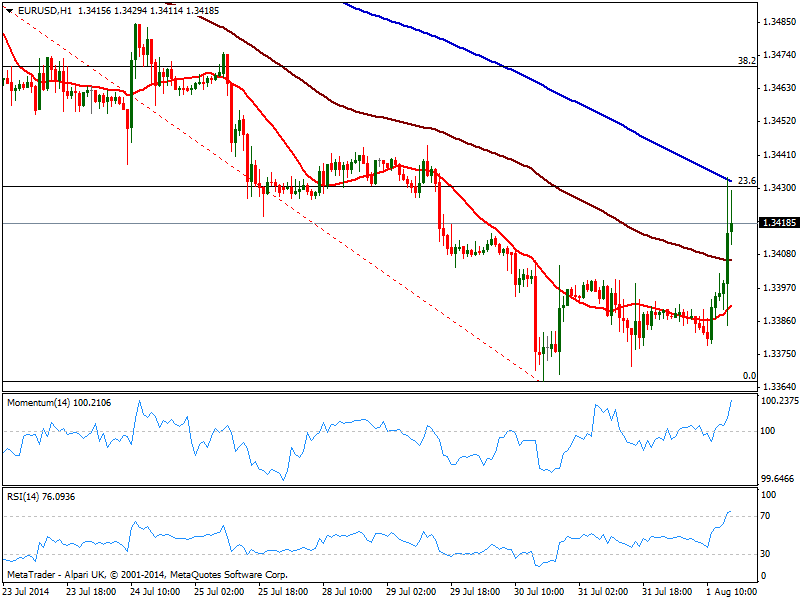

EUR/USD Current price: 1.3419

View Live Chart for the EUR/USD

The high expectations investors had ahead of payrolls, resulted in a dollar setback after the US added “just” 209K new jobs last month. Unemployment rate also ticked higher, up to 6.2%, and after the initial crazy spikes, the EUR/USD is up in correction mode: price approaches 1.3430, 200 SMA in the 1 hour chart and 23.6% retracement of the latest bearish run from 1.3639 to 1.3368 this week low. In the same time frame indicators present a strong upward momentum, while the 4 hours chart shows price above its 20 SMA and indicators about to cross their midlines with a strong upward slope. The critical short term level to break to confirm further advances is 1.3440, level that contained the upside for most of this week.

Support levels: 1.3405 1.3370 1.3335

Resistance levels: 1.3440 1.3475 1.3500

GBP/USD Current price: 1.6834

View Live Chart for the GBP/USD

The GBP/USD remains under pressure, having at least halted its early slide trigger by a mild weak UK Manufacturing PMI reading. The hourly chart shows price was unable to extend beyond 1.6350, with 20 SMA maintaining a strong bearish slope a few pips above and indicators holding near oversold levels. In the 4 hours chart technical readings maintain a strong bearish tone, keeping the pressure to the downside. Renewed selling pressure below 1.6815, should lead to further falls into next week.

Support levels: 1.6815 1.6770 1.6735

Resistance levels: 1.6850 1.6880 1.6920

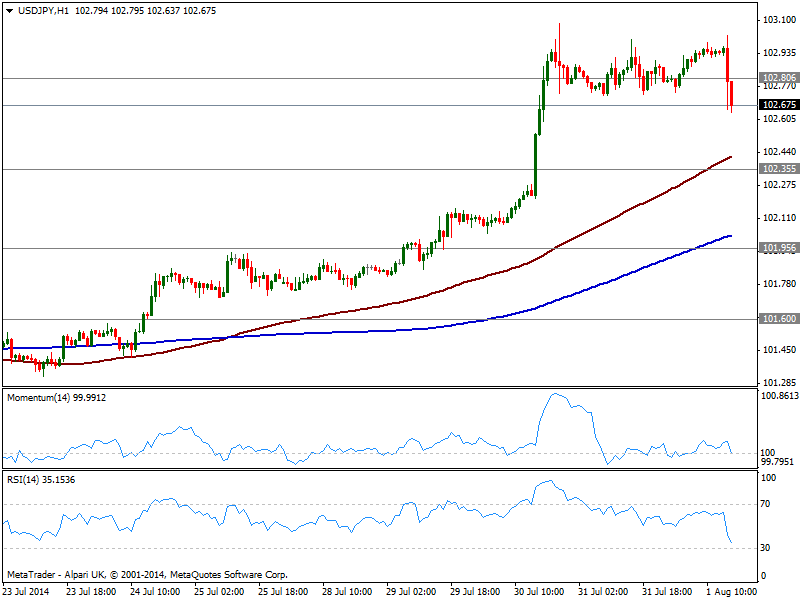

USD/JPY Current price: 102.66

View Live Chart for the USD/JPY

The USD/JPY stands at fresh daily lows with US opening, heading towards 102.35 immediate support. The hourly chart shows indicators gaining bearish momentum and 100 SMA around 102.40, offering some intraday support in case of further slides. In the 4 hours chart indicators turned lower from overbought territory, also gaining bearish strength and supporting the shorter term view.

Support levels: 102.35 101.95 101.60

Resistance levels: 103.10 103.40 103.80

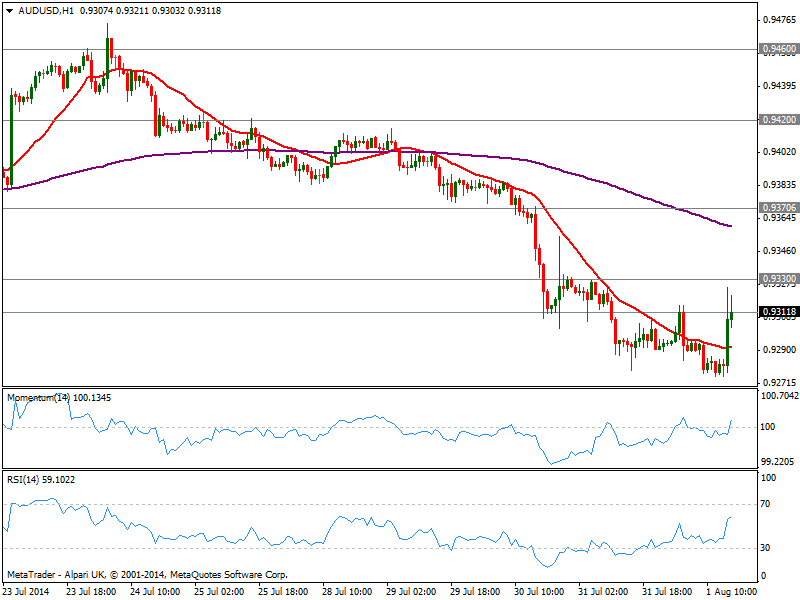

AUD/USD Current price: 0.9311

View Live Chart for the AUD/USD

Australian dollar advanced against the greenback with the news, but stalled a few pips below 0.9330 strong static resistance area. The hourly chart shows price above its 20 SMA and indicators heading higher in positive territory, albeit long upward shadows in candles suggest buyers are still containing the upside. In the 4 hours chart technical readings maintain a bearish tone, with 0.9260 as critical support to break to see a downward extension in the midterm.

Support levels: 0.9300 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9420

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.