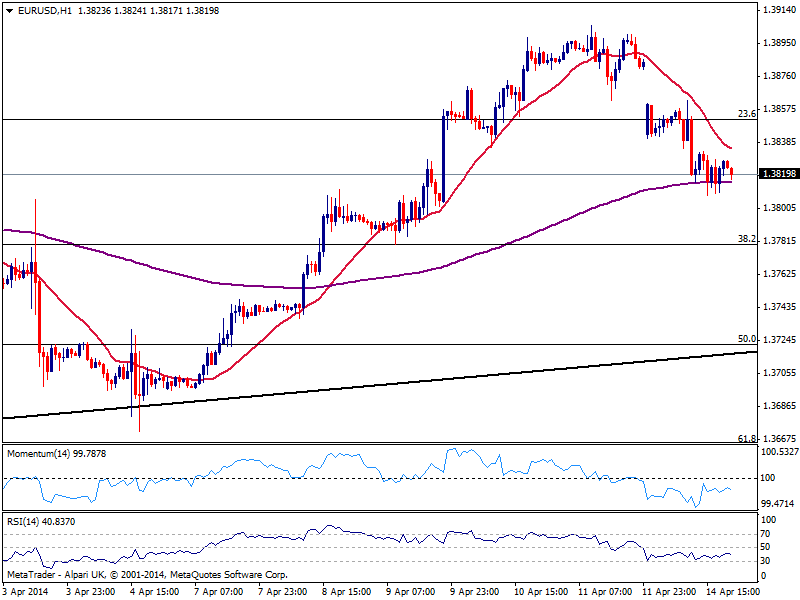

EUR/USD Current price: 1.3819

View Live Chart for the EUR/USD

EUR suffered this Monday trading near its daily low of 1.3807 ahead of Asian opening against the greenback. The pair has even left the weekly opening gap unfilled after the constant bombard of ECB officers all though the day supporting some QE. It’s yet to be seen if words will be backed by actions and how much more are investors willing to bend blindly on next month action. As for the short term, the EUR/USD presents a slightly bearish tone according to the hourly chart as indicators head lower in negative territory and 20 SMA continues to contain the upside. In the 4 hours chart the pair presents a limited bearish tone, as indicators aim now higher barely below their midlines: current bearish tone may face strong buying interest in the 1.3750/80 area, with bears taking control only with a break below 1.3720 support.

Support levels: 1.3810 1.3780 1.3750

Resistance levels: 1.3850 1.3890 1.3920

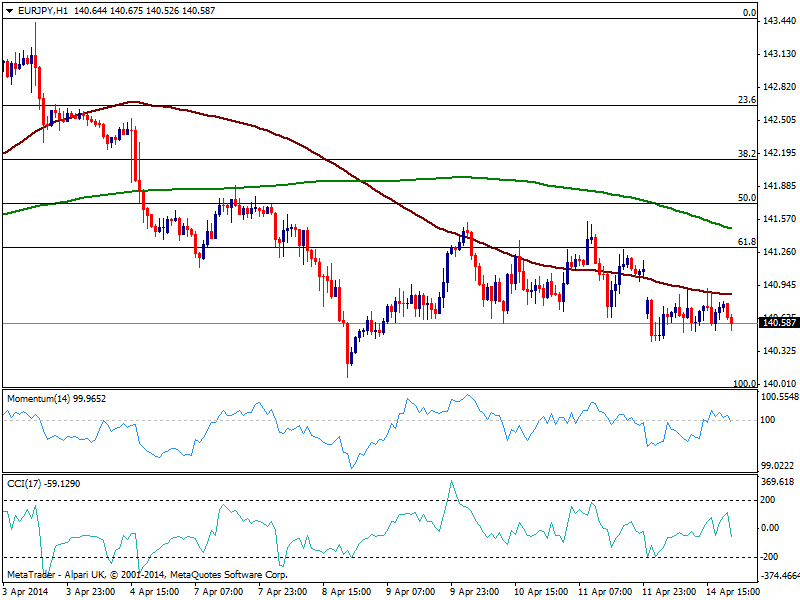

EUR/JPY Current price: 140.58

View Live Chart for the EUR/JPY

The EUR/JPY remained subdue on EUR weakness, with the pair trading in a tight range since early Asian opening. The hourly chart shows price remained limited below a bearish 100 SMA, while indicators are now turning south around their midlines. In the 4 hours chart indicators present a neutral stance, albeit the downside remains exposed with the daily chart showing current candle developing fully below its 100 DMA, now offering dynamic resistance around 141.00: as long as below the level, bulls had little chance today.

