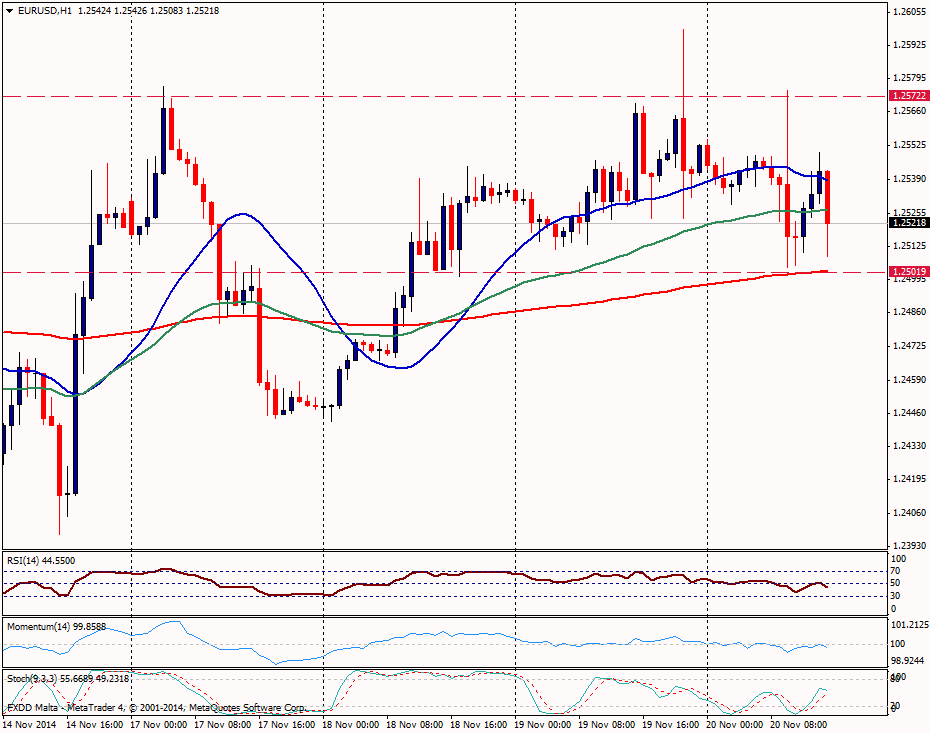

EUR/USD Current price: 1.2550

View Live Chart for the EUR/USD

The EUR/USD is moving in a consolidating mode, without a clear trend for the day, but holding a bearish tone after Eurozone and US economic data, but as long as it holds above 1.2500, declines would be limited; a break below could trigger a bearish rally, targeting initially 1.2475 and below here 1.2450. To the upside the euro has been unable to break above 1.2570; it needs a consolidation above to gain strength and break the current trading range.Technical indicators in the 1-hour and 4-hours charts show indicators mixed. The 4-hour chart is at an important support level, that could favor a rebound, but below 1.2500 the scenario could change.

Support levels: 1.2500 1.2465 1.2445

Resistance levels: 1.2550 1.2575 1.2605

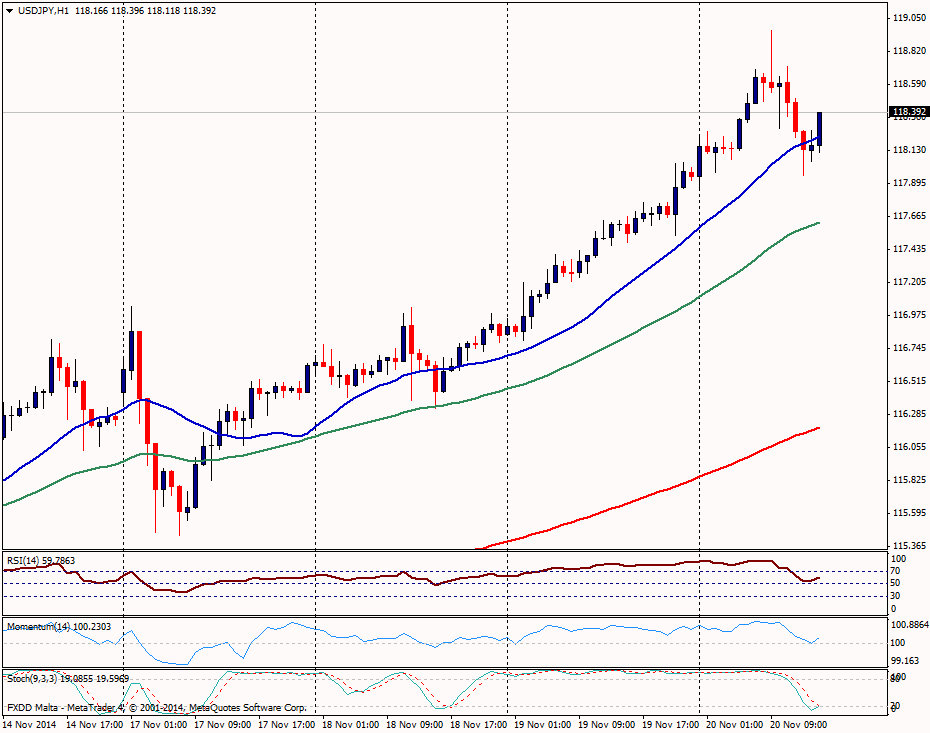

USD/JPY Current price: 118.15

View Live Chart for the USD/JPY

Price continued to advance to fresh multi-year highs, until found resistance below 119.00, increasing volatility around that level. After an expected bearish correction during the European session, technical indicators are turning again to the upside, particularly after US economic data. USD/JPY rose back above 118.00 and recovered ground. The trend remains bullish but longer term charts show overbought reading, that could limit the upside. If the price falls back below 118.10 (where the hourly 20-SMA stands), it would expose daily lows and open the doors for a bigger correction.

Support levels: 118.10 117.80 117.05

Resistance levels: 118.45 118.70 119.00

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.