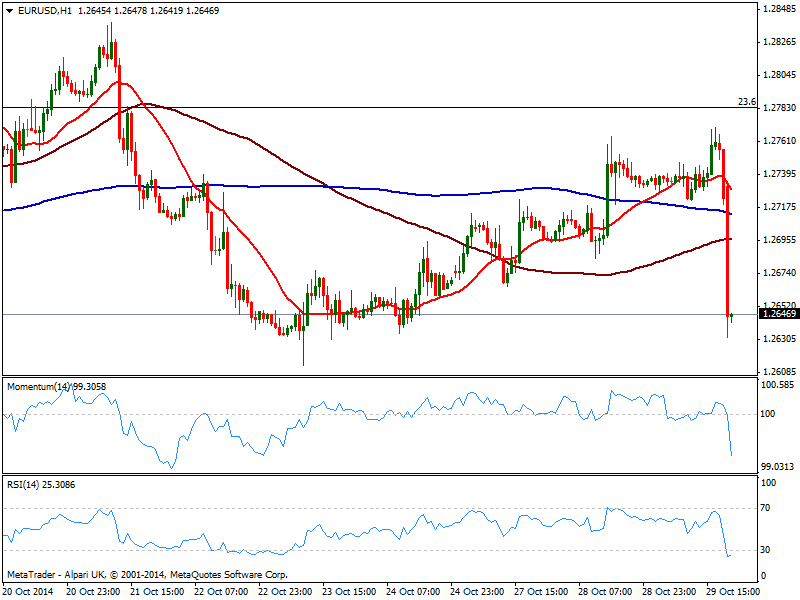

EUR/USD Current price: 1.2645

View Live Chart for the EUR/USD

FED surely knows how to keep traders busy: the US Central Bank has ended its QE programs as scheduled, and maintained the “considerable time” wording on low rates, but the surprise came from an upgraded in its outlook of the employment sector, by saying the underutilization is diminishing. Dollar surged, stocks had a strong but short lived kneejerk, and US Yields rose after the news that shrunk the time frame ahead of a possible rate hike.

As for the EUR/USD, the pair trades at a fresh weekly low a handful pips above 1.2620, having lost over 100 pips in less than an hour. The 1 hour chart shows price breaking through all of its moving averages and indicators turning south into negative territory, while the 4 hours chart shows present a quite similar picture ahead of US close. Intermediate pullbacks had been extremely shallow, favoring further declines for the upcoming sessions towards the 1.2500 lows posted earlier this month.

Support levels: 1.2620 1.2580 1.2550

Resistance levels: 1.2660 1.2700 1.2745

EUR/JPY Current price: 137.53

View Live Chart for the EUR/JPY

The EUR/JPY turns intraday negative with the news, breaking below the 50% retracement of the latest bearish run, around 137.70. The movements in the pair are limited in light of both currencies falling even against the greenback, yet in the long run, chances turned to the downside. Technically the 1 hour chart shows indicators cross their midlines to the downside, but price still above moving averages, with 100 one offering dynamic support now around 137.20. In the 4 hours chart indicators turned lower, with momentum still in positive territory and RSI pulling back from overbought territory: 136.80 level is the support to break to confirm a stronger downward extension, not yet clear according to price action.

Support levels: 137.20 136.80 136.40

Resistance levels: 137.70 138.50 138.85

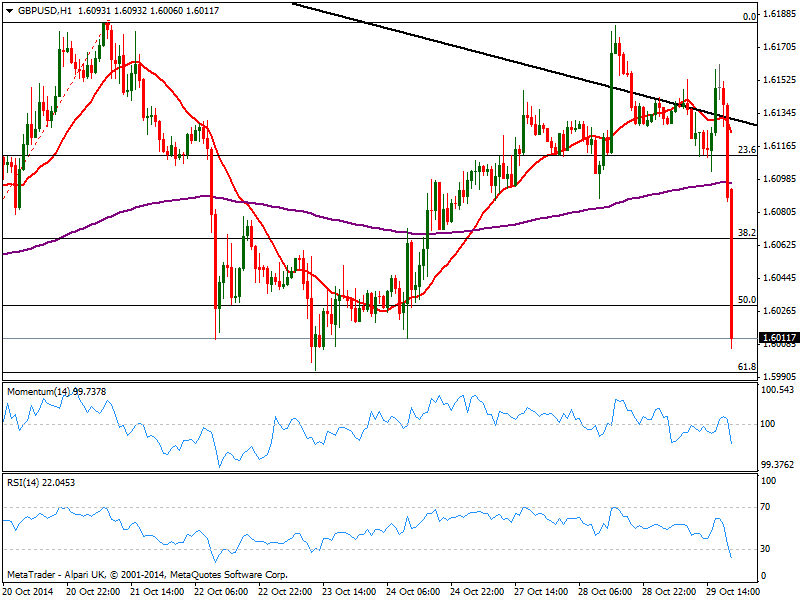

GBP/USD Current price: 1.6011

View Live Chart for the GBP/USD

The GBP/USD flirts with the 1.6000 level, trading nearly 150 pips below its daily high and poised to extend its decline according to the technical picture: the 1 hour chart shows indicators heading south almost vertically, with RSI entering oversold territory with no signs of turning back anytime soon. In the 4 hours chart, the rejection from the 200 EMA around 1.6185 tested late Tuesday extended enough to support a midterm downward continuation, moreover if 1.6000 finally capitulates. Indicators in this last time frame had also turned south, with momentum about to give a selling signal and RSI accelerating towards 30.

