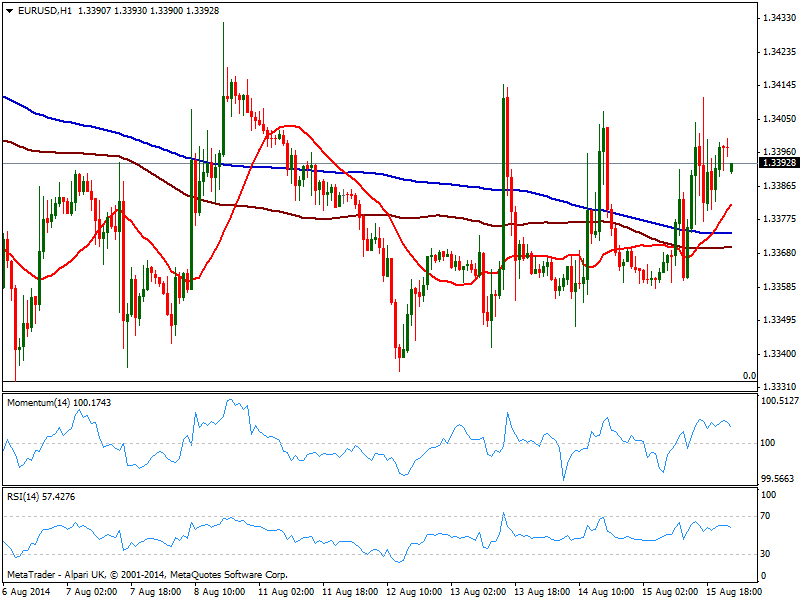

EUR/USD Current price: 1.3392

View Live Chart for the EUR/USD

The EUR/USD opens slightly lower but within range, little changed from Friday’s close. Technically, the pair maintains a quite flat stance, trading in a 100 pips range for the past 3 weeks, unable to pick up from its year low set at 1.3322 August 8th. In fact, price has bounced from the level multiple times over these last days, which reinforces its strength as breakout support. In the meantime, the hourly chart presents a mild positive tone, with price above its moving averages yet indicators turning south in positive territory. In the 4 hours chart technical readings favor the downside, as per momentum crossing its midline south and with 20 SMA flat around 1.3370, acting as immediate short term support. The roof of the range is set at 1.3440, so it will take an advance beyond it to see current negative tone reversing, at least in the short term.

