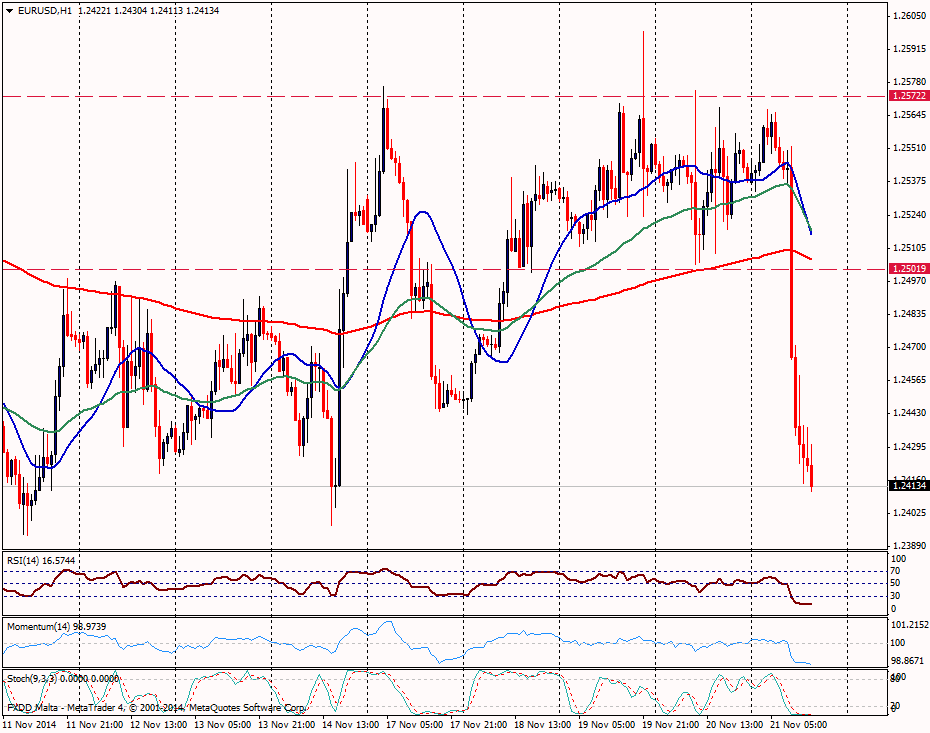

EUR/USD Current price: 1.2412

View Live Chart for the EUR/USD

A calm Friday, changed dramatically with Draghi’s press conference and the surprising rate cut in China. EUR/USD has been most affected by Draghi’s words rather than the boost to risk appetite from China that weakened the US dollar across the board. The pair broke below a key support level located around 1.2500 and plummeted to 1.2415 and the recovery from the lows was short lived, showing that weakness still remain in the EUR/USD. A break below the lows would expose 1.2400 and then 1.2390 and 2014 lows at 1.2355. Technical indicators in the hourly chart shows oversold conditions, suggesting that the consolidation could continue and even a recovery but the main picture shows EUR/USD still under pressure, that would ease if it rises back above 1.2500. To the upside, the two key short term resistance levels are 1.2570 and 1.2600.

