sharply lower and hover now around their midlines, not yet confirming a downward continuation. A break through the 117.00 should however trigger some further declines exposing the 115.55 level for the upcoming sessions if the yen continues to advance.

Support levels: 117.00 116.60 116.15

Resistance levels: 117.45 117.80 118.20

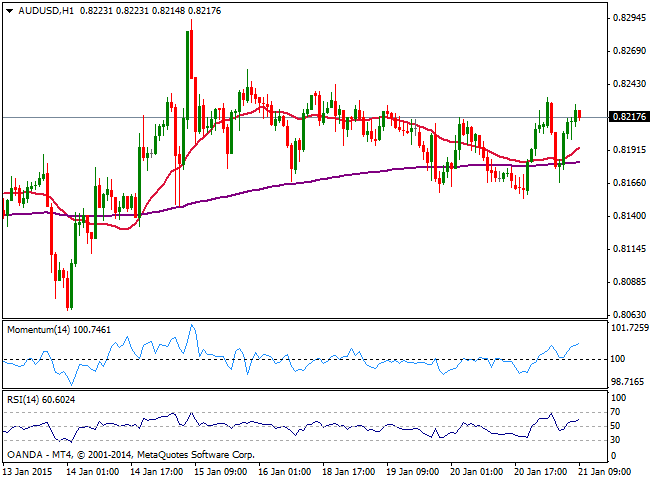

AUD/USD Current price: 0.8217

View Live Chart of the AUD/USD

The AUD/USD pair recovered the 0.8200 figure supported on rising gold, actually trading above $ 1,300/oz, but failed to advance beyond 0.8240 resistance, tested earlier in the day. The 1 hour chart presents a slightly positive tone as per price advancing above its 20 SMA and indicators aiming higher in positive territory, while the 4 hours chart maintains a neutral technical stance. Above the mentioned resistance, the pair could attempt an approach to the 0.8300 figure, where selling interest may halt the advance.

Support levels: 0.8190 0.8145 0.8110

Resistance levels: 0.8240 0.8290 0.8330

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.