Support levels: 1.3370 1.3330 1.3295

Resistance levels: 1.3405 1.3440 1.3485

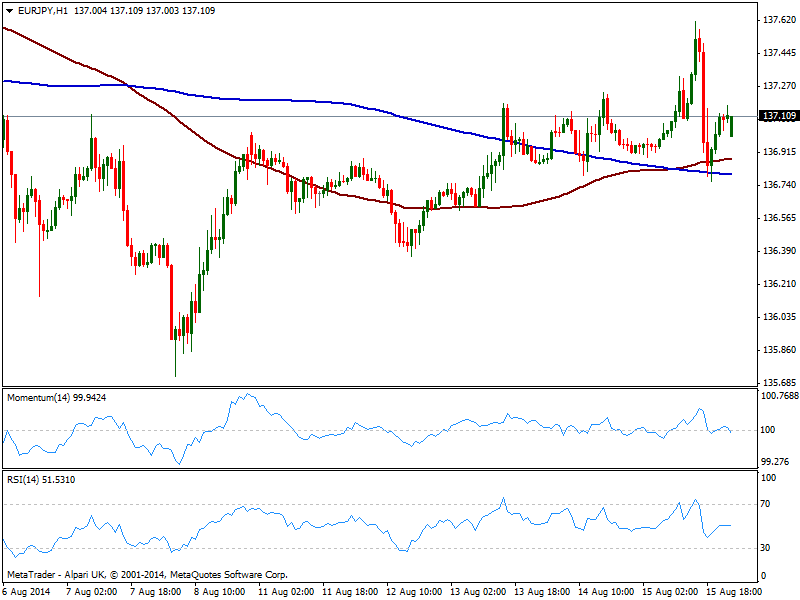

EUR/JPY Current price: 137.10

View Live Chart for the EUR/JPY

Yen weakness has helped EUR/JPY advance beyond the 137.00 level on Friday, yet the movement was quickly retraced before the day was over. Nevertheless, the hourly chart shows price found support around its moving averages, with 100 and 200 SMAs both in the 136.70 price zone, offering immediate support. Indicators in the mentioned time frame present a neutral stance, hovering around their midlines, while the 4 hours chart shows indicators also turning south in neutral territory. Having been as high as 137.60 last week, it would take a price acceleration trough the level to confirm a continued rally, with critical support standing at mentioned 136.70 price zone.

Support levels: 136.70 136.20 135.70

Resistance levels: 137.30 137.60 138.00

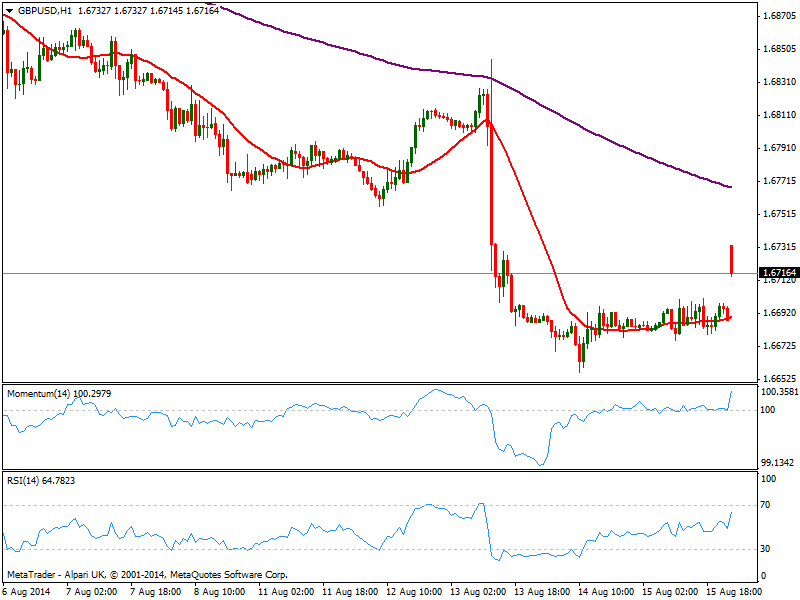

GBP/USD Current price: 1.6716

View Live Chart for the GBP/USD

Having been as high as 1.6838 early interbank trading, the GBP/USD gaps higher on the back of a newspaper interview gave by BOE’s Governor Carney over the weekend. The head of the Central Bank stated that he would not have to wait for real wages to turn positive before raising interest rates. The news comes as a shock following the quarterly inflation report, when he stated that rates will rise from current 0.5% next year but only if wage growth picks up. After spending the last 48 hours confined to a 40 pips range, the GBP/USD trades above the 1.6700 level, with the hourly chart showing indicators strongly up due to the opening gap, while 20 SMA stands flat around 1.6690. In the 4 hours chart current candle opened above a still bearish 20 SMA, while indicators also aim strongly up around their midlines. Current strength however is still to be confirmed: if the pair fills the gap, and bounce back above 1.6730, that could be a clear sign of upward strength, while if the gap stands unfilled the picture won’t be that clear. Nevertheless, the strong resistance level to break is 1.6760 area, where the pair presents a couple of recent daily lows.

