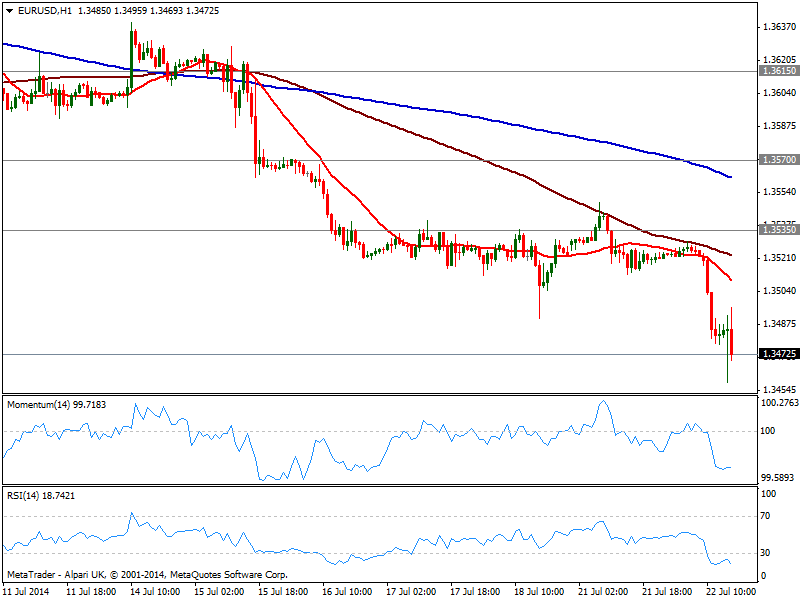

EUR/USD Current price: 1.3471

View Live Chart for the EUR/USD

US inflation data came out showing both year and monthly readings in line with expectations, but core numbers increased less than expected in June, putting the dollar under pressure across the board. But not before the EUR/USD posted a fresh year low of 1.3458: the hourly chart shows indicators maintaining the bearish slope despite in oversold levels, with price hovering around 1.3475 and well below moving averages. In the 4 hours chart the bearish momentum is quite strong, all of which favors a downward continuation towards fresh year lows.

Support levels: 1.3475 1.3440 1.3410

Resistance levels: 1.3500 1.3535 1.3570

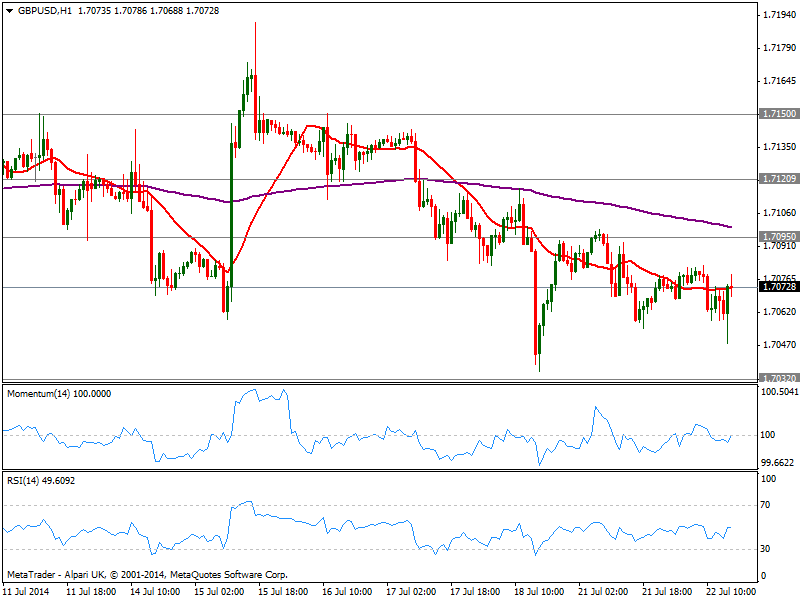

GBP/USD Current price: 1.7073

View Live Chart for the GBP/USD

The GBP/USD recovers some from a daily low of 1.7048 but maintains a weak tone amid limited well below 1.7100. The hourly chart shows price unable to overcome its 20 SMA as indicators hold around their midlines, keeping a quite neutral stance. In the 4 hours chart the technical outlook is mild bearish, with its 20 SMA also capping the upside and indicators turning south below their midlines. Critical support stands around 1.7030 past week low and 200 EMA in this last time frame. A break below it should fuel the bearish momentum eyeing then 1.6985 as next probable short term target.

