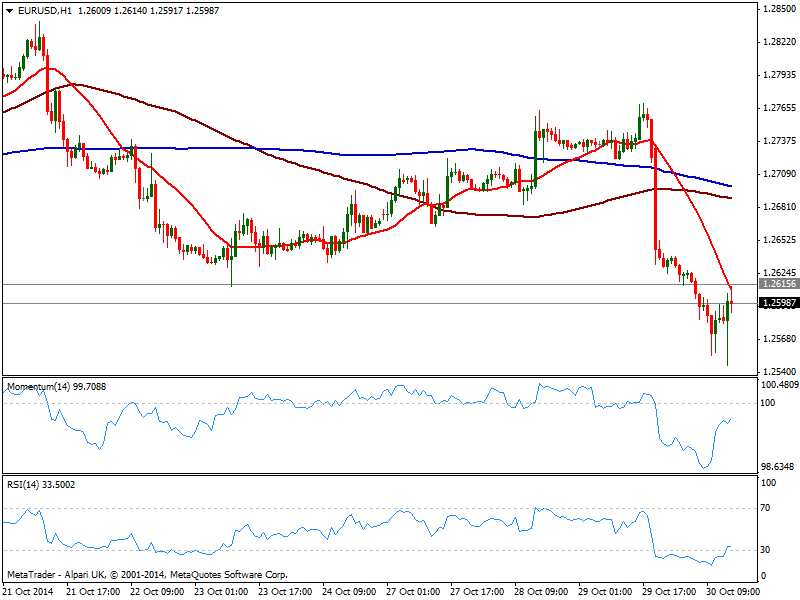

EUR/USD Current price: 1.2605

View Live Chart for the EUR/USD

The EUR/USD posted a lower low for the week of 1.2546 on the release of a better than expected US GDP reading, up to 3.5% against the expected 3.0%. The movement however was short lived, as the pair bounced up to 1.2614 with the news, hovering around the 1.2600 with US opening. The movement was for the most corrective as the critical price zone held, probably triggered by some profit taking. Technically, the 1 hour chart shows indicators recovered from extreme oversold levels yet remain in negative territory, while 20 SMA maintains a strong bearish slope, capping the upside around mentioned 1.2614. In the 4 hours chart momentum continues heading south with RSI posting a shy bounce form 30: above 1.2620, the corrective movement can extend up to 1.2660, without affecting the ongoing bearish trend. Renewed selling interest that pushes price below 1.2550 on the other hand, should lead to a test of the year low at 1.2501.

Support levels: 1.2580 1.2550 1.2500

Resistance levels: 1.2620 1.2660 1.2700

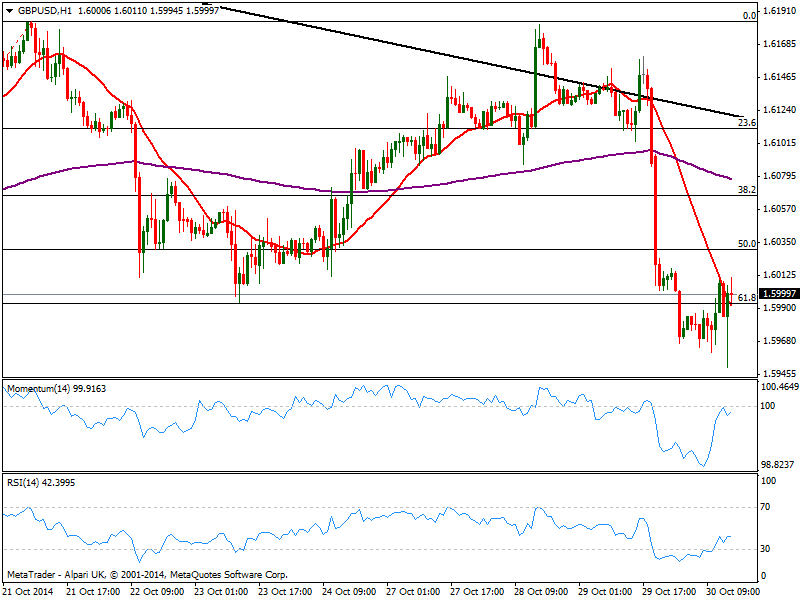

GBP/USD Current price: 1.5999

View Live Chart for the GBP/USD

The GBP/USD also bounced back to hold around 1.6000 after posting a lower low for the week of 1.5950. The pair how shows little aims to extend its gains beyond the 1.6010 price zone, and the hourly chart shows price also hovering back and forth around a bearish 20 SMA, while indicators corrected oversold readings but remain below their midlines. In the 4 hours chart indicators are bouncing form oversold levels, and 20 SMA maintains a strong bearish slope above current price. An upward correction is possible, moreover on a break above 1.6030, 50% retracement of the latest bullish run.

Support levels: 1.5995 1.5950 1.5910

Resistance levels: 1.6030 1.6060 1.6090

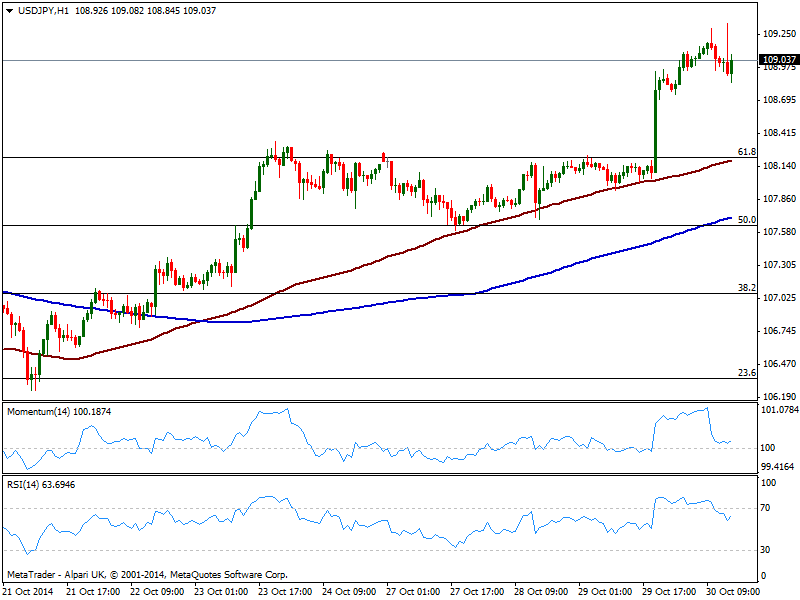

USD/JPY Current price: 109.03

View Live Chart for the USD/JPY

The USD/JPY holds around 109.00, maintaining its bullish tone both short and longer term according to technical readings: the 1 hour chart shows indicators regaining the upside with momentum recovering from its midline, while 100 and 200 SMAs advanced further: the shortest one now converges with a strong Fibonacci support around 108.25. In the 4 hours chart, indicators look exhausted in overbought territory, but remain far from suggesting a bearish correction.

Support levels: 108.70 108.25 107.70

Resistance levels: 109.45 109.90 110.20

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.