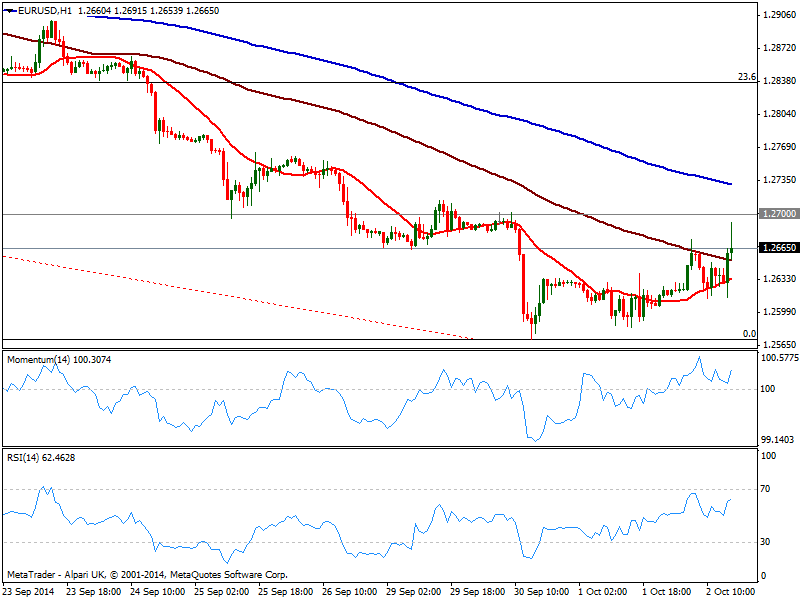

EUR/USD Current price: 1.2660

View Live Chart for the EUR/USD

Dollar is under pressure across the board, but is not just about Draghi and ECB today: US indexes are pressuring yesterday’s lows weighting also on the greenback. The ECB head bring nothing new to the table, again stating they are ready to launch full QE if needed. He expects inflation slowly to pick up over the upcoming 2 years, expressing not much concern on latest lowest readings but extending the time of a recovery.

Anyway, the EUR/USD managed to advance up to 1.2691, retracing some for the level and maintaining a mild positive tone in the 1 hour chart as per price holding above both 20 and 100 SMAs and indicators aiming higher above their midlines. In the 4 hours chart price indicators remain below their midlines, with price above a flat 20 SMA, showing no actual upward strength. Only steady gains above 1.2700 will favor further intraday recoveries, eyeing a test of 1.2745 price zone.

Support levels: 1.2620 1.2570 1.2540

Resistance levels: 1.2690 1.2745 1.2780

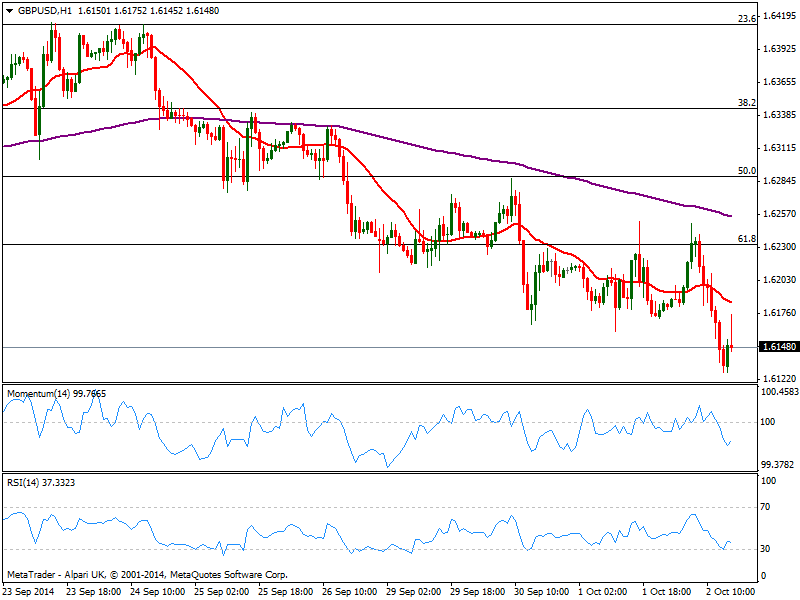

GBP/USD Current price: 1.6147

View Live Chart for the GBP/USD

The GBP/USD trades steady near its daily low, having failed to advance on dollar weakness: the 1 hour chart shows price stalled below a bearish 20 SMA and indicators still in negative territory, as price losses all of its latest gains. In the 4 hours chart the technical picture maintains a clear bearish tone, with 20 SMA below the 1.6235 Fibonacci resistance, tops in case of further gains. A break below 1.6120 will increase the risk of a steady fall with immediate target at 1.6085.

