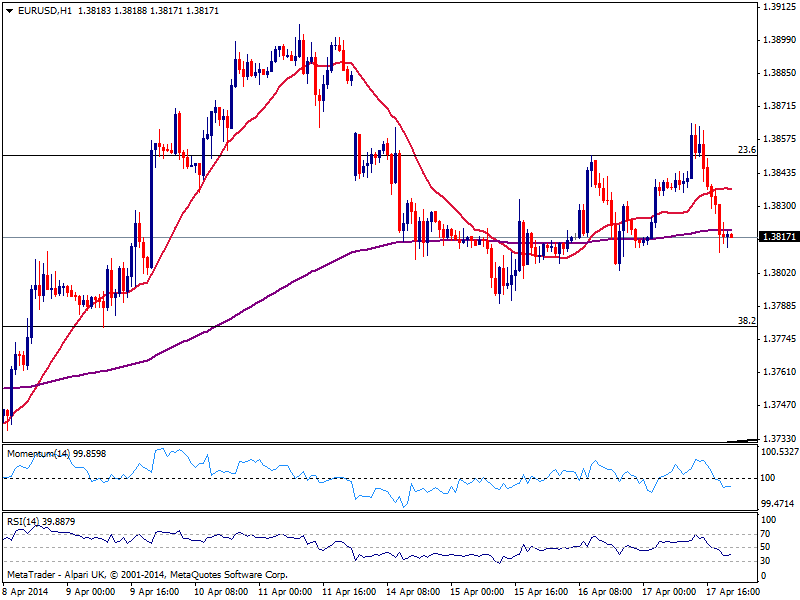

EUR/USD Current price: 1.3818

View Live Chart for the EUR/USD

Dollar got some favor over the US session, rising against most rivals as stocks extend their weekly gains. With markets half active amid the Easter holiday, current daily gains may be due to some profit taking and short covering ahead of the long weekend. Early on the day, the EUR rose above 1.3850 while GBP established a fresh 4-year high. The continued political crisis in Ukraine has so far avoided FX board, yet the risk increases daily basis, another reason to profit from recent moves.

As for the EUR/USD, the pair trades near the daily low set at 1.3810 aiming to close for second day in a row mostly where it started, and with the daily candle showing a long upper shadow which reflects sellers are for now, defending the upside around 1.3850/60. The hourly chart shows a bearish tone with price developing below its 20 SMA and indicators losing bearish potential below their midlines, while the 4 hours chart shows indicators turning flat in neutral territory and price hovering around its 20 SMA giving little indications on upcoming movements. With most markets closed on holidays, range will likely prevail until Monday weekly opening.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3860 1.3890

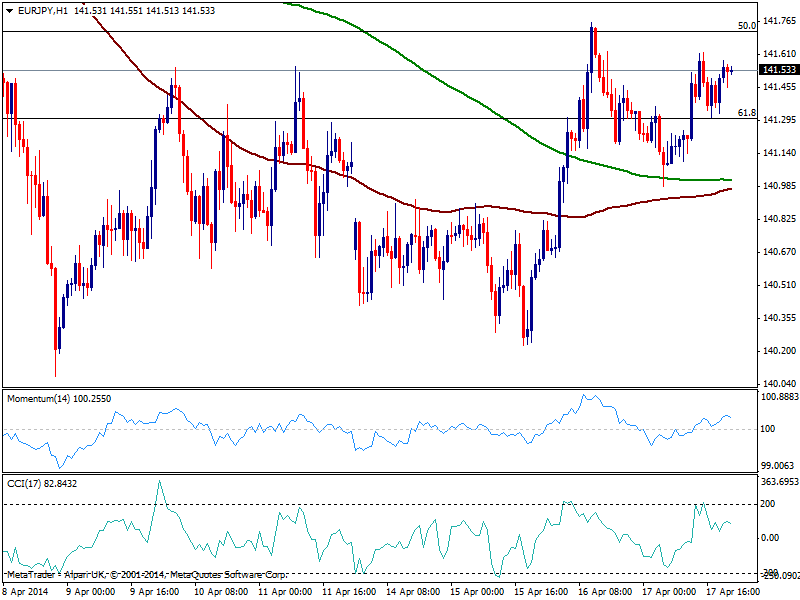

EUR/JPY Current price: 141.53

View Live Chart for the EUR/JPY

US bond yields rose strongly this Thursday, keeping the yen under pressure across the board: the EUR/JPY advanced up to 141.62, consolidating above a key Fibonacci level around 141.30. The hourly chart shows 100 and 200 SMAs converging in the 140.90 price zone, offering further support in case of slides; indicators in the mentioned time frame lost the upward potential and turn lower still above their midlines. In the 4 hours chart technical readings maintain a strong upward tone, with a break above mentioned daily high favoring an advance beyond the 142.00 figure in the short term.

