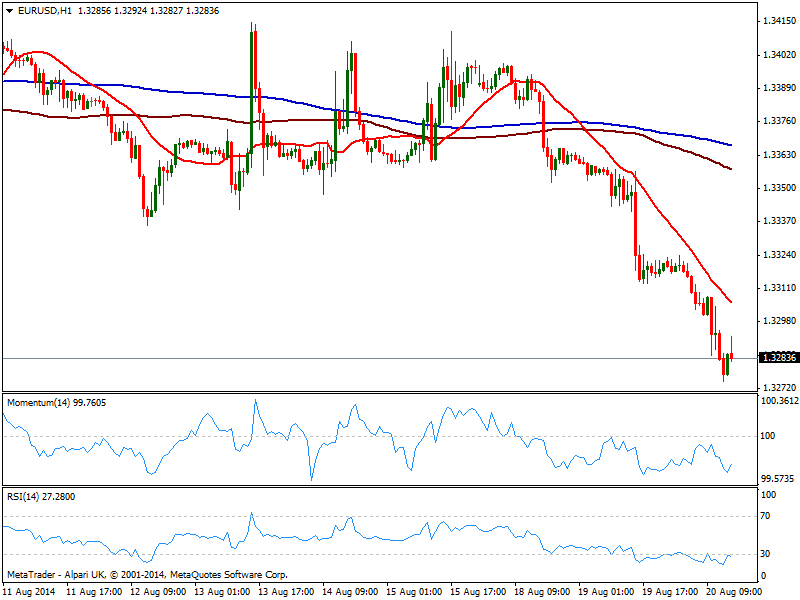

EUR/USD Current price: 1.3283

View Live Chart for the EUR/USD

The EUR/USD extended its decline so far today to 1.3274, consolidating below the 1.3300 figure ahead of US opening. Dollar strength along with another round of weak European data supported the already bearish trend, with the pair now consolidating around its year lows ahead of FED monetary policy meeting Minutes. Technically the hourly chart shows 20 SMA with a strong bearish slope above current price, albeit indicators are slightly exhausted in oversold levels. Nevertheless, price seems to have no aims of correcting higher, while indicators in the 4 hours chart maintain a strong bearish momentum that support a continued decline.

Support levels: 1.3250 1.3210 1.3170

Resistance levels: 1.3300 1.3330 1.3370

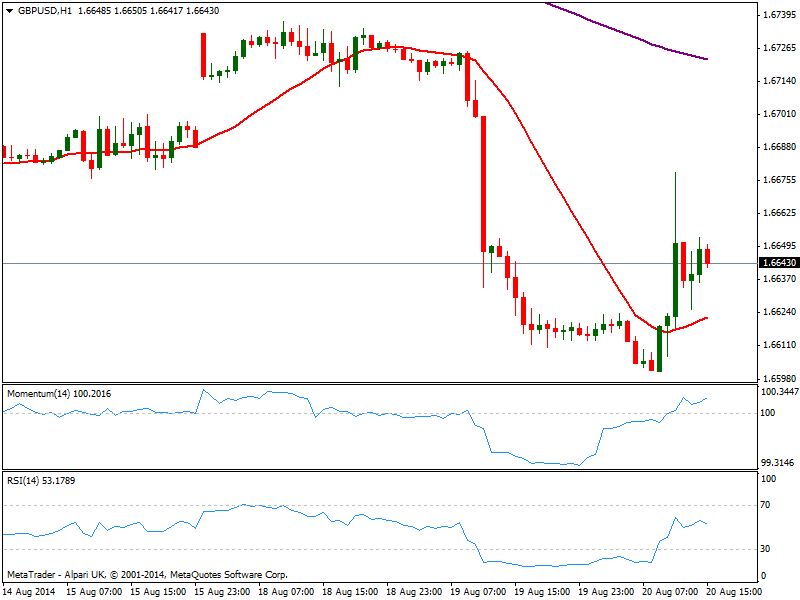

GBP/USD Current price: 1.6643

View Live Chart for the GBP/USD

The GBP/USD jumped up to 1.6678 after BOE Minutes showed 2 out of the 9 members voted for a rate hike as soon as this month. Considering latest dovish tone coming from authorities, it was a positive surprise, yet not enough to revert the bearish tone of the pair: the hourly chart shows indicators losing upward strength above their midlines, while price holds steady above a flat 20 SMA. In the 4 hours chart latest spike higher failed around its 20 SMA while indicators turned back south in negative territory after correcting oversold readings, all of which supports the dominant bearish tone. Furthermore, the pair is unable to firmly establish itself above the 200 DMA, at 1.6650, adding to the negative outlook in the midterm.