Support levels: 1.2390 1.2360 1.2335

Resistance levels: 1.2465 1.2500 1.2570

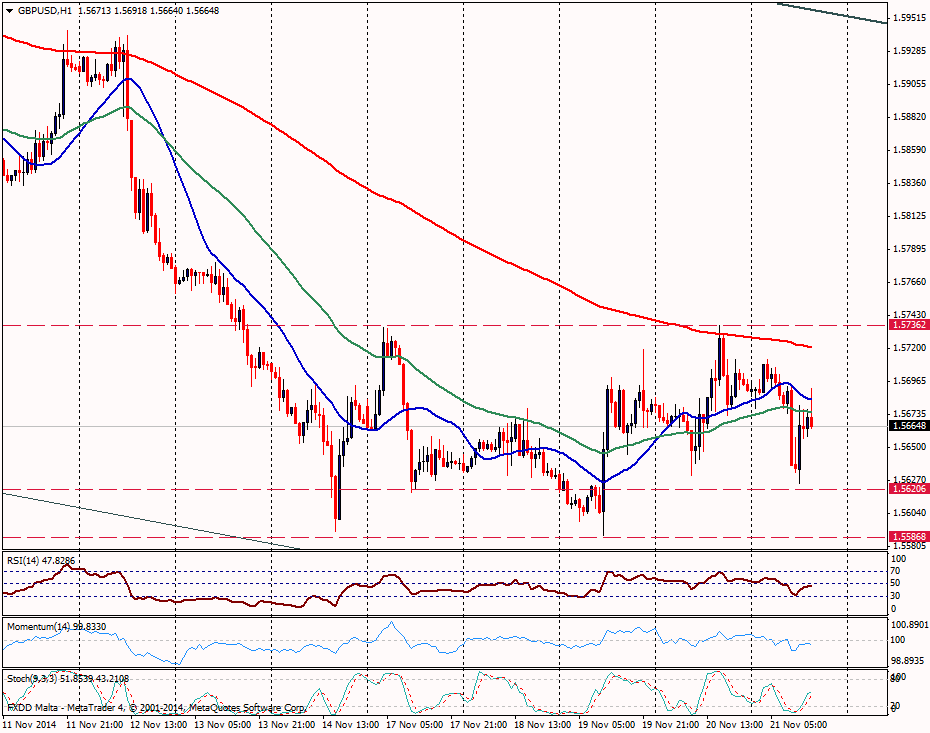

GBP/USD Current price: 1.5665

View Live Chart for the GBP/USDGBP/USD continues to move in ranges. Earlier dropped to 1.5620 as the EUR/USD tumbled but found support and bounced to the upside approaching 1.5700. The range is likely to persist and only a break above 1.5740, key short term resistance (200-SMA) that capped the upside on Monday and yesterday, could trigger a bullish run. On the downside, price has two strong support levels at 1.5620 and 1.5590 (2014 low); below it could accelerate but considering that no major economic data will be released and if risk appetite remains in place, GBP/USD is likely to avoid reaching fresh 1-year lows on Friday.

