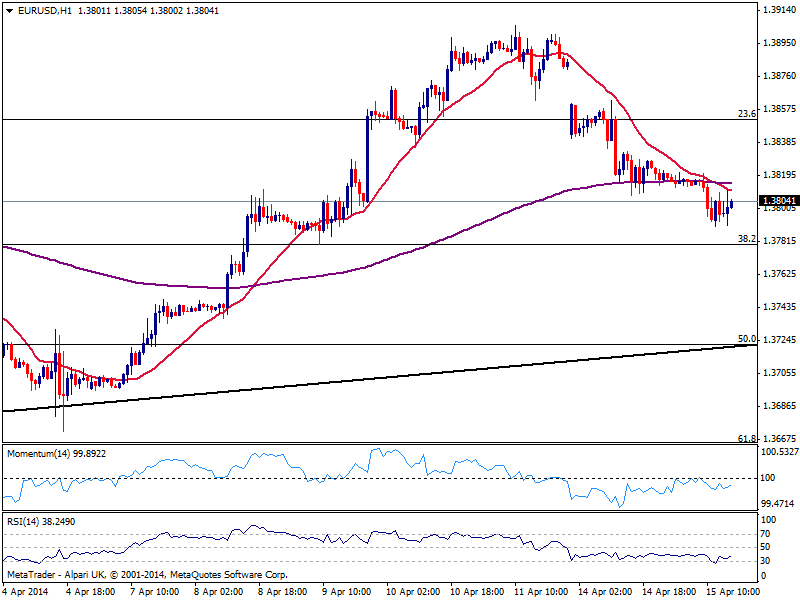

EUR/USD Current price: 1.3804

View Live Chart for the EUR/USD

More entertained day this Tuesday, with data releases from all major economies sees EUR/USD holding around the 1.3800 figure ahead of US opening. In Europe, German ZEW survey came out mixed, with sentiment decreasing in the country, but positive for the region. In the US, inflation readings surprised to the upside with a shy spike up to 0.2% monthly basis, albeit the Empire State manufacturing index presented a huge miss, decreasing to 1.3 from 5.6 previous month. Finally TIC long term purchases for the US beat expectations, while Janet Yellen added nothing new to the economic policy picture. Stocks in Europe present a slightly bearish tone, while gold nosedived, dragging AUD lower against its rivals.

Technically the EUR/USD hourly chart shows price limited below a strongly bearish 20 SMA, while indicators stand neutral in negative territory; in the 4 hours chart indicators maintain a bearish tone, with price coming back some from its 200 EMA, currently around 1.3790. Either a break below 1.3780 or above 1.3820 will set a more clear directional move for the day, with the downside favored towards 1.3720 on a break of the strong Fibonacci support.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3820 1.3850 1.3890

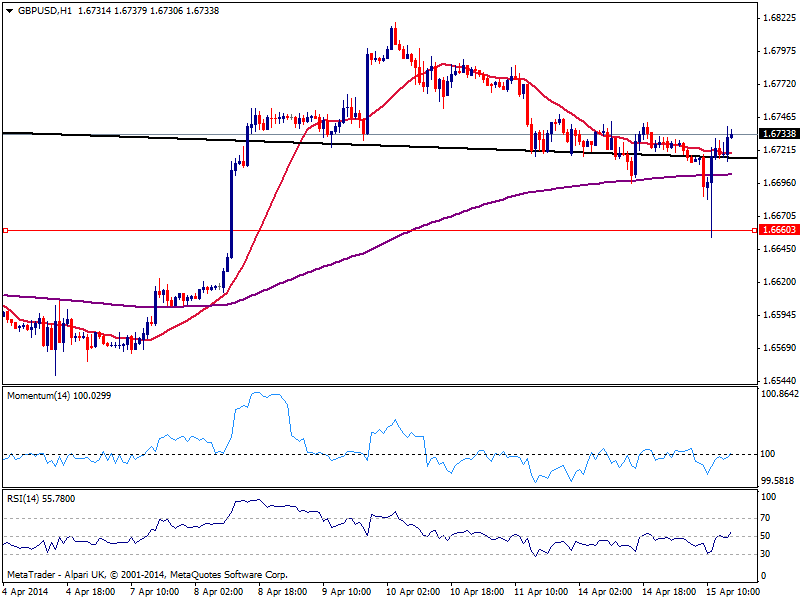

GBP/USD Current price: 1.6733

View Live Chart for the GBP/USD

Pound holds around its daily high against the greenback, reached after the shocking improvement in housing data, which gathered far more attention than inflation readings in line with expectations. As commented on previous updates, buyers around 1.6660 strong static support level were strong enough to halt any attempt to break lower, and when the level was tested triggered an impressive recovery. Technically, the hourly chart shows price above its 20 SMA while indicators grind higher around their midlines, lacking strength at the time being. In the 4 hours chart 20 SMA caps the upside around 1.6745 while indicators lost the downward potential, but hold right below their midlines. Further gains above 1.6750 are now required to confirm a full recovery, eyeing then 1.6820 price zone.

