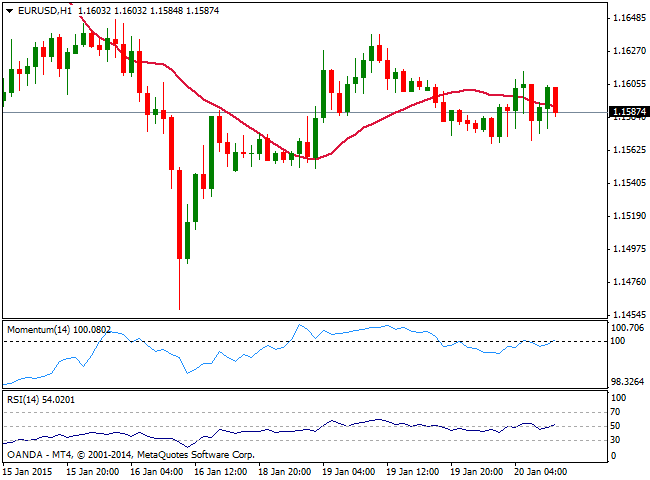

EUR/USD Current price: 1.1556

View Live Chart for the EUR/USD

Currency pairs are yet to find their north this week with range trading prevailing across the board, exception made by commodity currencies as NZD and CAD fell sharply against the dollar. The American currency surged alongside with Asian equities in an early spike of risk appetite, with the greenback bid despite US equities gave up early week gains. From the fundamental side, there was no relevant data in the US, and in Europe German ZEW survey surprised to the upside, with investors’ confidence rising for the most in almost a year, although the reading was not enough to support the EUR/USD pair that traded for most of the day below the 1.1600 level.

The range will likely prevail on Wednesday, with the pair contained between 1.15 and 1.16 ahead of the ECB decision on Thursday. In the meantime, the short term picture presents a mild bearish tone, with the 1 hour chart showing the price is extending below its 20 SMA as indicators aim lower in negative territory. In the 4 hours chart 20 SMA continued to cap the upside, now around 1.1595, whilst indicators present a tepid bearish slope below their midlines, supporting the downside despite lacking momentum.

Support levels: 1.1540 1.1510 1.1460

Resistance levels: 1.1595 1.1640 1.1680

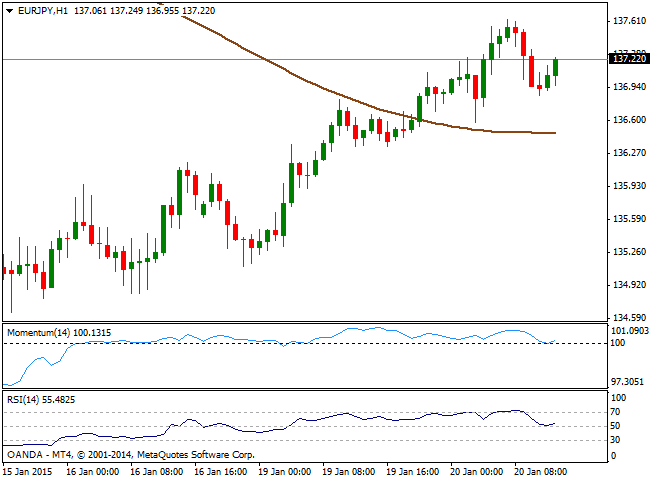

EUR/JPY Current price: 137.21

View Live Chart for the EUR/JPY

The Japanese yen weakened against most of its rivals on the back of Nikkei’s gains, with the local benchmark surging over 2.0% in the day. During the upcoming Asian session, the BOJ will have its monthly monetary policy meeting, largely expected to remain on hold, although any remarks on inflation may be enough to give fresh direction to yen crosses. In the meantime, the EUR/JPY advanced to a fresh 4-day high of 137.63, holding above the 137.00 level ahead of Asian opening. The 1 hour chart shows that price found short term support around its 100 SMA now around 136.40, whilst indicators aim higher after bouncing from their midlines, supporting further advances. In the 4 hours chart however, indicators are beginning to look exhausted to the upside, and suggest a short term downward correction movement ahead. If the mentioned 136.40 level is enough to attract buyers however, the pair may recover again towards the 138.00 price zone.