Support levels: 1.6700 1.6650 1.6620

Resistance levels: 1.6730 1.6760 1.6800

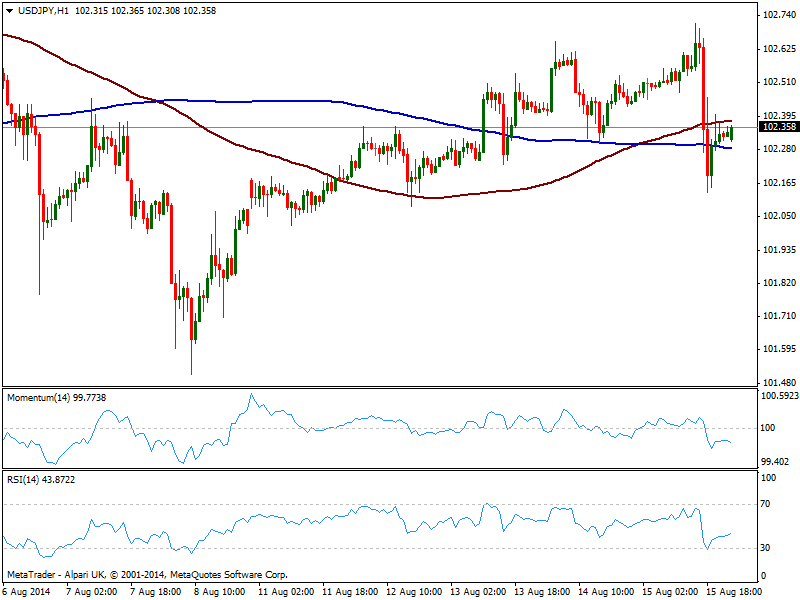

USD/JPY Current price: 102.35

View Live Chart for the USD/JPY

The USD/JPY starts the week with a soft tone, trading however steady above the 102.00 mark. A spike that approached 102.80 strong static resistance area saw price retracing back lower, but finding buyers around at mentioned 102.00 price zone, turning the upside a bit more attractive in term. The hourly chart however shows price contained below it 100 SMA and indicators mostly flat below their midlines, while the 4 hours chart shows indicators in neutral territory and price standing above bullish moving averages. A daily descendant trend line coming from this year high of 105.43, stands today at 102.85 reinforcing the strength of the resistance area, and a break above it will favor a recovery beyond the 103.00 level.

Support levels: 102.30 101.95 101.60

Resistance levels: 102.80 103.10 103.45

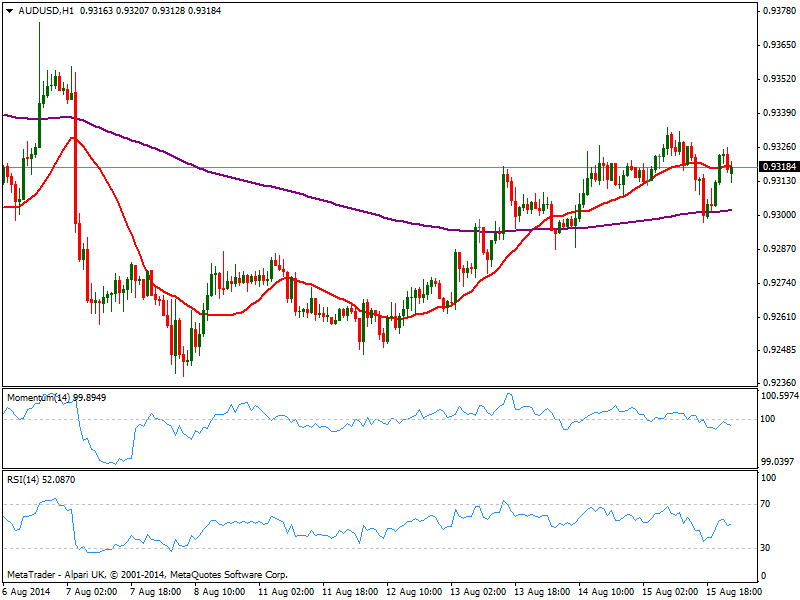

AUD/USD Current price: 0.9318

View Live Chart for the AUD/USD

The AUD/USD recovery continues to stall around 0.9330 former strong support, trading however in range right below it. The hourly chart shows price hovering around a flat 20 SMA and indicators retracing from their midlines; in the 4 hours chart however, 20 SMA maintains a strong bullish slope acting as short term support around 0.9300 while indicators hold in neutral territory as per recent range. The levels to watch are 0.9330 to the upside and 0.9260 to the downside, as it will take a clear break of any to confirm some directional strength for the upcoming days.

Support levels: 0.9300 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.