Support levels: 1.5620 1.5590 1.5555

Resistance levels: 1.5710 1.5740 1.5780

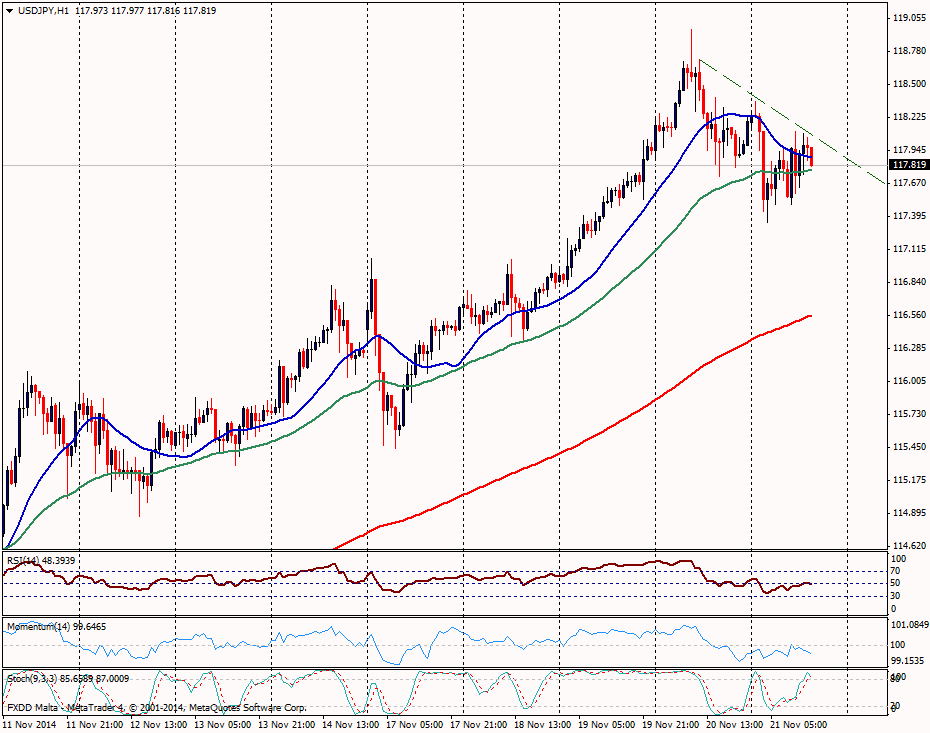

USD/JPY Current price: 117.90

View Live Chart for the USD/JPYThe pair USD/JPY is making a correction from multi -year highs on Friday, but moved off session lows suggesting that some demand is still there. Currently is attempting to consolidate above 118.00 but so far it has been unable. It is moving with a downside bias since yesterday, but a consolidation above 118.15 could give momentum to the US dollar. The 1-hours chart shows a flat 20-SMA while indicators are mixed. Below 117.75 sellers could appear. If a stronger correction ocurrs the 117.00/10 is an area to look for potential rebound and buying interest.

Support levels: 117.80 117.45 117.05

Resistance levels: 118.15 118.40 118.70

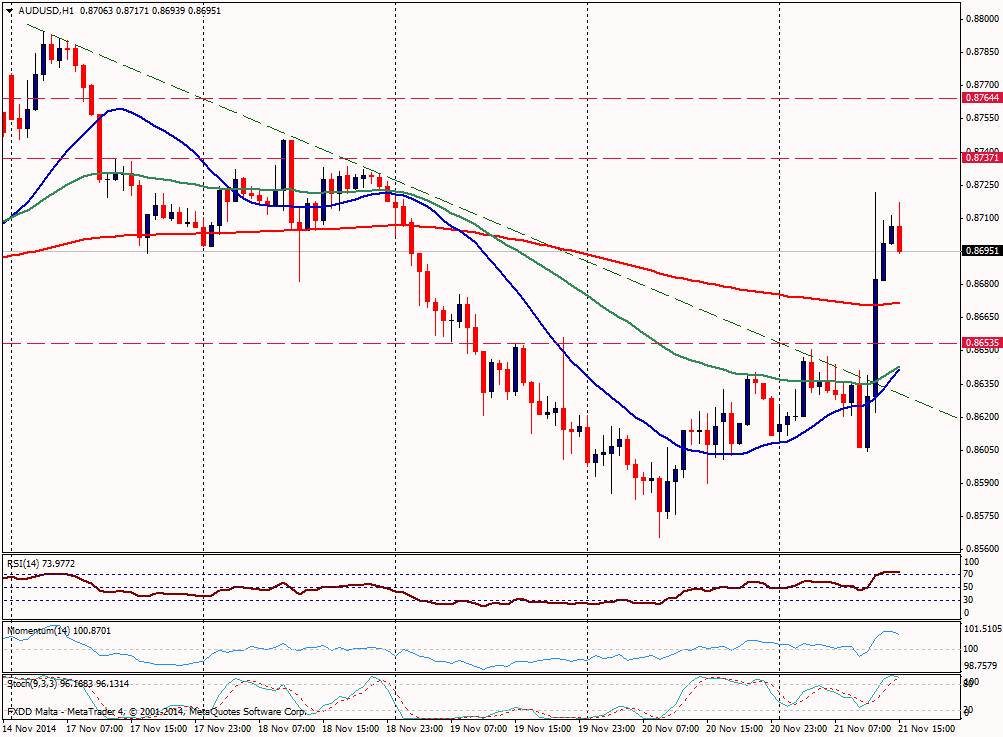

AUD/USD Current price: 0.8698

View Live Chart of the AUD/USDThe aussie jumped in the market amid the rate cut in China while the AUD/USD pair rose from 0.8630 to 0.8720; and then pulled back to the 0.8700. Price broke a downtrend line and gained momentum but now technical indicators of the 1 hour chart shows exhaustion signals and some potential for a bearish correction with RSI turning lower; but price remains well above the 20-SMA and the 200-SMA. The 4-hour indicators still favor the upside. If it manages to hold above 0.8700 the pair could gained strength and rally toward the next resistance located at 0.8735; above it could climbed to 0.8765. Risk appetite if persists should favor the aussie versus the US dollar.

Support levels: 0.8680 0.8650 0.8605

Resistance levels: 0.8705 0.8735 0.8765

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.