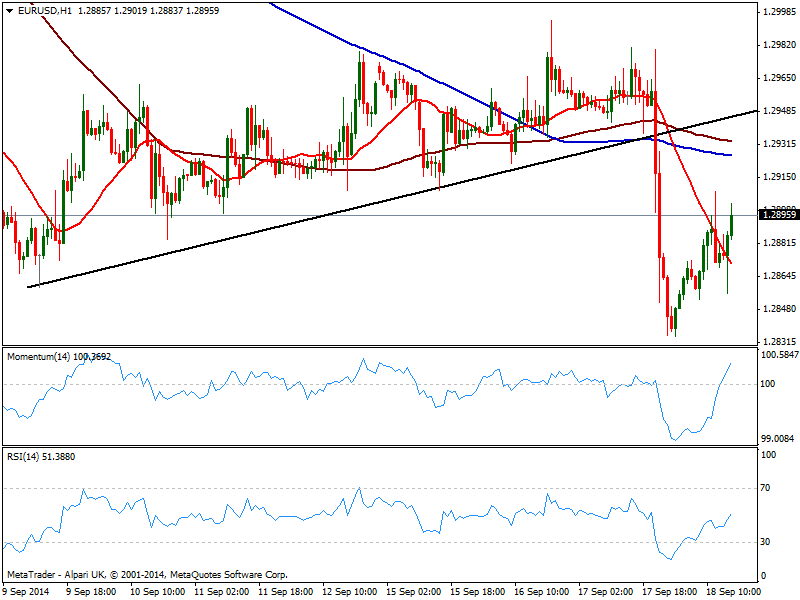

EUR/USD Current price: 1.2895

View Live Chart for the EUR/USD

The EUR/USD flirts with the 1.2900 level, with market attention mostly focused on GBP today, and the Scottish referendum. News coming from all major economies have had no pause this Thursday, with the SNB leaving its economic policy unchanged early Europe, against expectations of negative rates which triggered some gains of European currencies against the greenback. Then, the ECB launched its first round of TLTRO, reaching barely 82.6B euro with market taking it as a sign banks don’t trust ECB that much. Finally US data failed to surprise, with U.S. housing starts tumbling to 14.4% in August, triggering some further short term spikes against the American currency.

Technically, the EUR/USD 1 hour chart shows price advancing above a still bearish 20 SMA, with indicators heading strongly up above their midlines. Sellers however, seem to be aligned in the 1.2900/20 price zone, adding to the dominant trend. In the 4 hours chart the technical stance is still quite bearish, with indicators having barely corrected oversold readings now turning lower well into negative territory, and 20 SMA reaffirming the mentioned resistance area around 1.2920.

Support levels: 1.2860 1.2825 1.2790

Resistance levels: 1.2920 1.2950 1.2990

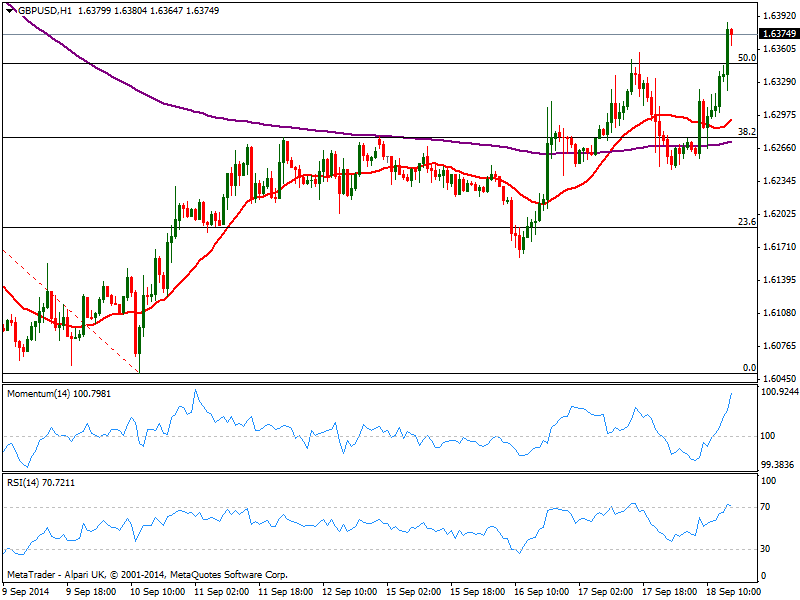

GBP/USD Current price: 1.6375

View Live Chart for the GBP/USD

The GBP/USD trades at its highest level in two weeks having reached so far a daily high of 1.6386 as market speculation inclines for a NO win in the ongoing poll about Scotland independence. The pair has breached the 50% retracement of this month fall, with the 1 hour chart showing a strong upward momentum which supports a continued advance, albeit risk of course, is quite high of headlines messing with technicals. In the 4 hours chart indicators are also biased higher in positive territory, with 20 SMA now converging with the 38.2% retracement of the same rally around 1.6250. It won’t be until Asian opening that the market will be closer to known the result which expectations of gains on a NO far more limited than the possible slide on a YES triumph.

Support levels: 1.6250 1.6220 1.6180

Resistance levels: 1.6315 1.6350 1.6385

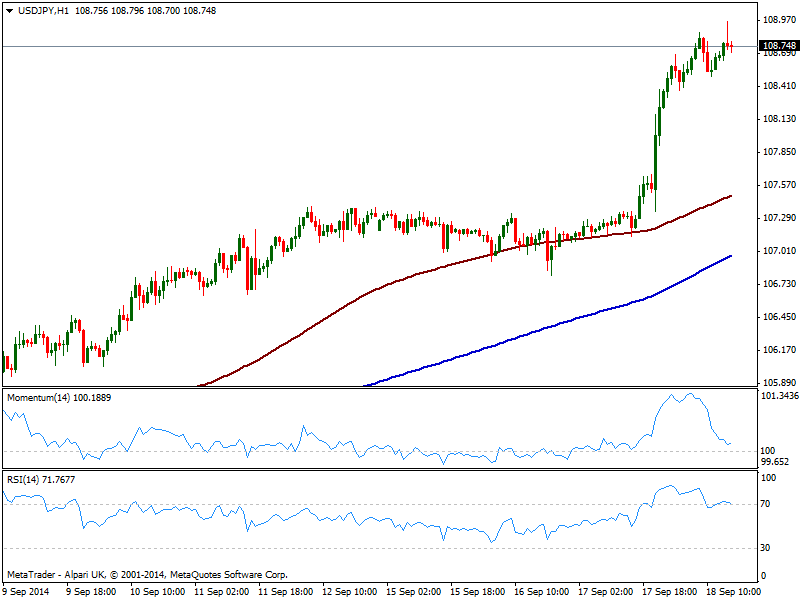

USD/JPY Current price: 108.74

View Live Chart for the USD/JPY

The USD/JPY reached 108.95 from where it retraced some, on the back of rising stocks and US Yields, overall maintaining the dominant bullish trend. The 1 hour chart shows indicators again showing some bearish divergences but holding above their midlines, with higher highs in price and lower ones in indicators. However that’s far from signaling a probable retracement in the pair, with 110.00 sounding now loud as a probable bullish target. In the 4 hours chart indicators continue heading north despite in overbought territory, with no signs of a downward move ahead.

Support levels: 108.40 108.00 107.65

Resistance levels: 109.10 109.40 109.75

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.