Support levels: 1.7030 1.6985 1.6950

Resistance levels: 1.7095 1.7120 1.7150

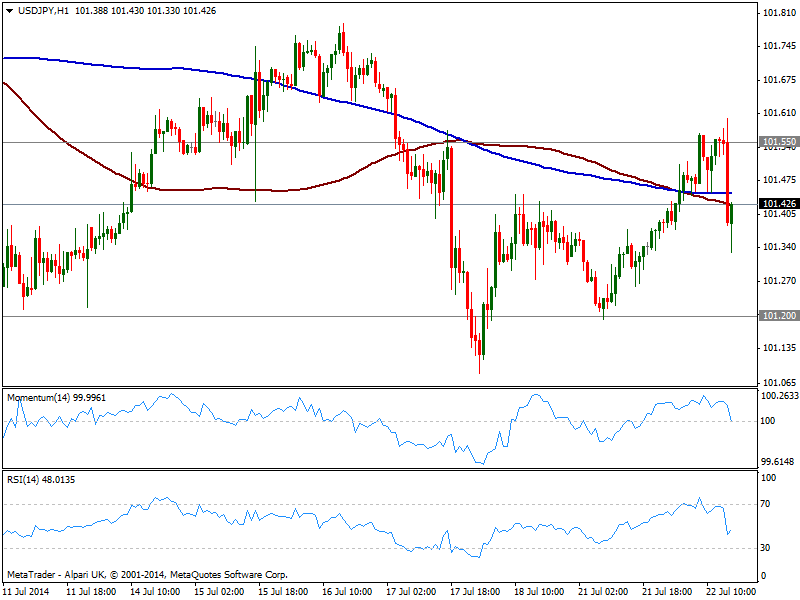

USD/JPY Current price: 101.42

View Live Chart for the USD/JPY

The USD/JPY retraces from a daily high of 101.60, albeit the slide remains limited on strong stocks: US indexes opened higher on earning reports, with S&P looking ready for new record highs. As for the USD/JPY the hourly chart shows indicators down around their midlines and price struggling below 100 and 200 SMAs, both around current 101.40/50 price zone. In the 4 hours chart a slightly negative tone comes from technical readings, yet a break either above 101.60 or below 101.20 is required to set a clearer intraday picture.

Support levels: 101.20 101.05 100.70

Resistance levels: 101.55 101.95 102.35

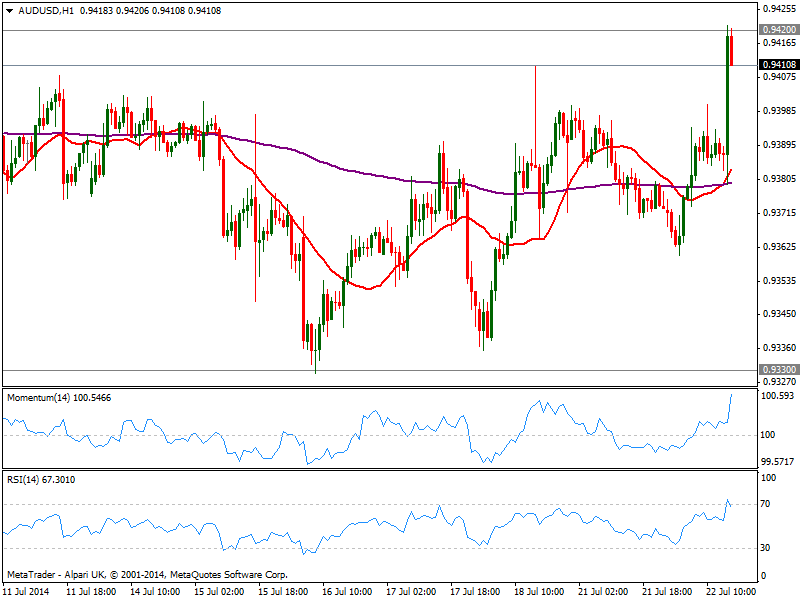

AUD/USD Current price: 0.9410

View Live Chart for the AUD/USD

The AUD/USD extended its advance up to 0.9420 on the back of weak US inflation readings, retracing now some from the strong static resistance level. The hourly chart shows however a strong upward momentum, with indicators entering overbought territory and price well above its 20 SMA, suggesting further gains are possible if the resistance is broken. In the 4 hours chart the outlook is also bullish, with immediate support now at 0.9370.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.