Support levels: 1.5995 1.5950 1.5910

Resistance levels: 1.6060 1.6090 1.6145

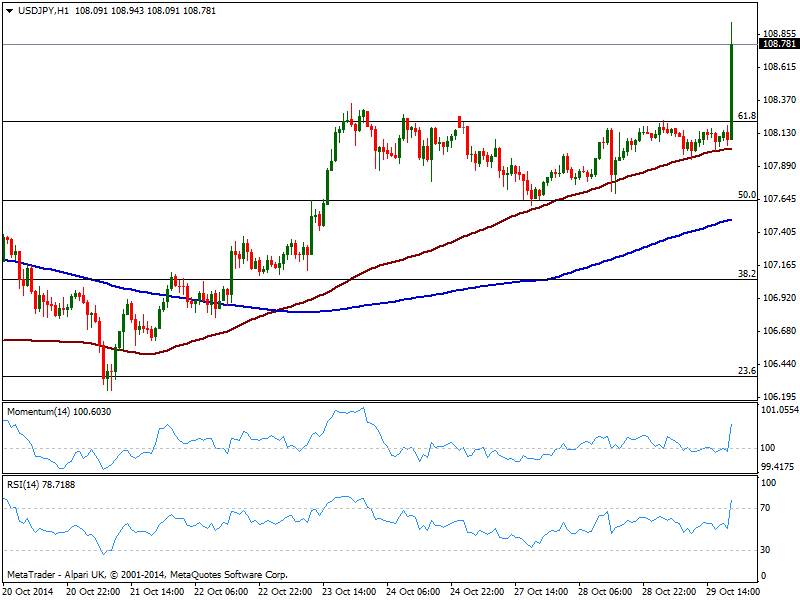

USD/JPY Current price: 108.77

View Live Chart for the USD/JPY

The USD/JPY reached a daily high of 108.94, holding a few pips below as US indexes stand practically at breakeven, a few points below their opening levels. With stocks surviving the end of QE, USD/JPY has now more chances of retesting the year high in the 110.00 area over the upcoming sessions. Short term, the 1 hour chart shows price extending strongly up after finding support in a bullish 100 SMA, with indicators presenting a clear upward momentum, supporting a break higher. In the 4 hours chart technical indicators also turned strongly north, with a break above 109.00 being the immediate trigger for a continued advance.

Support levels: 108.50 108.10 107.70

Resistance levels: 109.00 109.45 109.90

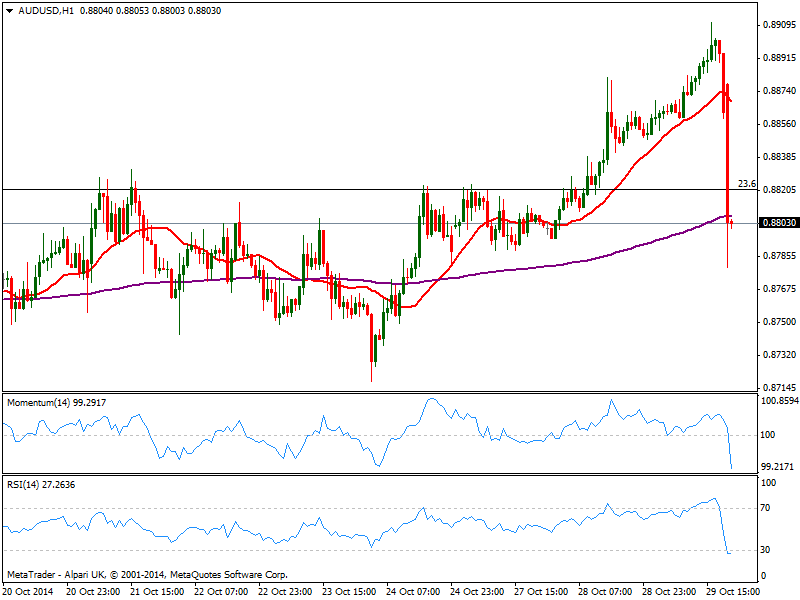

AUD/USD Current price: 0.8802

View Live Chart of the AUD/USD

Australian dollar gave back all of its latest gains, trading back below critical 0.8820 Fibonacci level. The pair however found some short term buying interest near the strong static support at 0.8770, but maintains the bearish bias in the short term: the 1 hour chart shows price accelerated strongly down also below its 20 SMA while indicators head lower deep in the red. In the 4 hours chart price stands below a still bullish 20 SMA, while indicators lost the latest bullish strength but remain in positive territory: a break through 0.8770 will likely see the pair down to 0.8730 in the short term, while sellers will likely surge on approaches to 0.8820 resistance.

Support levels: 0.8730 0.8690 0.8655

Resistance levels: 0.8820 0.8850 0.8890

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.