Support levels: 141.30 140.90 140.40

Resistance levels: 141.70 142.20 142.60

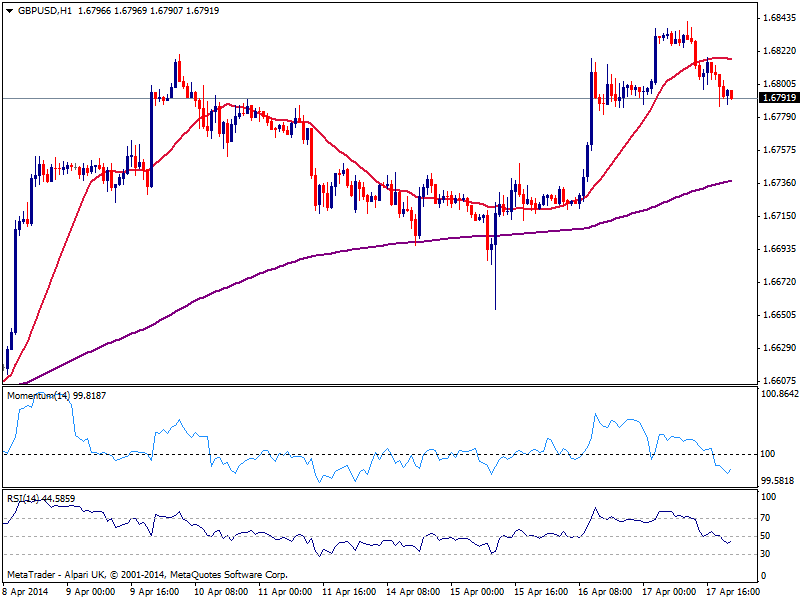

GBP/USD Current price: 1.6791

View Live Chart for the GBP/USD

Losing some ground after setting a fresh 4 year high of 1.6841, the GBP/USD consolidates right below the 1.6800 figure, entering Asian session with a slightly bearish tone according to the hourly chart: indicators head lower in negative territory, with 20 SMA turning lower above current price. In the 4 hours chart indicators also turn lower, albeit 20 SMA maintains a strong bullish slope below current price, currently around 1.6770. As long as above this last, downward risk remains limited, with a break below favoring a test of the 1.6745 strong static support.

Support levels: 1.6780 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

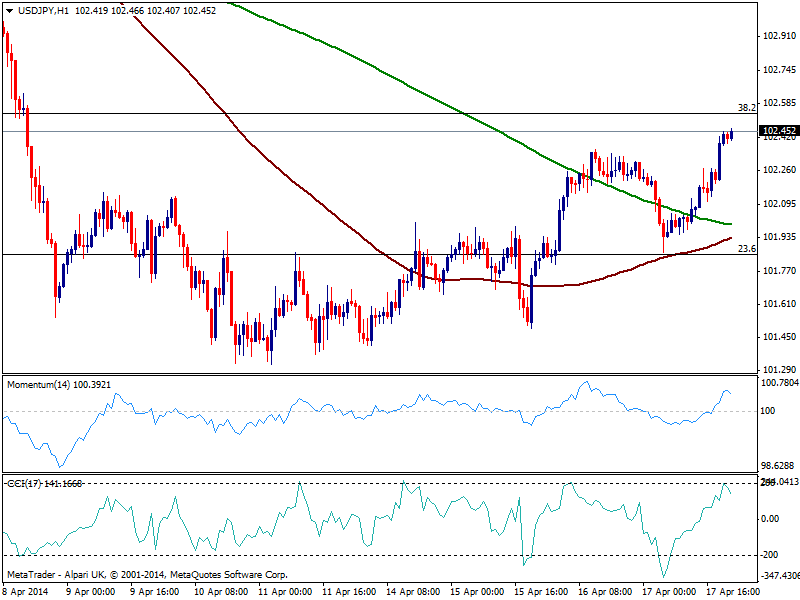

USD/JPY Current price: 102.45

View Live Chart for the USD/JPY

The USD/JPY trades at fresh weekly highs, approaching 102.60 resistance as US afternoon fades. The pair has been favored by dovish BOJ comments along with rising stocks, looking now overbought in the hourly chart with indicators turning lower at the extremes. In the 4 hours chart technical readings present a strong upward momentum supporting further upward continuations probably limited by thin markets.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.60 102.95 103.20

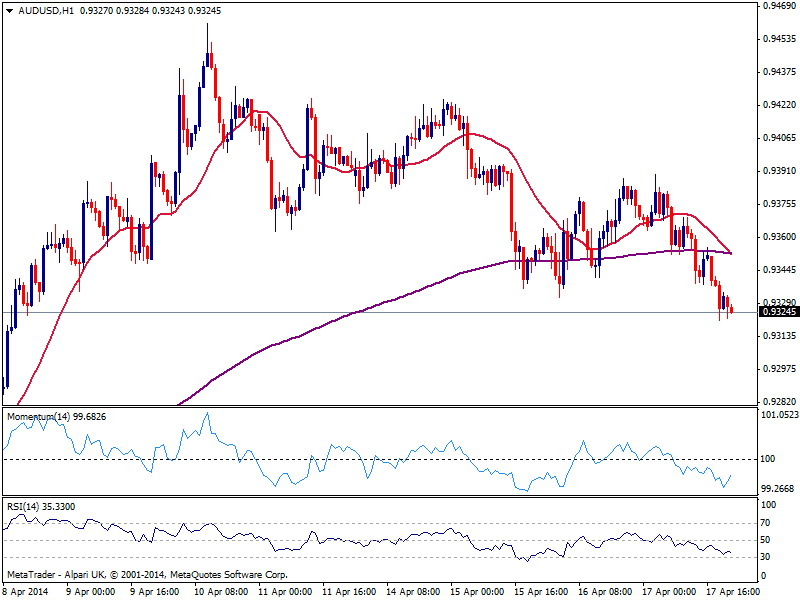

AUD/USD Current price: 0.9324

View Live Chart for the AUD/USD

Aussie extended its decline against the greenback, having been unable to recover ground and holding near the daily lows ahead of the long weekend. The hourly chart shows RSI still heading lower, while momentum recovers some below its midline; price stands below a bearish 20 SMA while price pressures the lows, which at the end seems pretty bearish for the pair. In the 4 hours chart technical readings present a clear bearish tone, supporting the shorter term one and pointing for a possible test of key 0.9260 support.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9355 0.9390 0.9445

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.