Support levels: 1.6710 1.6695 1.6660

Resistance levels: 1.6750 1.6785 1.6820

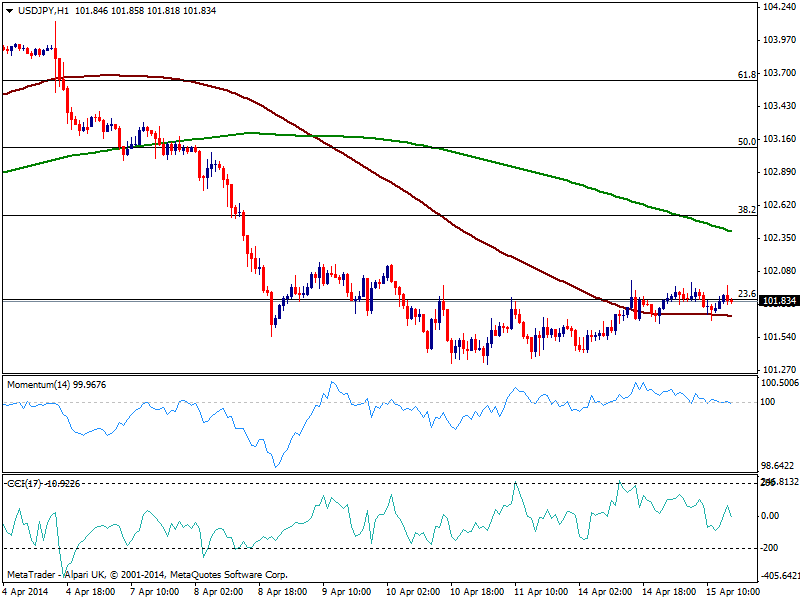

USD/JPY Current price: 101.83

View Live Chart for the USD/JPY

The USD/JPY struggles around the Fibonacci resistance of 101.85, maintaining a pretty right range right below key 102.00 figure. The hourly chart shows price holding also above a flat 100 SMA, while indicators present a slightly bearish tone. In the 4 hours chart technical readings are mostly neutral due to the lack of action surrounding the pair. Nevertheless, the downside remains favored towards 101.20 as long as sellers continue to defend mentioned 102.00 price zone.

Support levels: 101.55 101.20 100.70

Resistance levels: 102.00 102.35 102.60

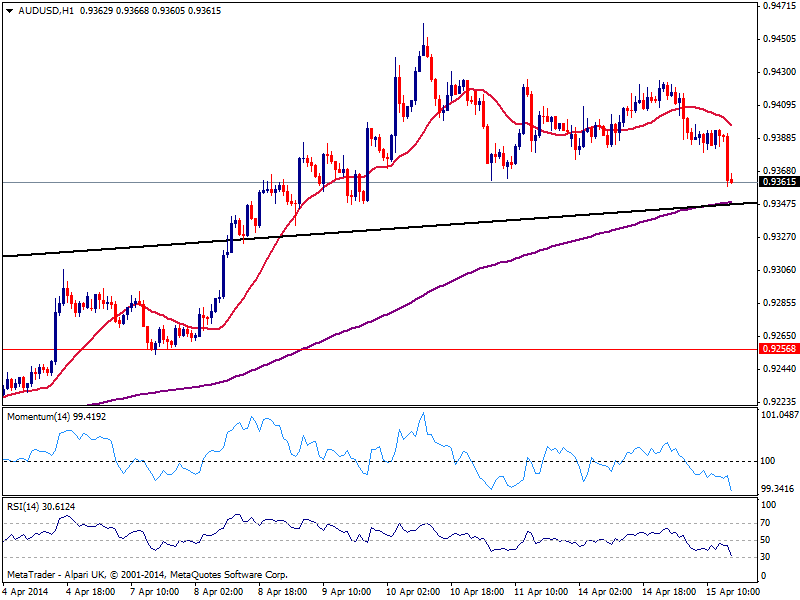

AUD/USD Current price: 0.9361

View Live Chart for the AUD/USD

Not a good day for Aussie today, with the currency weighted by gold drop as commented above: the AUD/USD trades right above 0.9360 static support, presenting a strong bearish short term tone according to the hourly chart, as indicators head lower deep into negative territory while 20 SMA gains bearish slope above current price. In the 4 hours chart technical readings present a slightly bearish tone, with a break below mentioned support favoring a downward extension for today.

Support levels: 0.9360 0.9320 0.9290

Resistance levels: 0.9445 0.9485 0.9530

Recommended Content

Editors’ Picks

EUR/USD tests the major level of 1.0650; followed by the nine-day EMA

EUR/USD remains lackluster during the early Tuesday, hovering near 1.0650. From a technical perspective, analysis suggests a bearish sentiment for the pair as it struggles below the pullback resistance at the 1.0695 level.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.