Support levels: 1.6120 1.6085 1.6040

Resistance levels: 1.6190 1.6235 1.6260

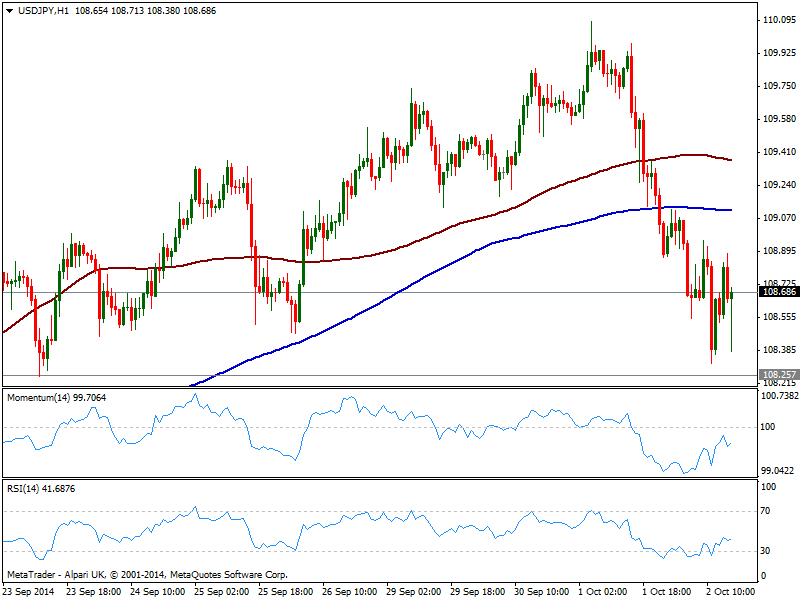

USD/JPY Current price: 108.69

View Live Chart for the USD/JPY

Having traded as low as 108.31, the USD/JPY remains under pressure, with the 1 hour chart showing price consolidating steady below 100 and 200 SMAs and indicators turning back south after correcting early oversold levels. In the 4 hours chart price is finding support at its 100 SMA that maintains a bullish slope, while indicators maintain a strong bearish momentum deep in negative territory. With price below 108.90, risk will remain to the downside, with a break below 108.20 exposing 107.70 price zone.

Support levels: 108.20 107.70 107.30

Resistance levels: 108.90 109.15 109.45

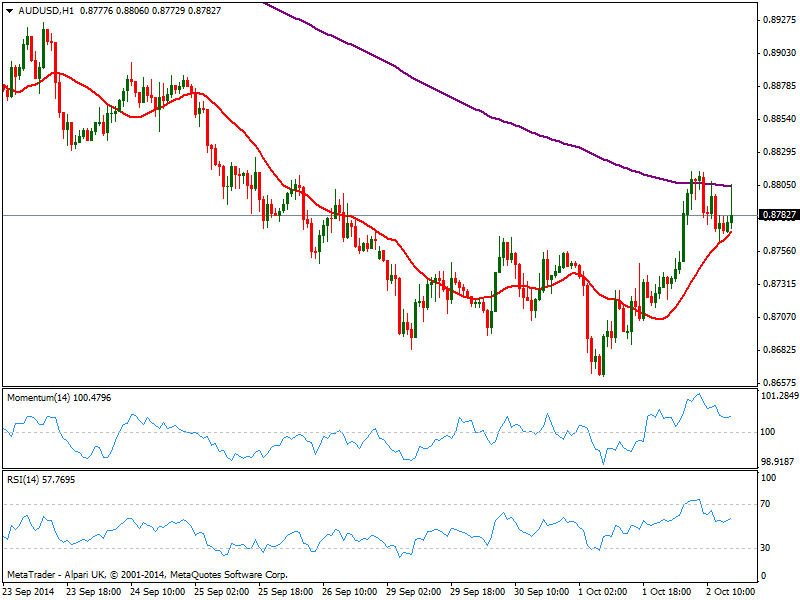

AUD/USD Current price: 0.8781

View Live Chart of the AUD/USD

The AUD/USD trades higher this Thursday, having reached a daily high of 0.8815 so far on the day, and with the 1 hour chart showing price steady above a bullish 20 SMA and indicators regaining the upside after a mild bearish correction. The 4 hours chart shows price also above its moving average, but momentum easing towards its midline, suggesting the upward move is losing steam: a break below 0.8765 will deny the possibility of further recoveries, exposing 0.8720 price zone.

Support levels: 0.8765 0.8720 0.8680

Resistance levels: 0.8810 0.8840 0.8890

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.