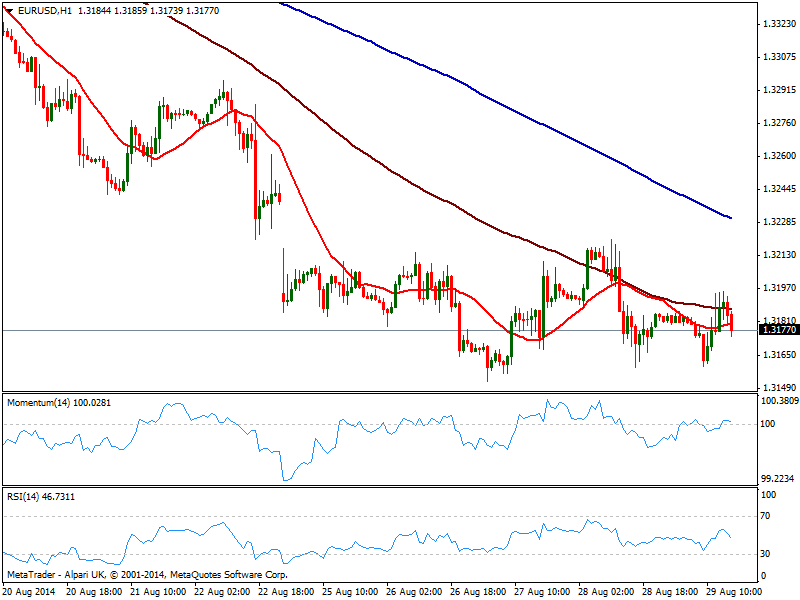

EUR/USD Current price: 1.3184

View Live Chart for the EUR/USD

Back and forth with fundamental news, the pair has once again lacked direction over the past session, trading uneventfully below the 1.3200 level, maintaining a bearish technical stance as per trading a few pips above its year low. Inflation in Europe matched expectations of 0.3% nothing really positive considering it puts the economy one step closer to deflation. Nevertheless, market will probably wait until upcoming ECB meeting on Thursday before taking any serious decision on the pair. At this point, the short term picture is mild bearish, with indicators turning lower around their midlines and price moving below its 20 SMA in the hourly chart. In the 4 hours one price is capped below a flat 20 SMA while momentum grinds higher in positive territory and RSI stands flat below its midline. Unless a price acceleration below 1.3150, the pair will likely maintain its weekly range for the rest of the day.

Support levels: 1.3150 1.3120 1.3090

Resistance levels: 1.3215 1.3240 1.3280

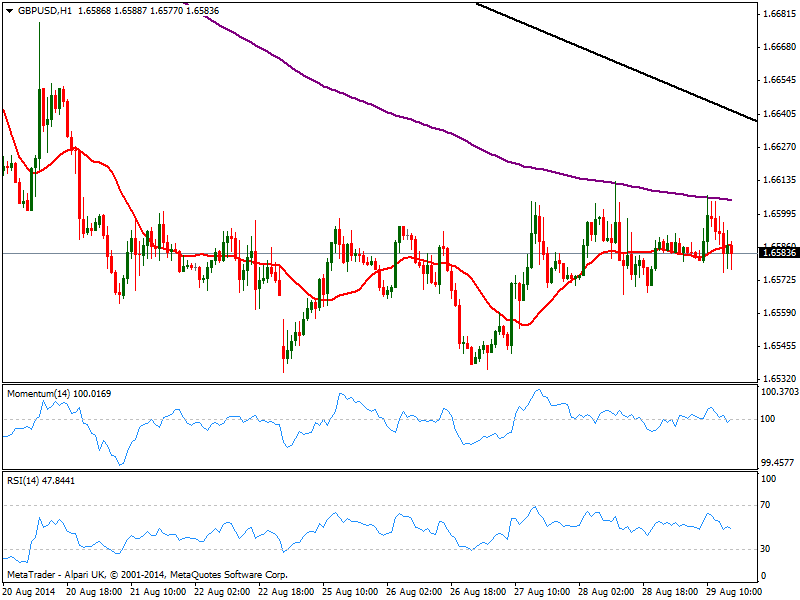

GBP/USD Current price: 1.6583

View Live Chart for the GBP/USD

The GBP/USD pressured the 1.6600 level early Europe, but failed once again to move beyond it, trading in a 30 pips range since early Asian opening right below the level. The technical picture in the short term remains neutral, with price hovering around a flat 20 SMA and indicators steady around their midlines, while the 4 hours chart presents the same technical stance. A daily descendant trend line coming from this year high offers resistance around 1.6650 today in case of a shocking advance, while a break below 1.6540 is required to confirm a new leg down.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6650

