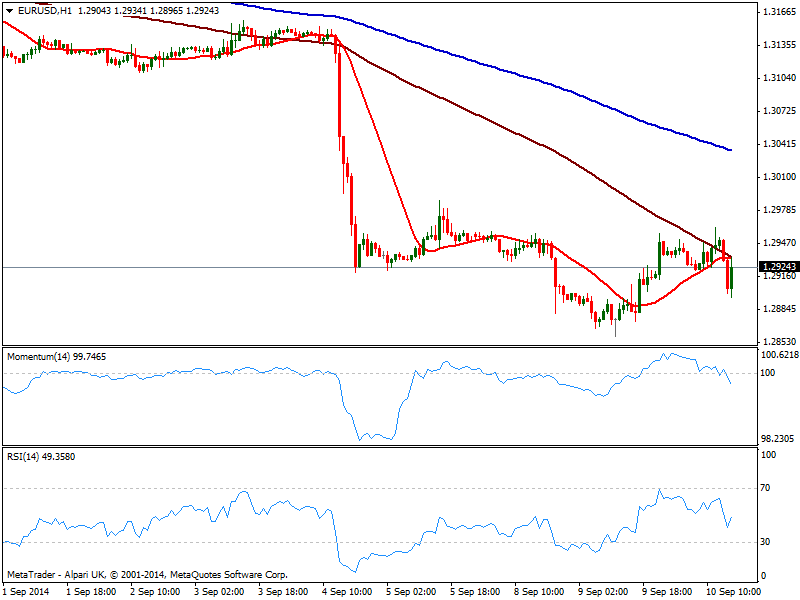

EUR/USD Current price: 1.2924

View Live Chart for the EUR/USD

The EUR/USD lost a good bunch of the gains hardly accomplished yesterday on the back of SNB's Moser comments about the SNB being open to negative interest rates. Quite a smart move to begin jawboning considering EUR/CHF latest approach to 1.20. The pair moved down to 1.2896 before recovering the 1.2900 level, heading higher into US opening with a mild bearish tone according to the hourly chart as price extended below its 20 SMA and momentum accelerated lower below 100. In the 4 hours chart indicators corrected all of their oversold readings, with momentum now retracing from its midline, keeping the pressure to the downside. The strong came back suggests some further upward corrections for the upcoming sessions, to be confirmed on a stronger advance beyond 1.2950. Nevertheless, a break below 1.2860 this week low is required to confirm a stronger downward continuation, eyeing then the 1.2810/20 price zone.

Support levels: 1.2860 1.2815 1.2780

Resistance levels: 1.2950 1.3000 1.3045

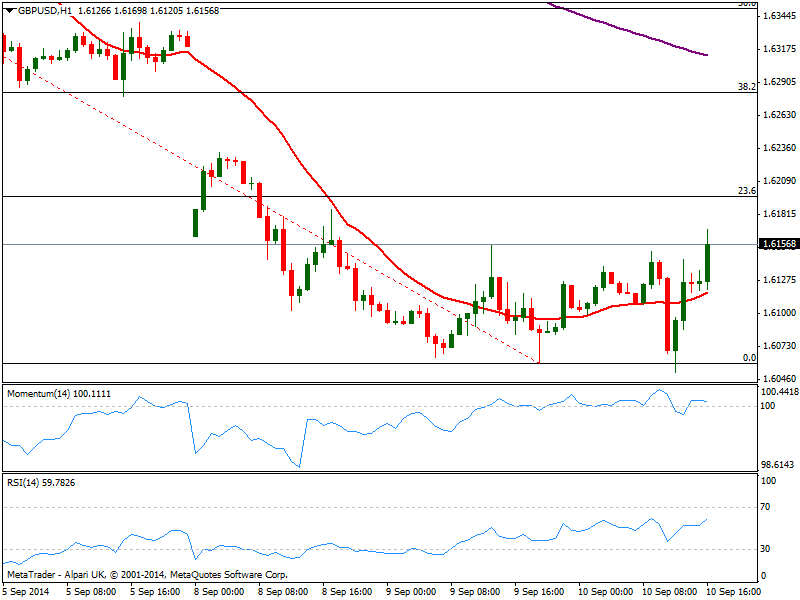

GBP/USD Current price: 1.6155

View Live Chart for the GBP/USD

The GBP/USD suffered an early kneejerk, enough to place a lower low for the week at 1.6051 from where the pair bounced back with little behind either move. Advancing above 1.6150 and with fresh highs for the day, the hourly chart shows a quite neutral technical stance, with price right above a flat 20 SMA and indicators also horizontal around their midlines. In the 4 hours chart indicators aim higher still below their midlines, while 20 SMA stands 1.6150, reinforcing the strength of the level: a rally above it should favor a continued advance towards 1.6200 area, 23.6% retracement of the latest bearish run.

