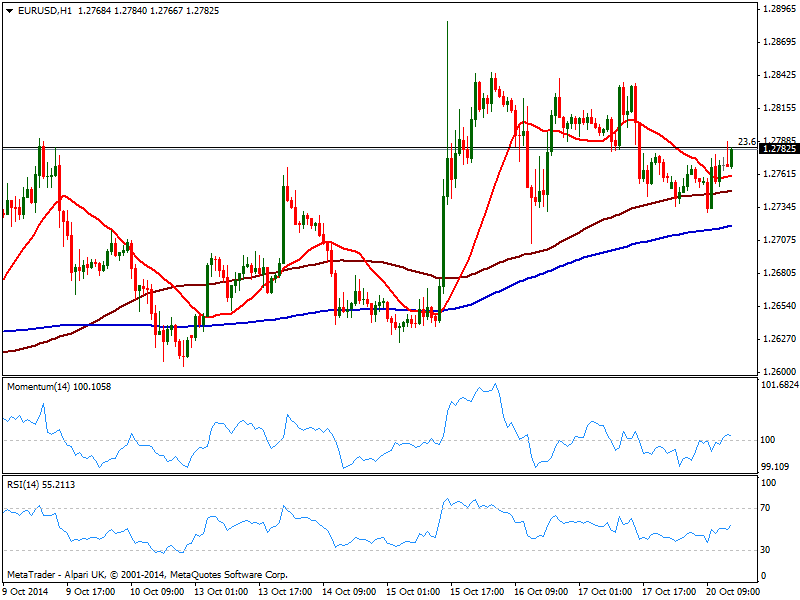

EUR/USD Current price: 1.2782

View Live Chart for the EUR/USD

Dollar is under mild pressure across the board ahead of US opening, after FED’s Fisher hit the wires saying he doesn't see any reason not to curtail QE at October meeting, weighting on stocks: futures are again in the red, pointing for a negative opening. Technically the EUR/USD hourly chart shows price pressuring the daily high, also static Fibonacci resistance at 1.2780, as per being the 23.6% retracement of the 1.37/1.25 bearish run. Price stands above moving averages, while indicators had barely overcome their midlines, remaining directionless. In the 4 hours chart the technical picture is mixed, with a strong bearish momentum opposing a rising RSI and a bullish 20 SMA. Some follow through above 1.2790 should indicate further intraday gains towards 1.2845 price zone, while bears will take control only on a break below 1.2700.

Support levels: 1.2740 1.2700 1.2660

Resistance levels: 1.2790 1.2845 1.2890

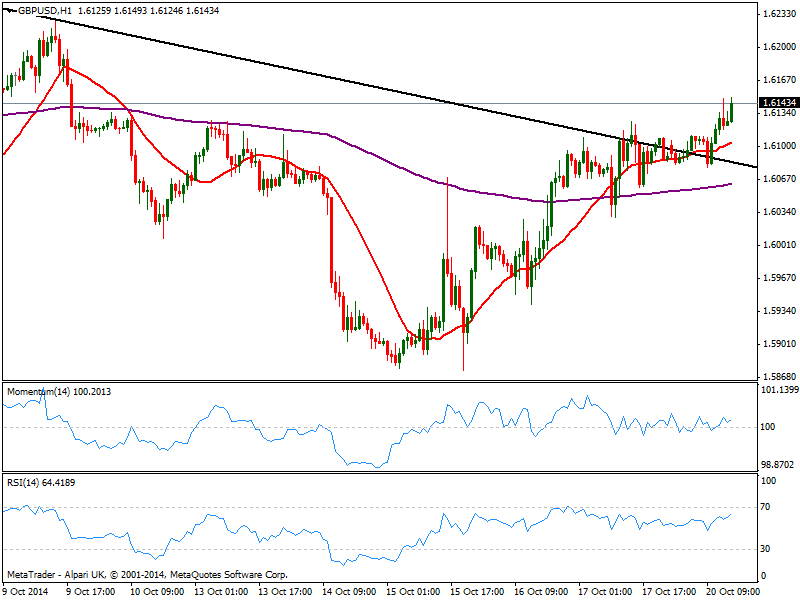

GBP/USD Current price: 1.6143

View Live Chart for the GBP/USD

The GBP/USD trades at its daily high after finally breaching above 1.6125, level that contained the upside for most of these last 2 weeks. The hourly chart shows an increasing upward potential in the short term, as price holds above a bullish 20 SMA and indicator aim higher above their midlines. In the 4 hours chart technical indicators head higher in positive territory, while 20 SMA also accelerates north below current price, now offering short term support around 1.6060; as long as mentioned 1.6125 attracts buyers, the upside is favored with 1.6185 as next target once the daily high gives up.