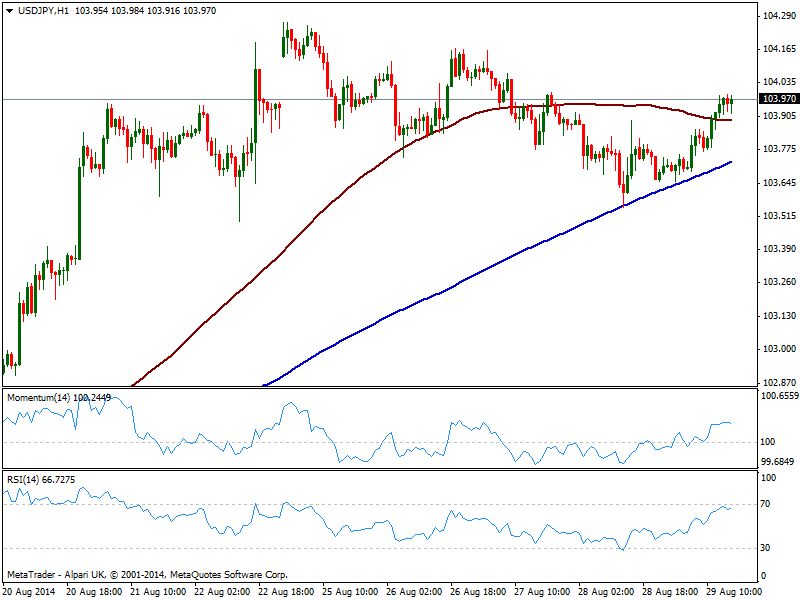

USD/JPY Current price: 103.97

View Live Chart for the USD/JPY

Flirting with the 104.00 figure, the USD/JPY got a boost from negative Japanese data coming from employment and industrial sectors. The pair has managed to add some, but remains capped below its weekly high posted on Monday, with the hourly chart showing price above its 100 SMA and indicators in positive territory, albeit losing early upward strength. In the 4 hours chart indicators head higher around their midlines, not yet suggesting a stronger rise but at least limiting the possibility of a short term decline.

Support levels: 103.55 103.20 102.85

Resistance levels: 104.20 104.50 104.80

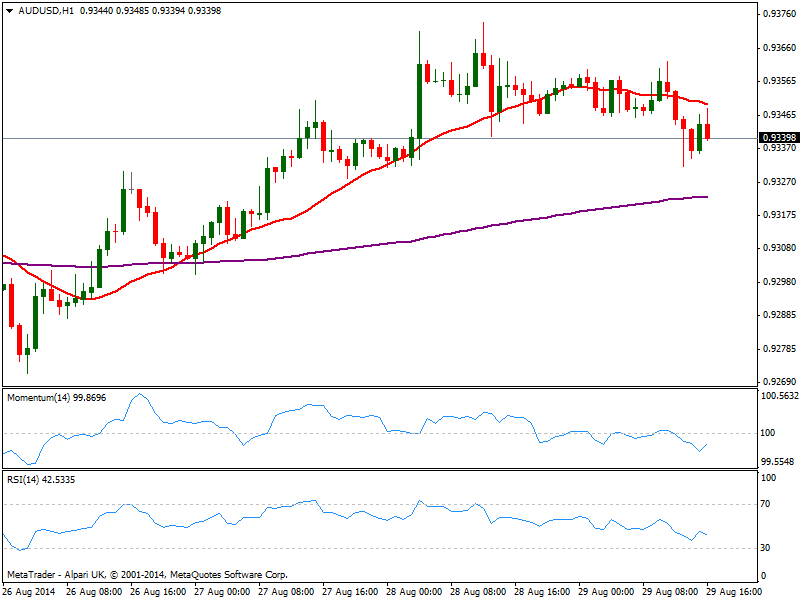

AUD/USD Current price: 0.9340

View Live Chart of the AUD/USD

The AUD/USD eased some further from its recent highs near 0.9370, yet holds so far above 0.9330 with the hourly chart showing price extending below its 20 SMA and indicators in negative territory but diverging between each other. In the 4 hours chart current candle extends below its 20 SMA while indicators turned south but remain above their midlines, pointing at least for a bearish correction towards 0.9300. A weekly close below this last however, will increase the downward potential, exposing 0.9260 price zone.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9410 0.9450

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.