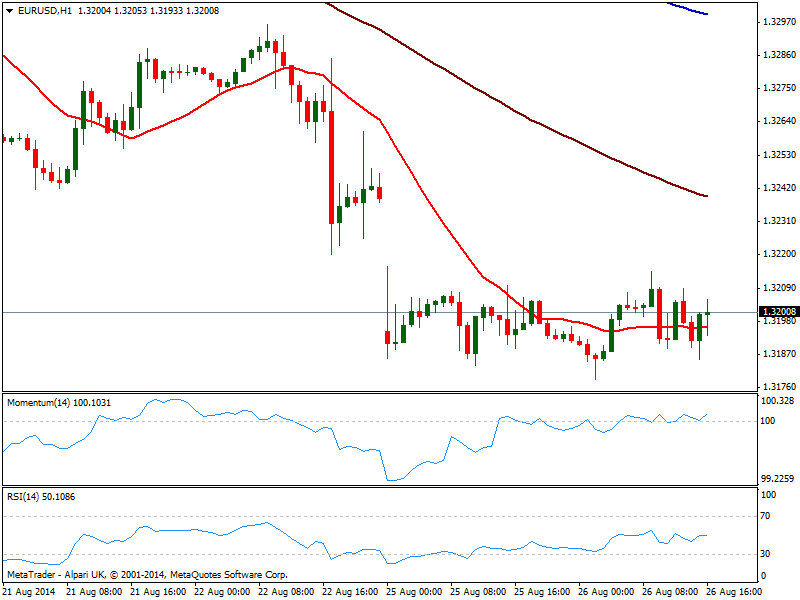

EUR/USD Current price: 1.3200

View Live Chart for the EUR/USD

US Durable Goods Orders jumped to 22.6%, yet the ex-transportation number resulted quite negative down to -0.8%: that means that despite the now confirmed rumor of strong gains due to unusually large aircraft orders, the rest of the sectors had been pretty lousy. Dollar is generally down against most majors, exception made again by the EUR/USD that remains unable to pickup beyond the 1.3200 level. Technically, the pair maintains a neutral short term stance, as the hourly chart shows indicators flat around their midlines, and 20 SMA horizontal. In the 4 hours chart 20 SMA stands now around 1.3240 converging with the unfilled gap and offering dynamic resistance, with indicators also directionless in negative territory.

Support levels: 1.3185 1.3150 1.3120

Resistance levels: 1.3215 1.3250 1.3270

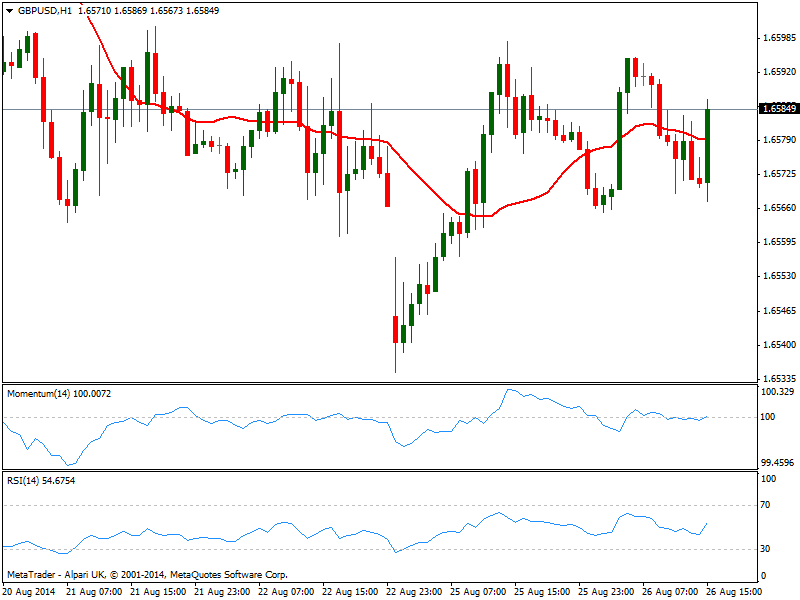

GBP/USD Current price: 1.6584

View Live Chart for the GBP/USD

The GBP/USD trades uneventfully bellow 1.6600, having been confined to a tight range for most of the last 24 hours. The hourly chart shows price moving back and forth around a flat 20 SMA as indicators rest horizontal around their midlines, giving no clues on upcoming direction. In the 4 hours chart the picture is quite alike, and only a steady recovery above 1.6600 can anticipate some advances, with a daily descendant trend line at 1.6660 as possible selling level if reached.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6660

