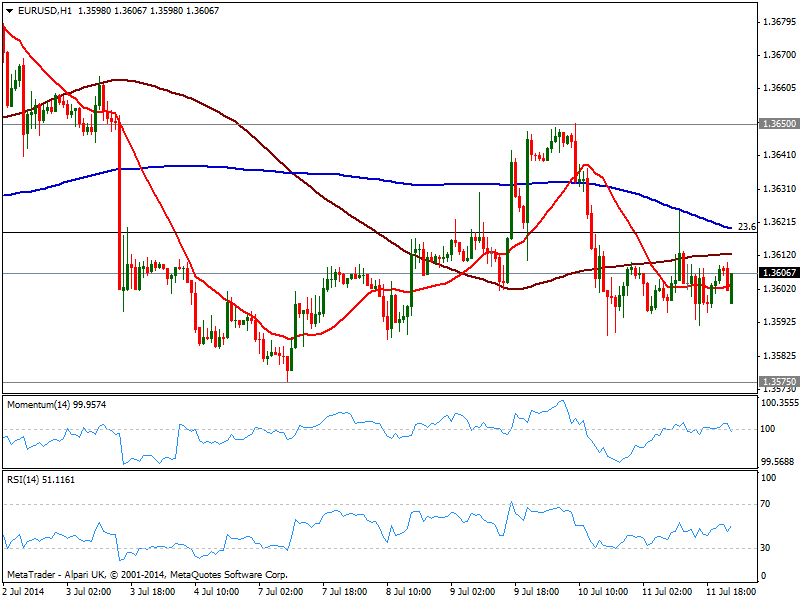

EUR/USD Current price: 1.3606

View Live Chart for the EUR/USD

The EUR/USD trades uneventfully around the 1.3600 level as the week starts, technically neutral. Nevertheless, the mild heavy tone seen for the past few weeks prevails, now supported by Portugal banking woes and fears it may extend through the region. The hourly chart shows price around a flat 20 SMA and indicators also horizontal around their midlines, giving no clear signs of short term direction. In the 4 hours chart the technical outlook is also neutral, with the extremes of the latest range at 1.3570 and 1.3650: some momentum outside the range may set some intraday direction, albeit the range should contain price this Monday.

Support levels: 1.3570 1.3530 13500

Resistance levels: 1.3620 1.3650 1.3680

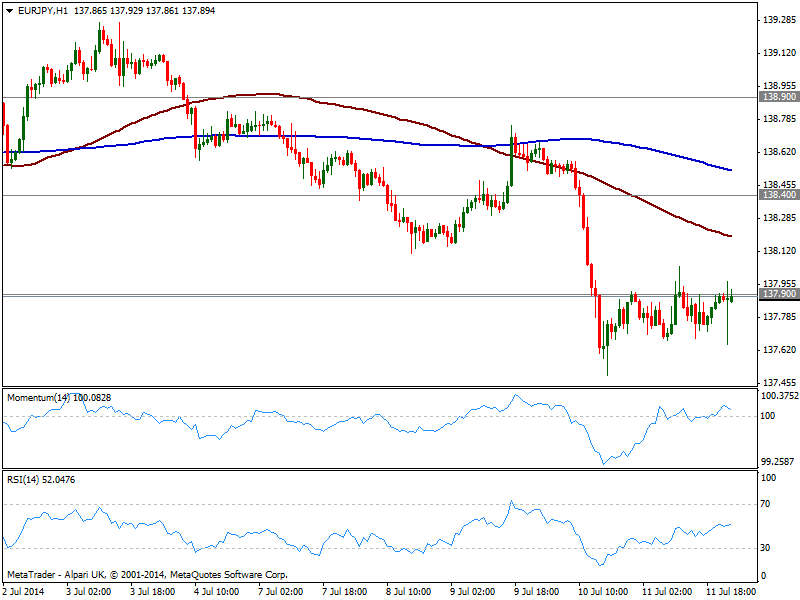

EUR/JPY Current price: 137.91

View Live Chart for the EUR/JPY

Stocks in the US recovered last Friday, putting a halt on yen strength, with the EUR/JPY however, unable to establish above the 138.00 mark. As a new day starts, the hourly chart shows price well below moving averages, and indicators losing upward potential right above their midlines. In the 4 hours chart technical readings stand in negative territory yet neutral, showing no current strength. As long as below 138.40, the downside is favored, with a break below 137.50, last week low, signaling a continued slide towards 136.60 price zone.