Support levels: 1.6610 1.6580 1.6545

Resistance levels: 1.6650 1.6700 1.6740

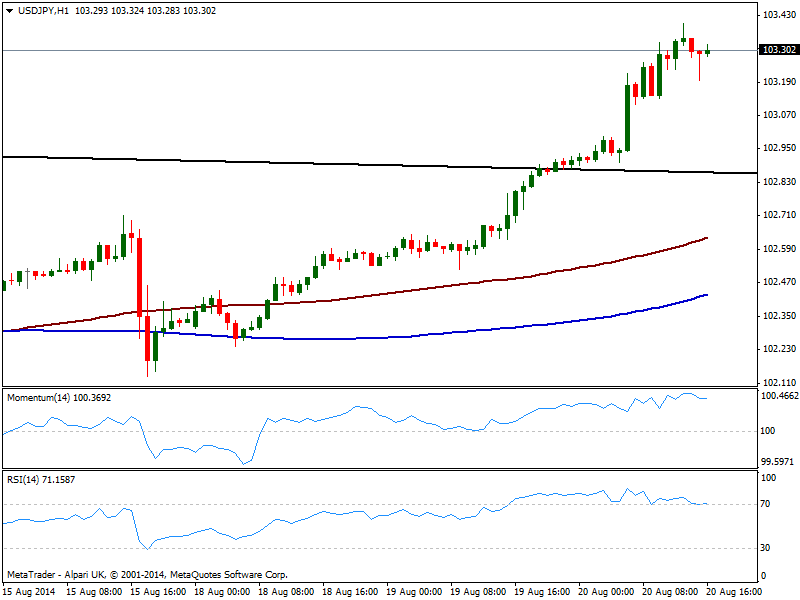

USD/JPY Current price: 103.30

View Live Chart for the USD/JPY

The USD/JPY set a fresh high at 103.40 and consolidates right below it this Wednesday, maintaining the overall bullish tone: the hourly chart shows price well above its moving averages, while indicators stand flat in overbought levels, with buyers now surging on approaches to 103.20. In the 4 hours chart indicators are losing some of their upward strength but hold in overbought territory and far from suggesting a downward correction in the short term. As long as above 102.80, the broken descendant trend line coming from this year high, the upside is favored towards the 103.70/80 area, next static resistance zone.

Support levels: 103.20 102.80 102.45

Resistance levels: 103.40 103.75 104.10

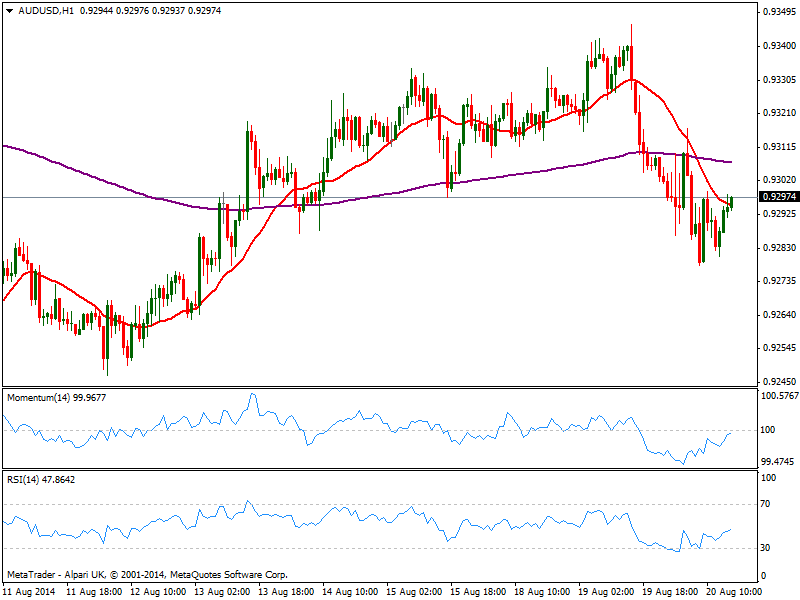

AUD/USD Current price: 0.9297

View Live Chart for the AUD/USD

The AUD/USD aims to recover some ground after falling down to 0.9278, still trading below the 0.9300 level. The hourly chart shows price struggling to overcome its 20 SMA, while indicators stand flat around their midlines, showing little upward strength at the time being. In the 4 hours chart the pair maintains a mild bearish tone, with indicators below their midlines and 20 SMA above current price, pointing to a limited recovery before next slide.

Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.