Support levels: 140.40 139.90 139.35

Resistance levels: 141.10 141.50 142.00

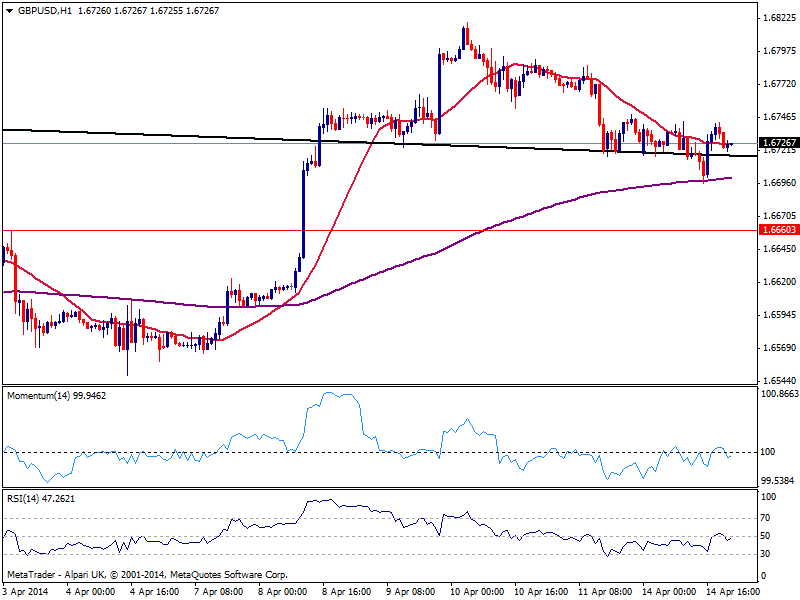

GBP/USD Current price: 1.6726

View Live Chart for the GBP/USD

The GBP/USD remained confined to a tight range for most of the day, finally unchanged right above 1.6720. A short term dip below 1.6700 triggered a quick bounce reflecting not enough selling interest at the time being. In the short term, the hourly chart shows price hovering back and forth around a flat 20 SMA while indicators stand in neutral territory; in the 4 hours chart indicators head higher near their midlines, erasing early bearish tone, reinforcing the short term view. Nevertheless, steady gains above 1.6750 are required to confirm further advances, while downside corrective movements can extend down to 1.6660 without really affecting the dominant bullish trend.

Support levels: 1.6695 1.6660 1.6625

Resistance levels: 1.6750 1.6785 1.6820

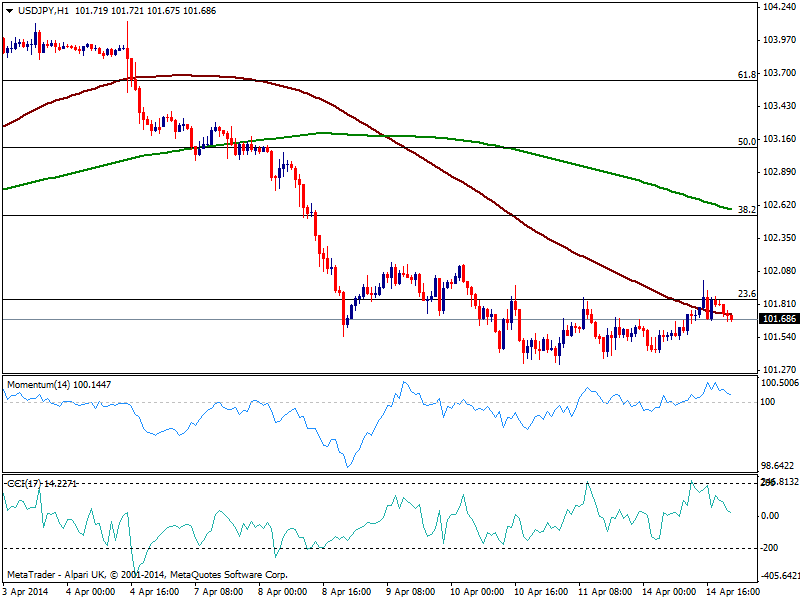

USD/JPY Current price: 101.68

View Live Chart for the USD/JPY

The USD/JPY erased its intraday gains triggered by positive US data, with the pair unable to advance beyond the 102.00 level. the hourly chart shows price now below its 100 SMA that maintains a strong bearish slope, while indicators aim lower in positive territory, showing neither much bearish strength. In the 4 hours chart indicators hold in neutral territory, yet as long as below the mentioned 102.00 mark, the downside remains favored towards a test of 101.20 price zone.

Support levels: 101.55 101.20 100.70

Resistance levels: 102.00 102.35 102.60

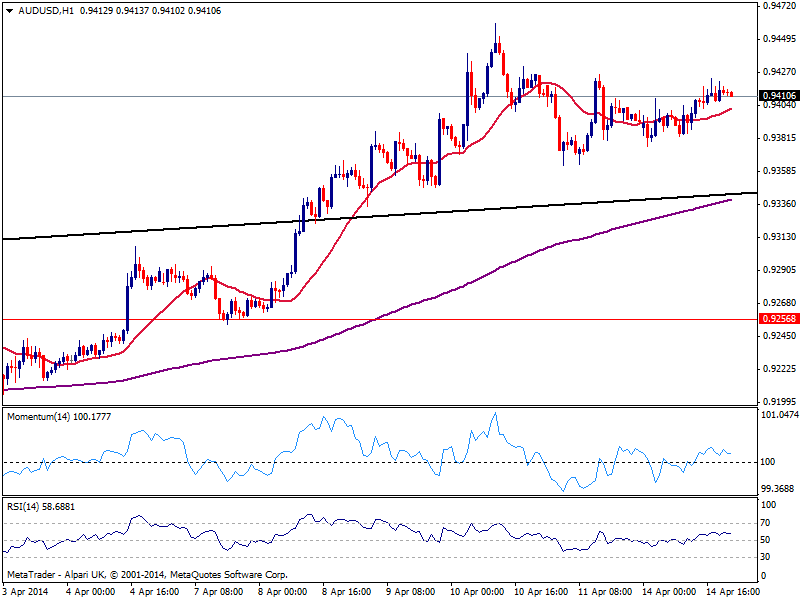

AUD/USD Current price: 0.9410

View Live Chart for the AUD/USD

With no changes in current US session, the AUD/USD holds to its shy intraday gains and consolidates above the 0.9410 price zone. Short term technical readings suggest the upside remains favored, while the 4 hours chart shows a quite neutral stance amid recent lack of momentum. Chinese data in today’s calendar will likely affect the pair, with dips down to 0.9360 area probably seen as buying opportunities.

Support levels: 0.9360 0.9320 0.9290

Resistance levels: 0.9445 0.9485 0.9530

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.