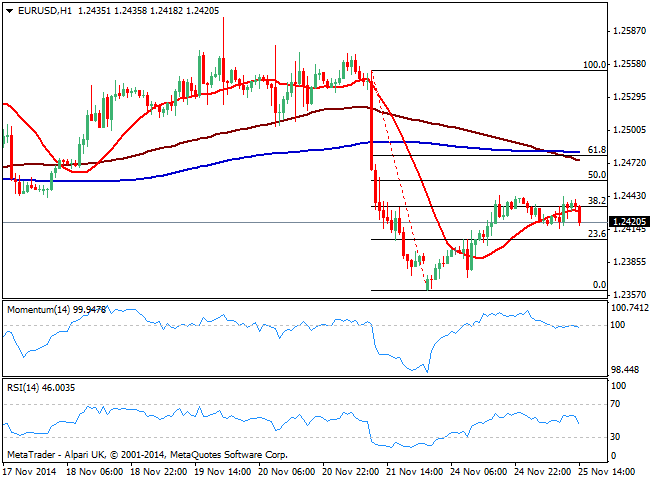

EUR/USD Current price: 1.2423

View Live Chart for the EUR/USD

The EUR/USD pair eases some ahead of US GDP readings, having been trading in a tight range for most of the day, unable to extend beyond the 1.2440 price zone. Mild positive German GDP readings helped the pair earlier on the day, but not enough to trigger stops above afore mentioned level. Short term, the 1 hour chart shows price easing below its 20 SMA and indicators turning lower in neutral territory, while the 4 hours chart presents a stronger bearish momentum, whilst 20 SMA offers resistance around 1.2455. Upcoming direction will be defined by US data, not just GDP as the country will also release consumer confidence and housing and manufacturing numbers in the next few hours. Either a price acceleration above 1.2455 or below 1.2400 will likely set the tone for the rest of the day.

Support levels: 1.2400 1.2360 1.2325

Resistance levels: 1.2455 1.2490 1.2520

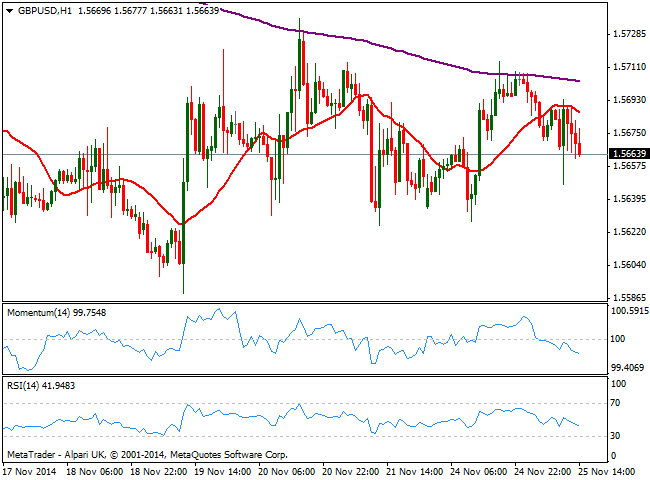

GBP/USD Current price: 1.5663

View Live Chart for the GBP/USD

The GBP/USD pair eases within range after another round of BOE’s inflation hearings brought nothing new to the table. Mild dovish wording was not a surprise and Pound regains the downside with discretion ahead of US news. Technically, the 1 hour chart shows price extending below a bearish 20 SMA while indicators head south into negative territory. In the 4 hours chart the technical picture is neutral to bearish, with price moving back and forth around a flat 20 SMA as indicators enter negative territory. Price needs to break below 1.5620 to confirm further declines, expecting them a break to fresh year lows near the 1.5550 price zone.

Support levels: 1.5620 1.5585 1.5550

Resistance levels: 1.5700 1.5740 1.5770

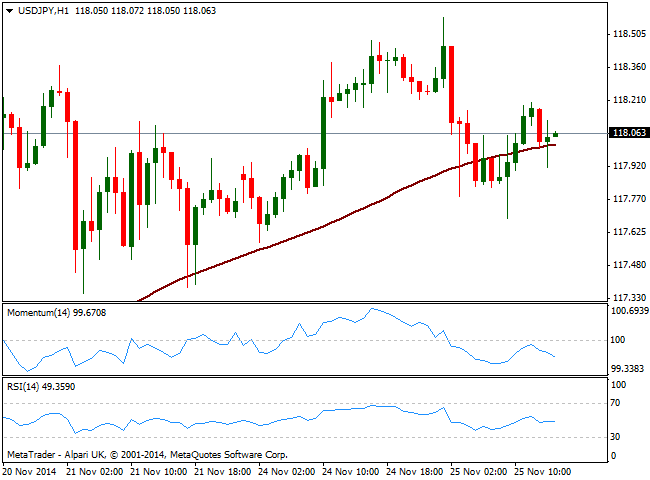

USD/JPY Current price: 118.05

View Live Chart for the USD/JPY

Yen advanced overnight against most of its majors, after BOJ Minutes showed some policymakers are concerned about the speed of yen depreciation and the costs of QE. The pair fell as low as 117.68 intraday before bouncing some, now struggling around the 118.00 figure. The 1 hour chart shows price aiming to break below 100 SMA as indicators gain bearish slope below their midlines. In the 4 hours chart however, indicators maintain a more neutral stance, with momentum hovering around its midline and RSI steady above 50. The dominant bullish trend does not exempt the pair from intraday declines, with deeps down to 117.00 being seen as just corrective and buying opportunities.

Support levels: 117.70 117.45 117.00

Resistance levels: 118.20 118.60 119.00

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.