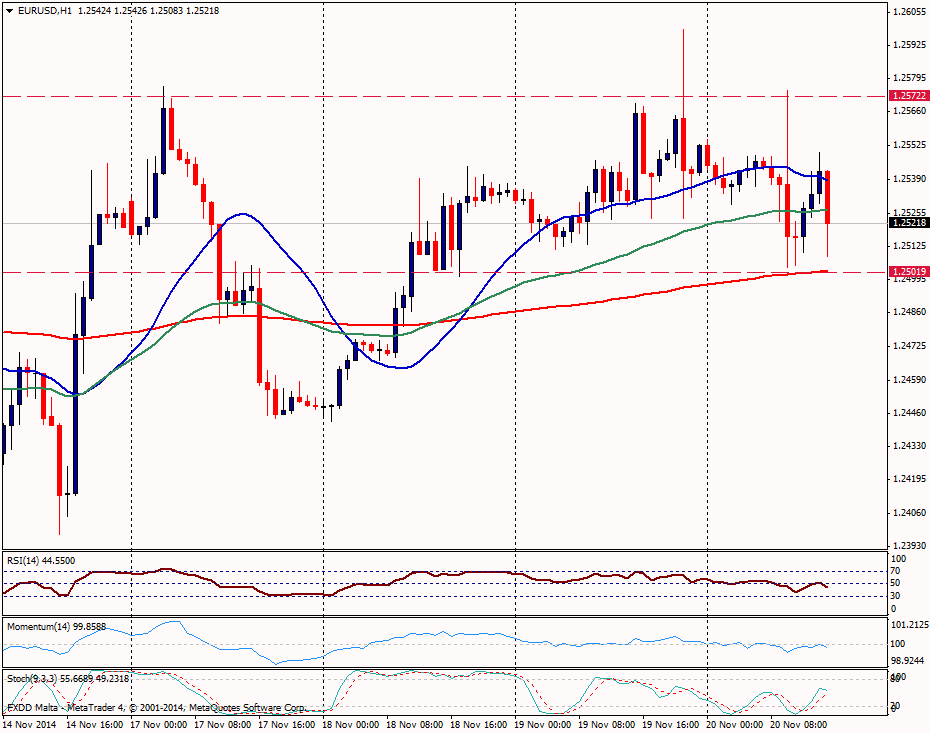

EUR/USD Current price: 1.2550

View Live Chart for the EUR/USD

The EUR/USD is moving in a consolidating mode, without a clear trend for the day, but holding a bearish tone after Eurozone and US economic data, but as long as it holds above 1.2500, declines would be limited; a break below could trigger a bearish rally, targeting initially 1.2475 and below here 1.2450. To the upside the euro has been unable to break above 1.2570; it needs a consolidation above to gain strength and break the current trading range.Technical indicators in the 1-hour and 4-hours charts show indicators mixed. The 4-hour chart is at an important support level, that could favor a rebound, but below 1.2500 the scenario could change.

Support levels: 1.2500 1.2465 1.2445

Resistance levels: 1.2550 1.2575 1.2605

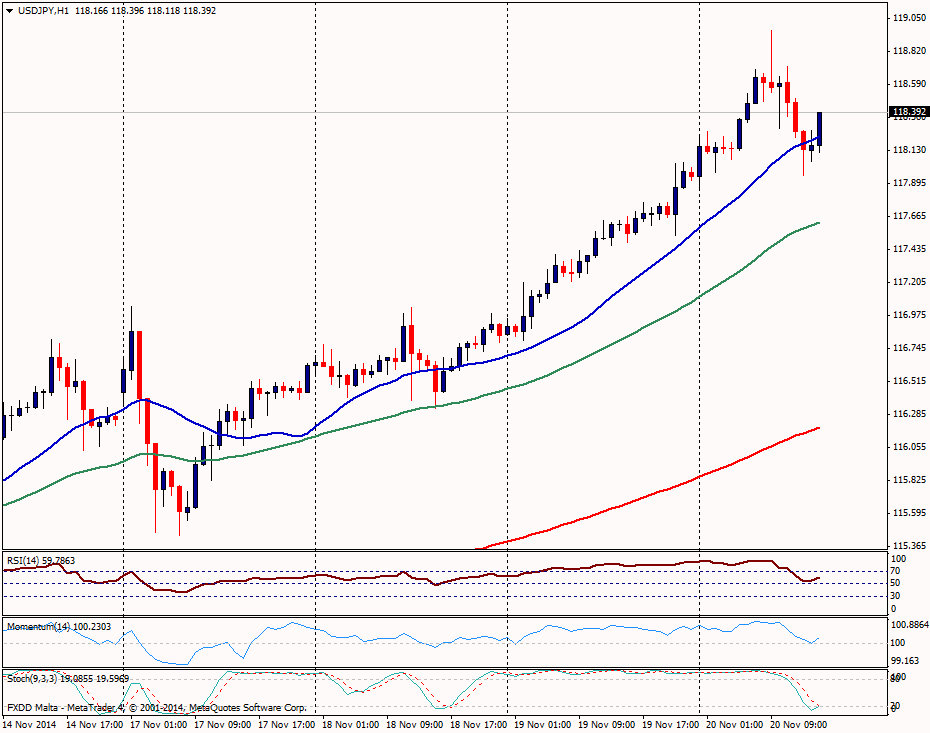

USD/JPY Current price: 118.15

View Live Chart for the USD/JPY

Price continued to advance to fresh multi-year highs, until found resistance below 119.00, increasing volatility around that level. After an expected bearish correction during the European session, technical indicators are turning again to the upside, particularly after US economic data. USD/JPY rose back above 118.00 and recovered ground. The trend remains bullish but longer term charts show overbought reading, that could limit the upside. If the price falls back below 118.10 (where the hourly 20-SMA stands), it would expose daily lows and open the doors for a bigger correction.

Support levels: 118.10 117.80 117.05

Resistance levels: 118.45 118.70 119.00

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.