Support levels: 137.50 137.00 136.60

Resistance levels: 138.40 138.90 139.35

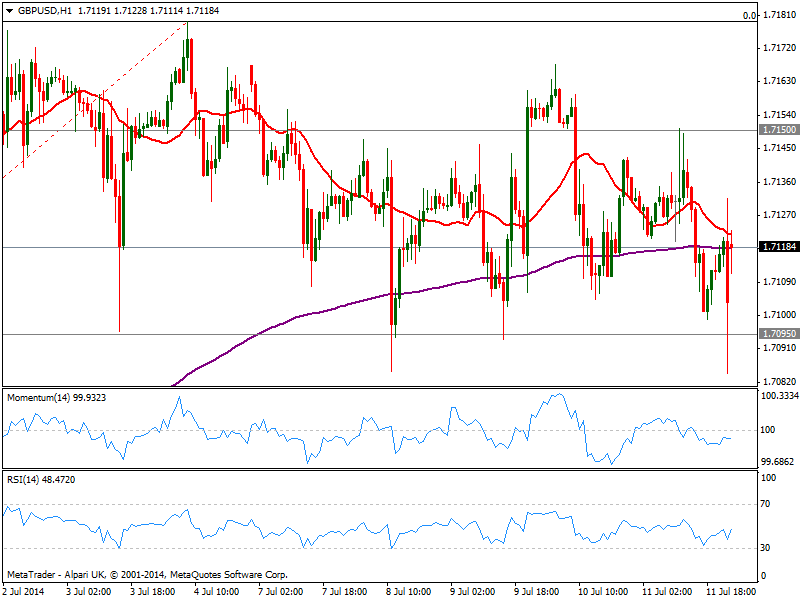

GBP/USD Current price: 1.7118

View Live Chart for the GBP/USD

Despite a late kneejerk on Friday, the GBP/USD holds its latest range, consolidating above the 1.7100 mark, with buyers surging on dips towards the figure. The hourly chart shows price below its 20 SMA and indicators heading slightly lower under their midlines, keeping the pressure to the downside. In the 4 hours chart the technical picture is quite similar, with a shy negative tone coming from technical readings, yet only with a break below 1.7060, 23.6% retracement of the latest bullish run, the downside will be favored towards the 1.7000/20 price zone.

Support levels: 1.7095 1.7060 1.7020

Resistance levels: 1.7150 1.7180 1.7220

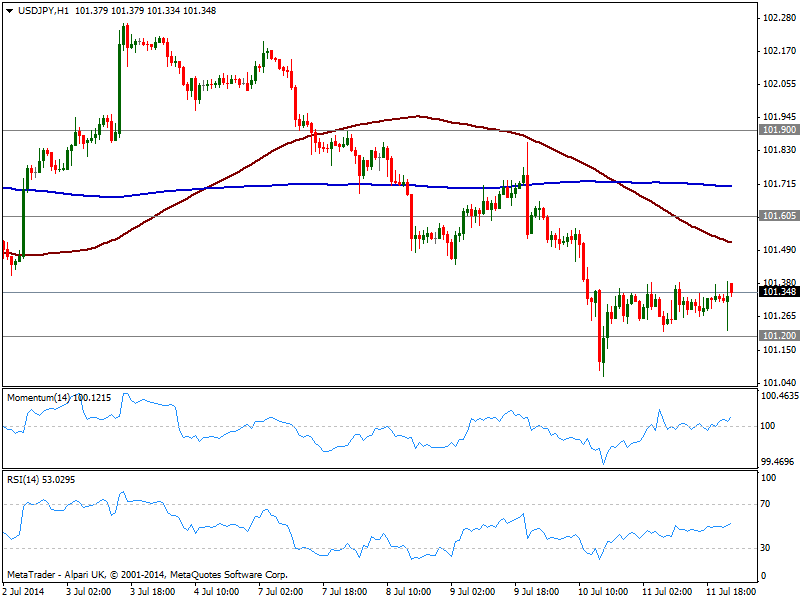

USD/JPY Current price: 101.34

View Live Chart for the USD/JPY

The yen maintains its strength against the greenback, with the USD/JPY trading some 50 pips above the year low, contained in a tight range for most of last Friday. The hourly chart shows 100 SMA with a strong bearish slope crossing below 200 one both well above current price, with indicators aiming slightly higher in positive territory. In the 4 hours chart however, indicators present a mild bearish tone below their midlines, with moving averages also well above current price which keeps the pressure to the downside. Immediate support stands in the 101.20 level, and if below, the pair will likely extend its slide down to 100.60/70 price zone.

Support levels: 101.20 100.70 100.25

Resistance levels: 101.60 101.95 102.35

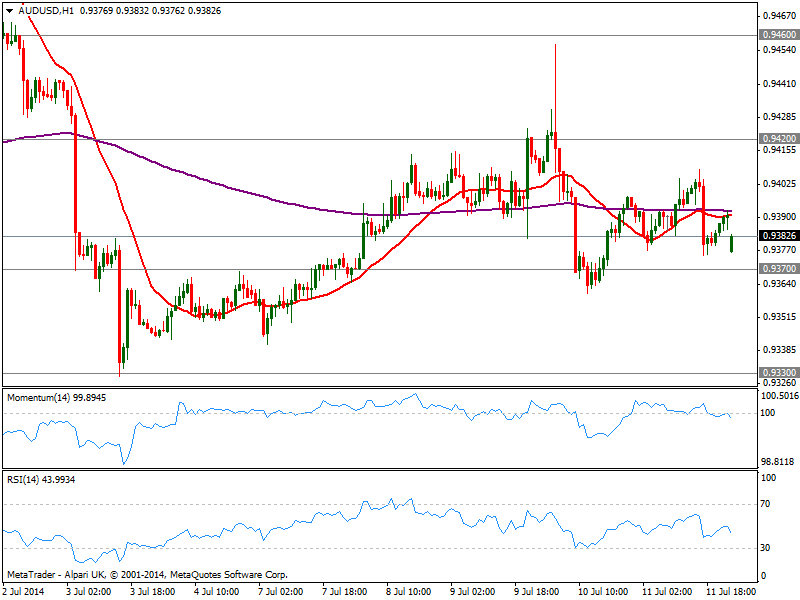

AUD/USD Current price: 0.9382

View Live Chart for the AUD/USD

The AUD/USD presents a weak tone in the short term, gapping lower in the opening, with price below moving averages and indicators heading lower in negative territory as seen in the hourly chart. In the 4 hours one, a mild bearish tone is also present, yet 200 EMA stands at 0.9370 a strong static support level, reinforcing its strength. A break below it may see the pair approaching 0.9330 area, while only above 0.9420 the pair may regain its upward strength, eyeing then 0.9460.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.