Support levels: 1.6125 1.6060 1.6020

Resistance levels: 1.6150 1.6185 1.6220

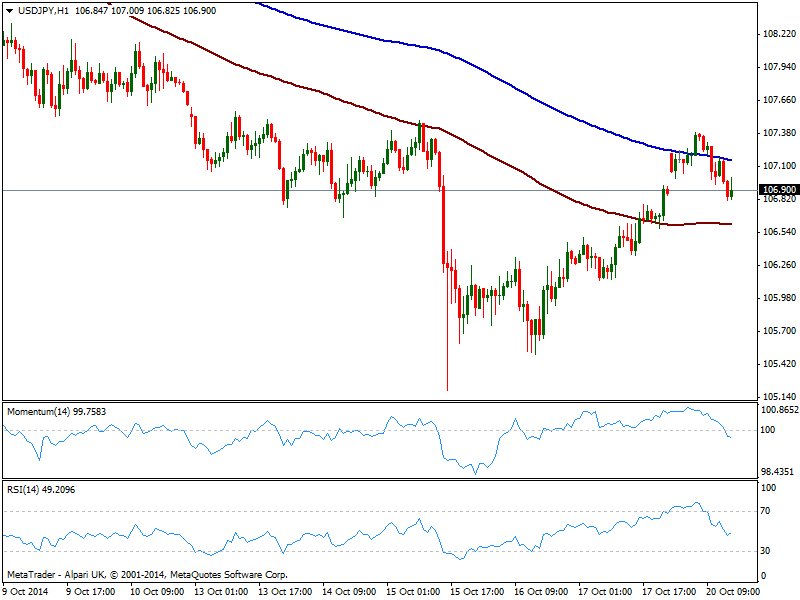

USD/JPY Current price: 106.90

View Live Chart for the USD/JPY

The USD/JPY lost the early day upward momentum over European hours, having advanced up to 107.38 before easing back. The 1 hour chart shows price heading lower between 100 and 200 SMAs, with the shortest offering intraday support at 106.60 and indicators heading lower below their midlines. In the 4 hours chart indicators turned south still above their midlines, while moving averages remain well above current price.

Support levels: 106.60 106.30 106.05

Resistance levels: 107.35 107.60 108.00

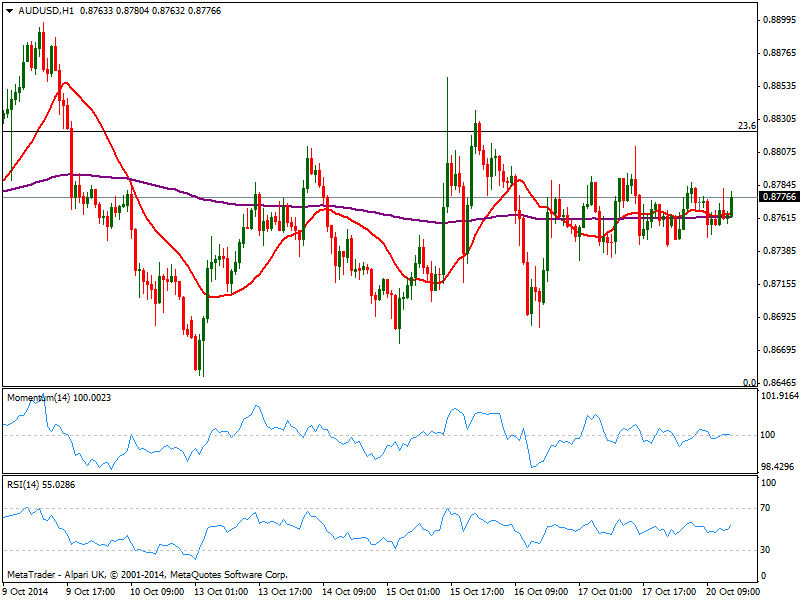

AUD/USD Current price: 0.8776

View Live Chart of the AUD/USD

AUD/USD range stretched further, with the pair showing no directional strength in the short term. The hourly chart shows price above flat moving averages, and indicators horizontal in neutral territory, while the 4 hours chart shows indicators present a mild bearish tone but the neutral tone also prevails. As commented on previous updates, 0.8820 is the key resistance to overcome, while short term support stands at 0.8730 now.

Support levels: 0.8730 0.8690 0.8640

Resistance levels: 0.8790 0.8820 0.8860

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.