Support levels: 1.6100 1.6060 1.6020

Resistance levels: 1.6205 1.6240 1.6285

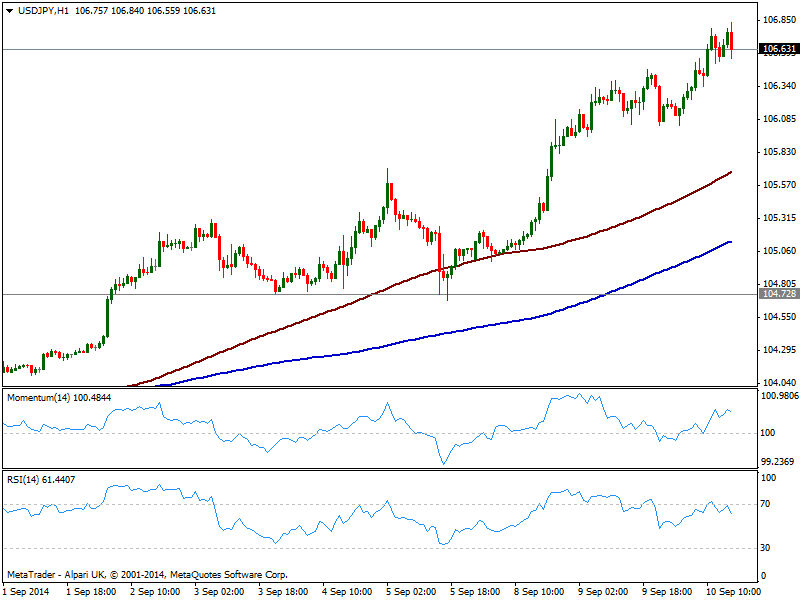

USD/JPY Current price: 106.63

View Live Chart for the USD/JPY

The unstoppable rally in USD/JPY extended today to 106.84, from where the pair corrects lower yet holding above yesterday’s high of 106.50 immediate short term support. The hourly chart shows indicators easing some still in positive territory and moving averages maintaining a strong bullish slope far below current price, which suggests the main interest is still to the upside. In the 4 hours chart indicators look exhausted to the upside still in overbought levels, giving no support to a stronger downward correction.

Support levels: 106.50 106.10 105.70

Resistance levels: 106.90 107.20 107.55

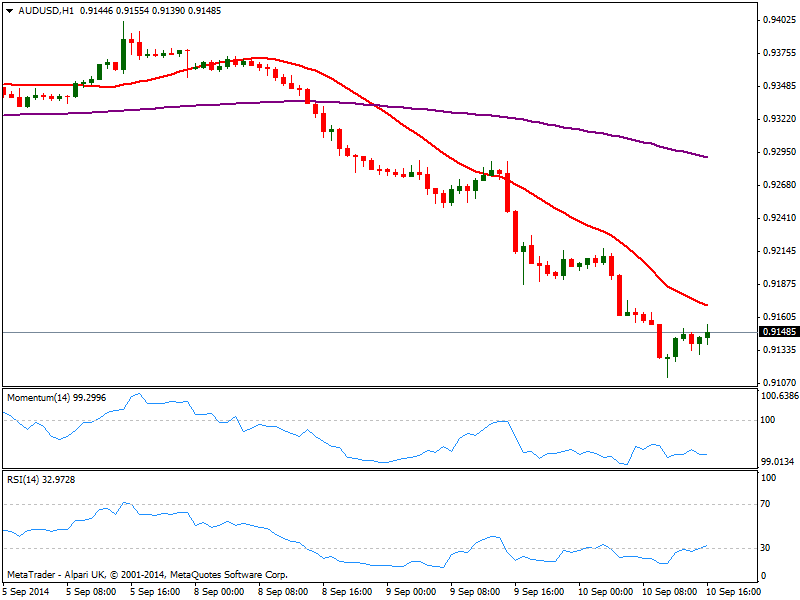

AUD/USD Current price: 0.9148

View Live Chart of the AUD/USD

Recovering from a daily low of 0.9112, the AUD/USD remains under strong pressure, presenting at the time being a limited upward correction, and with the hourly chart showing a strongly bearish 20 SMA capping the upside at 0.9170 and indicators steady near oversold levels. In the 4 hours chart the pair presents a strong bearish tone with RSI heading lower below 30 and momentum steady near oversold levels, suggesting further falls ahead towards critical 0.9000 figure.

Support levels: 0.9145 0.9110 0.9070

Resistance levels: 0.9160 0.9220 0.9265

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.