Support levels: 136.90 136.40 135.85

Resistance levels: 137.55 138.00 138.45

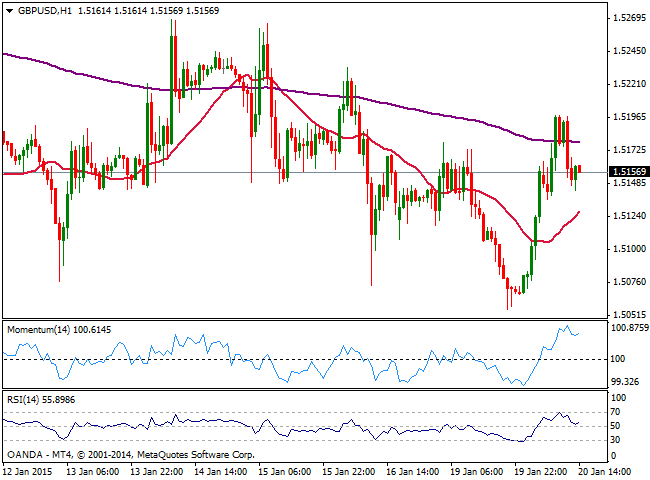

GBP/USD Current price: 1.5156

View Live Chart for the GBP/USD

The GBP/USD pair enjoyed some early demand during Asian hours, reaching a daily high of 1.5198 before finding sellers. The pair however erased all of its Monday losses, and is now expected to consolidate ahead of Wednesday UK data which includes BOE’s Minutes and monthly employment figures. Minutes are not expected to be a surprise, as Governor Carney seems determinate to keep the ongoing economic policy for most of this 2015. When it comes to employment, market attention will likely focus in wages rather than employment creation, as weak salaries had been a key hurdle in inflation growth. Technically, the short term picture maintains a positive bias, as per indicators turning back north after correcting overbought readings, and the price well above a bullish 20 SMA. In the 4 hours chart indicators aim higher around their midlines, while the price hovers above a flat 20 SMA, all of which indicates a clear lack of momentum at the time being.

Support levels: 1.540 1.5110 1.5070

Resistance levels: 1.5190 1.5225 1.5250

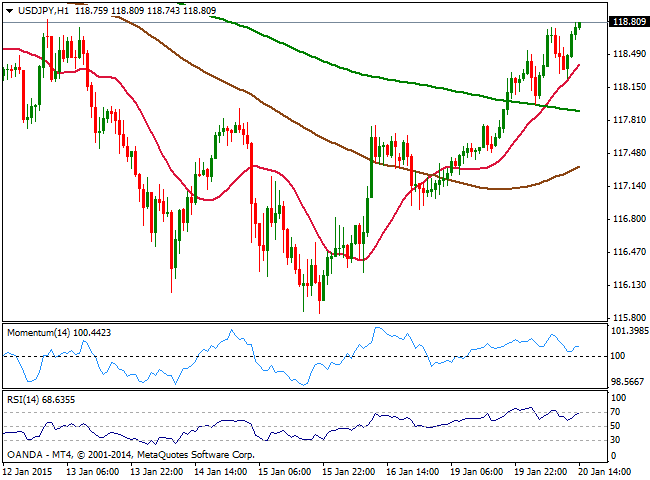

USD/JPY Current price: 118.80

View Live Chart for the USD/JPY

The USD/JPY pair trades at a fresh 6-day high around current 180.80 level, supported by renewed dollar demand. The 1 hour chart for the pair shows that the price extended its advance above its 200 SMA with a shorter 20 SMA offering immediate intraday support now around 118.40. Indicators in the same time frame had regained the upside after a failure approach to break below their midlines, suggesting the pair may continue to advance. In the 4 hours chart indicators lost their upward strength but remain well above their midlines, as the price advances firmly above a now bullish 20 SMA, supporting the shorter term view.

Support levels: 118.30 117.90 117.35

Resistance levels: 119.20 119.50 120.00

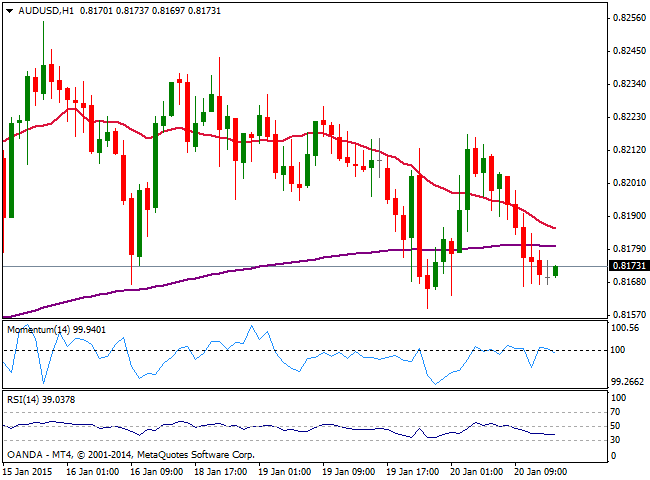

AUD/USD Current price: 0.8172

View Live Chart of the AUD/USD

The AUD/USD pair legged down to the 0.8160 price zone early this Tuesday, weighed by soft Chinese growth figures as yearly GDP for 2014 closed at 7.3% while in the 4Q the economy grew just 1.5%. There will be no relevant data coming from Australia or China today, leaving AUD/USD in the hands of market sentiment. The 1 hour chart shows that the price trades near its daily low of 0.8159 and below a bearish 20 SMA, albeit indicators hold in neutral territory. In the 4 hours chart, the pair is biased lower as per 20 SMA offering now dynamic resistance around 0.8215, while indicators turn south below their midlines.

Support levels: 0.8145 0.8110 0.8070

Resistance levels: 0.8215 0.8240 0.8290

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.