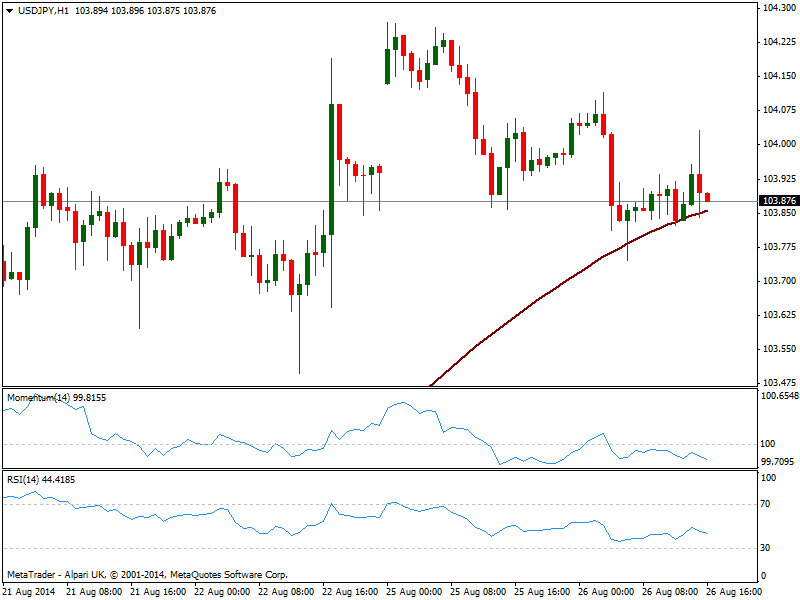

USD/JPY Current price: 103.99

View Live Chart for the USD/JPY

The USD/JPY eased towards 103.75 over Asian hours, having however found short term support in its 100 SMA, with the pair holding right above it for most of the day. The hourly chart shows indicators heading south below their midlines, yet as long as above 103.70, the downside seems limited. In the 4 hours chart indicators lost downward strength and turned flat above their midlines, supporting the shorter term view. Stocks strength seems to be the cause of the limited downward potential, and unless a reversal there, the pair will likely remain range bound.

Support levels: 103.70 103.20 102.85

Resistance levels: 104.10 104.45 104.80

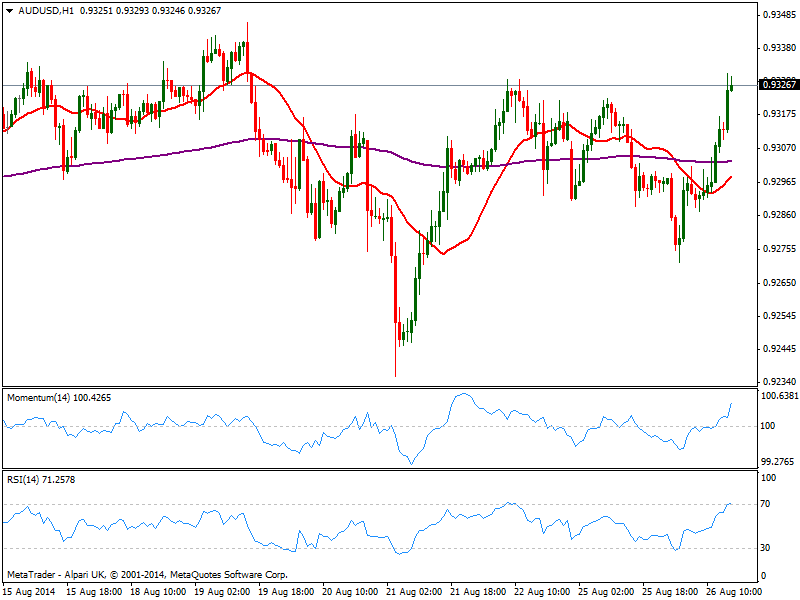

AUD/USD Current price: 0.9326

View Live Chart for the AUD/USD

Aussie strengthened against the greenback early European session, helped by rising gold and rumors off a Chinese requirement ratio cut. Approaching 0.9330 the hourly chart presents a strong upward momentum early US session, with price accelerating well above its 20 SMA. In the 4 hours chart technical readings present a mild positive tone, with price now pressuring 200 EMA, usually a strong static resistance. A price acceleration above 0.9330 should trigger stops and therefore help the pair advance up to 0.9370 price zone.

Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.